Oil jumped yesterday after news hit the market that Russian rockets overshot the territory of Ukraine and hit a village in Poland, a NATO member. So far, it remains uncertain what really happened - whether it was a Russian missile that missed its target and landed in Poland or whether it was a Ukrainian air defense missile that failed to intercept its target. While Russian strike on NATO soil would be a massive escalation and would likely see oil spike, oil traders should be aware that it is not the only reason for the oil catching bid yesterday.

One of Russian missiles fired at Ukraine during yesterday's massive barrage hit a power station at Ukrainian-Belarusian border that was powering a pump station at the Druzhba pipeline. As a result, oil flow via the pipeline had to be halted and it meant that oil supply to Hungary, Czech Republic and Slovakia was halted. There is no news on the scope of the damage done by that missile and whether damages will be quickly repaired or not. Potential long-term disruption to Eastern and Central European oil supply could be another factor pointing to a higher crude price going forward.

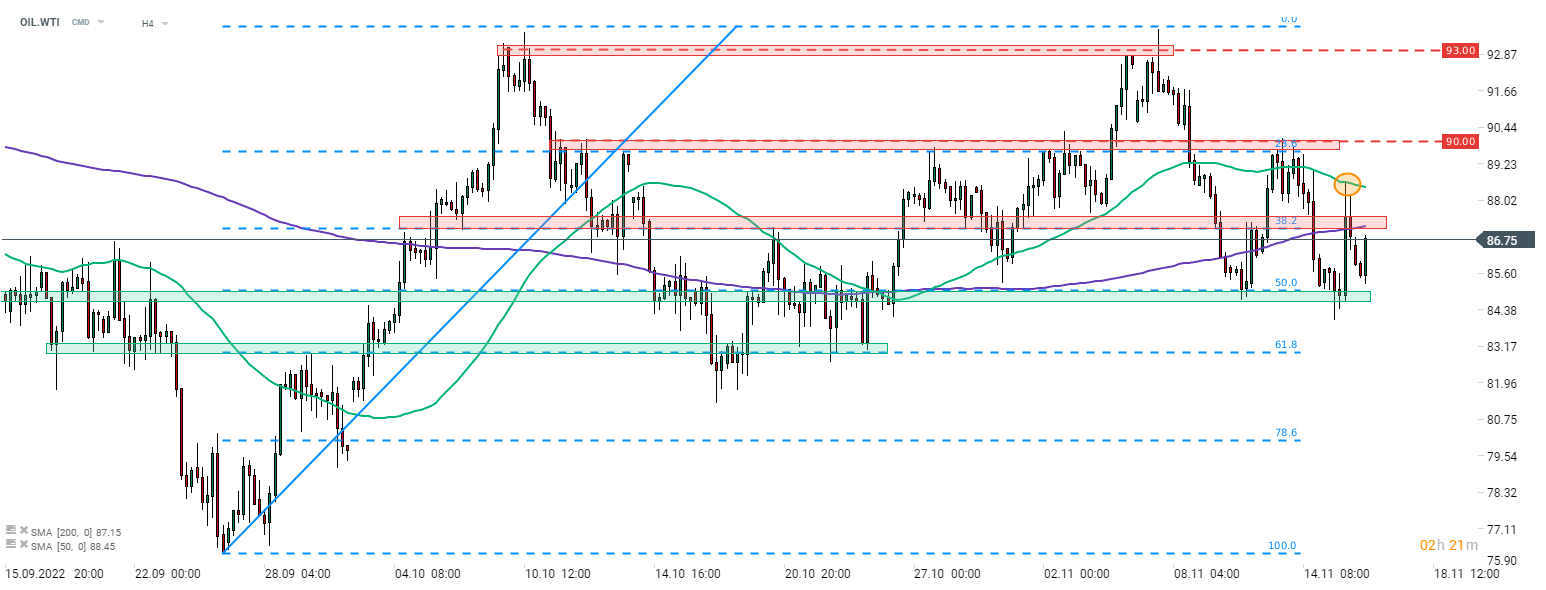

Taking a look at OIL.WTI chart at H4 interval, we can see that the price jumped yesterday in the afternoon and broke above the resistance zone marked with 38.2% retracement and a 200-session period moving average (purple line). Advance was halted at the 50-period moving average (green) and OIL.WTI started to erase gains later on. Price pulled back below the aforementioned 38.2% retracement and moved towards $85 per barrel handle. However, an attempt to launch another upward impulse can be spotted today following reports of a drone strike on an oil tanker off the coast of Oman.

Source: xStation5

Source: xStation5

Gold surges 2% 📈Is a pullback in precious metals close?

Daily Summary: "Sell America" pushes US assets off the cliff (20.01.2026)

NATGAS up by 10%🔥📈

💡Geopolitics and Tariffs Under the Spotlight: Precious Metals Hit Records (Commodity Wrap, 20.01.2026)