Ministers from OPEC+ countries will hold an online meeting today at 1:00 pm GMT to make a decision on the group's output. According to media reports, the most likely outcome is that OPEC+ will continue with its policy of increasing output by 400k bpd in February. Statement from a technical meeting yesterday showed that the group does not see a big impact from the Omicron variant as countries are reluctant to impose lockdowns. Another event that may bring elevated volatility on oil today is the release of API report on oil inventories in the evening (9:40 pm GMT). Market expects a 3.4 mb drop in oil stockpiles.

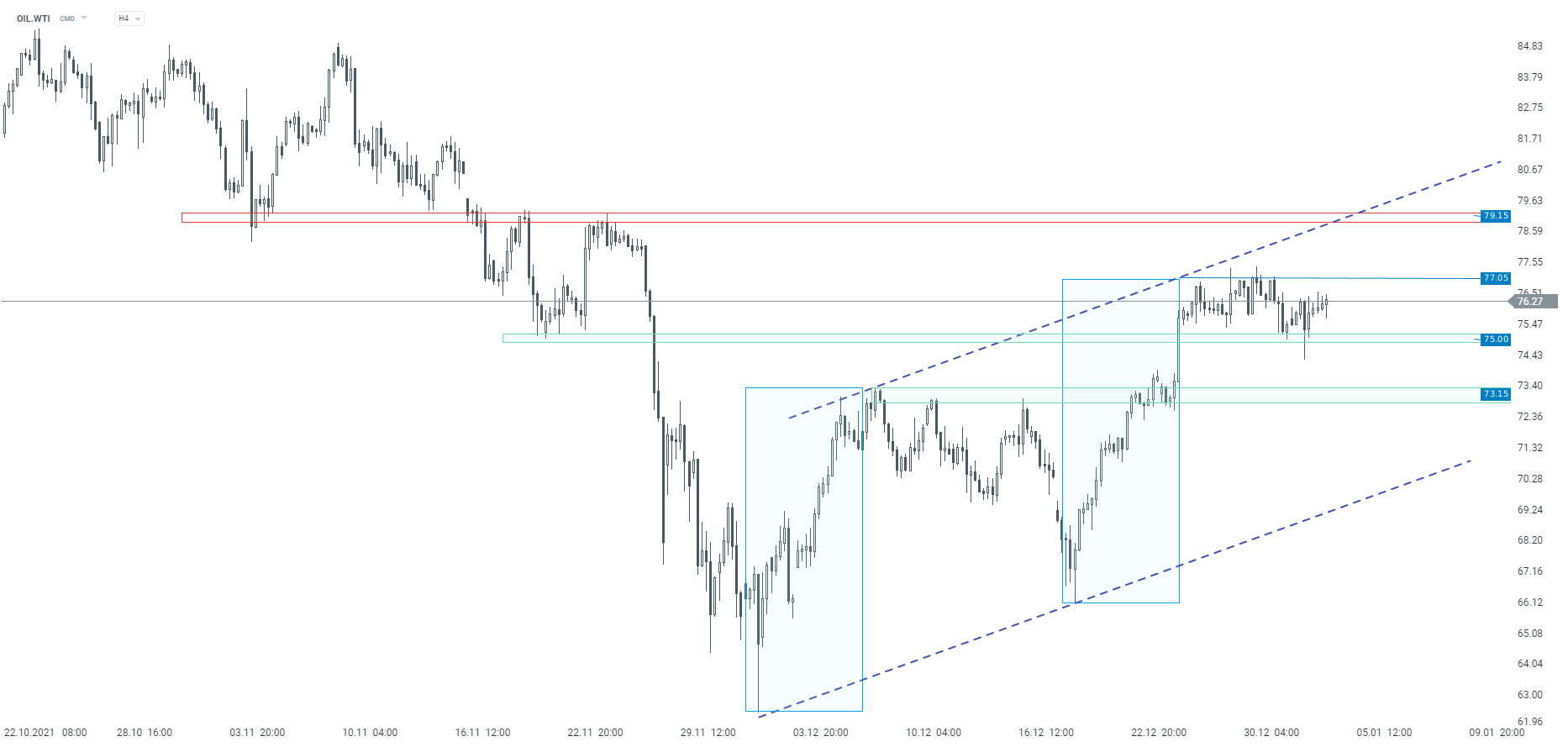

Taking a look at the OIL.WTI chart, we can see that the price halted after reaching $77.00 per barrel area and started to trade sideways. Traders should have limits of the $75-77 trading range in mind today as OPEC+ and API data may trigger some moves on the market. In case of a break above the upper limit in the $77 area, the next major resistance to watch can be found at the upper limit of the upward channel (slightly above $79).

Source: xStation5

Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook