Oil prices, including Brent and WTI, dropped more than 5% after yesterday’s FED meeting regarding interest rates. Oil.WTI dropped below $69 - the lowest level since March 24, 2023. Prices fell from $71.5 per barrel to as low as $63.6 per barrel. However, prices have rebounded slightly from lows. Higher volatility was caused by rising concerns about the global economy and demand. The re-emergence of US banking problems and OPEC+'s unwillingness to intervene are also contributing factors. The collapse of First Republic Bank has increased the risk of recession in the United States and China's post-COVID demand recovery is slower than expected. The oil producers' calendar remains unchanged, with the next meeting scheduled for June.

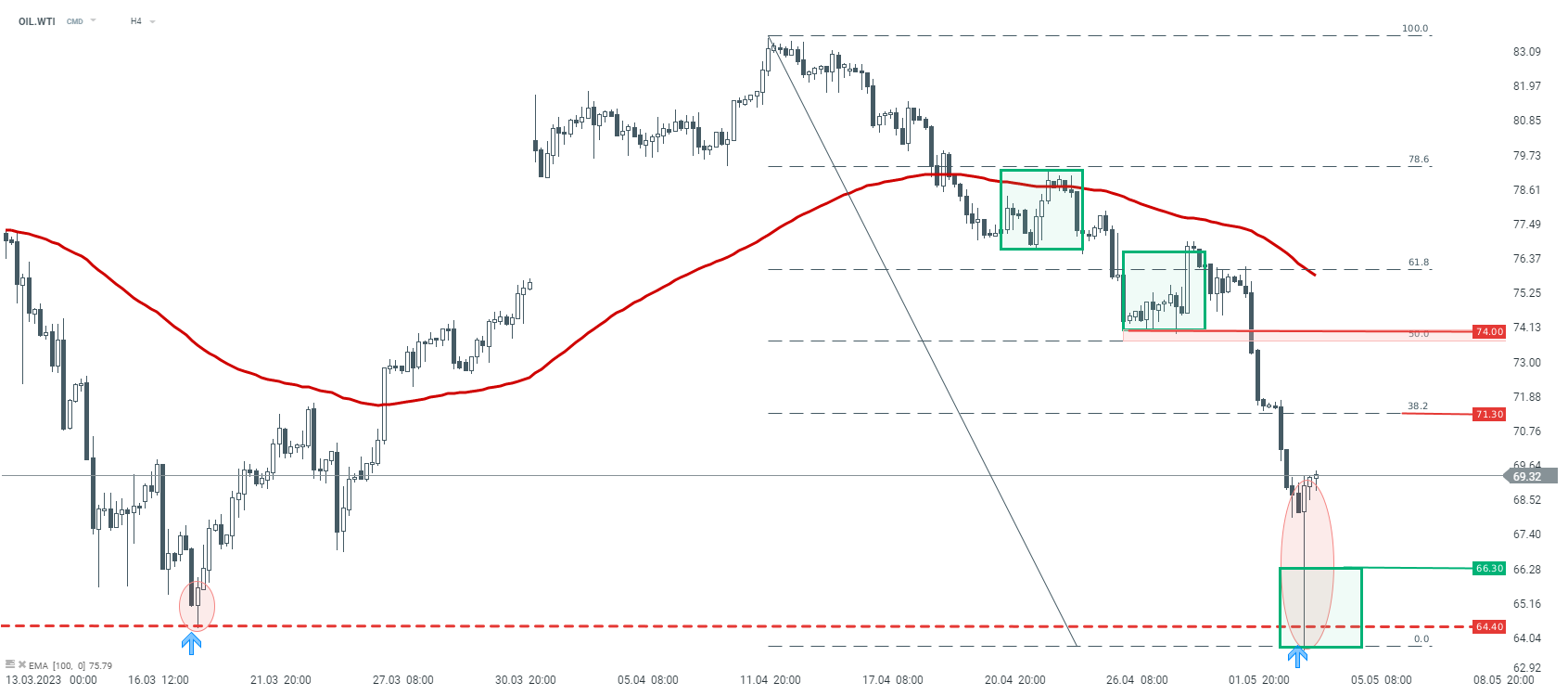

Looking at the technical analysis of OIL.WTI on the H4 interval, after midnight the downward trend intensified and a tests of the lows from March occurred at $63.6 per barrel. However, the price decrease was temporary and bulls responded immediately at the support level resulting in a pro-growth hammer formation on the chart. If the upward trend continues, attention should be paid to two resistance levels. The first, at $71.30 is derived from measuring the 38.2% Fibonacci retracement of the last downward wave. The second resistance level is around $74 and set at the previous local lows and the next Fibonacci retracement - 50%. On the other hand, If the bearish sentiment extends, the support level should be at $66.30, which is the upper limit of the 1:1 formation breakout.

OIL.WTI, H4 interval. Source: xStation5.

Chart of the Day: OIL.WTI, how will the US intervention in Venezuela affect the oil market? 🔎

Daily Summary: Massive Gains in U.S. Indices Completely Wiped Out

Three Markets to Watch Next Week (02.01.2026)

Will institutions spark a cocoa bull run in 2026? 📈 BCOM flows in focus