Beginning of a new week is rather calm on the European stock markets with major indices from the Old Continent trading more or less flat. However, the same cannot be said about the situation on the oil market, where both WTI and Brent post big gains. Brent (OIL) trades over 4% higher and breaks above $109 per barrel area while WTI (OIL.WTI) jumps more than 3% and approaches $108 area.

War in Ukraine is the prime reason for those gains, or more precisely, consequences of Russian aggression on its neighbor. Media reports began to circulate saying that EU countries are holding discussion over the possibility of complete ban on Russian oil. Decision could come as soon as this week and the ban would be part of the fifth EU sanction package. This would be a major twist as up to this point there was no consensus on levying energy sanctions on Russia among EU countries. However, as this would be a major blow to Russia, some kind of retaliation is expected and one cannot rule out the possibility of Russian cutting Europe off its natural gas supply. On the other hand, this would backfire on Russia as income from commodity exports is basically the only recurrent source of revenue Russia currently has.

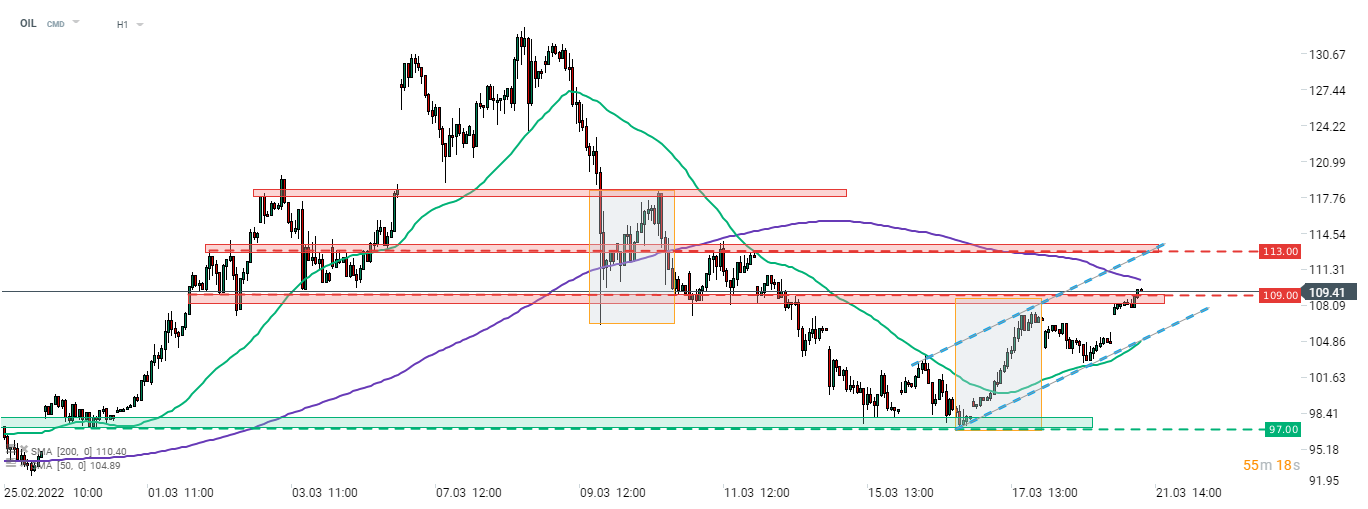

Taking a look at Brent chart (OIL), we can see that oil prices have been recovering steadily following recent correction. OIL trades within an upward channel and is currently making a break above the short-term resistance zone in the $109 area. Note that this zone also marked the upper limit of market geometry. The 200-period moving average (H4 interval, purple line), that can be found near $110.50, may also offer some resistance. Next important resistance - upper limit of the channel - can be found near the $113 mark.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report