Trading on the oil market is back after the Easter break. Today’s session on the oil market started on a positive note, with about a 1% increase. The main reason for the increases is again concerns about future oil supply. There is speculation that the European Union may impose price and export regulations on Russian oil in another round of sanctions. Ultimately, investors expect a ban on Russian oil imports to finally occur in the future. Such measures are being considered for natural gas, which price continued its gains today in the U.S. futures market.

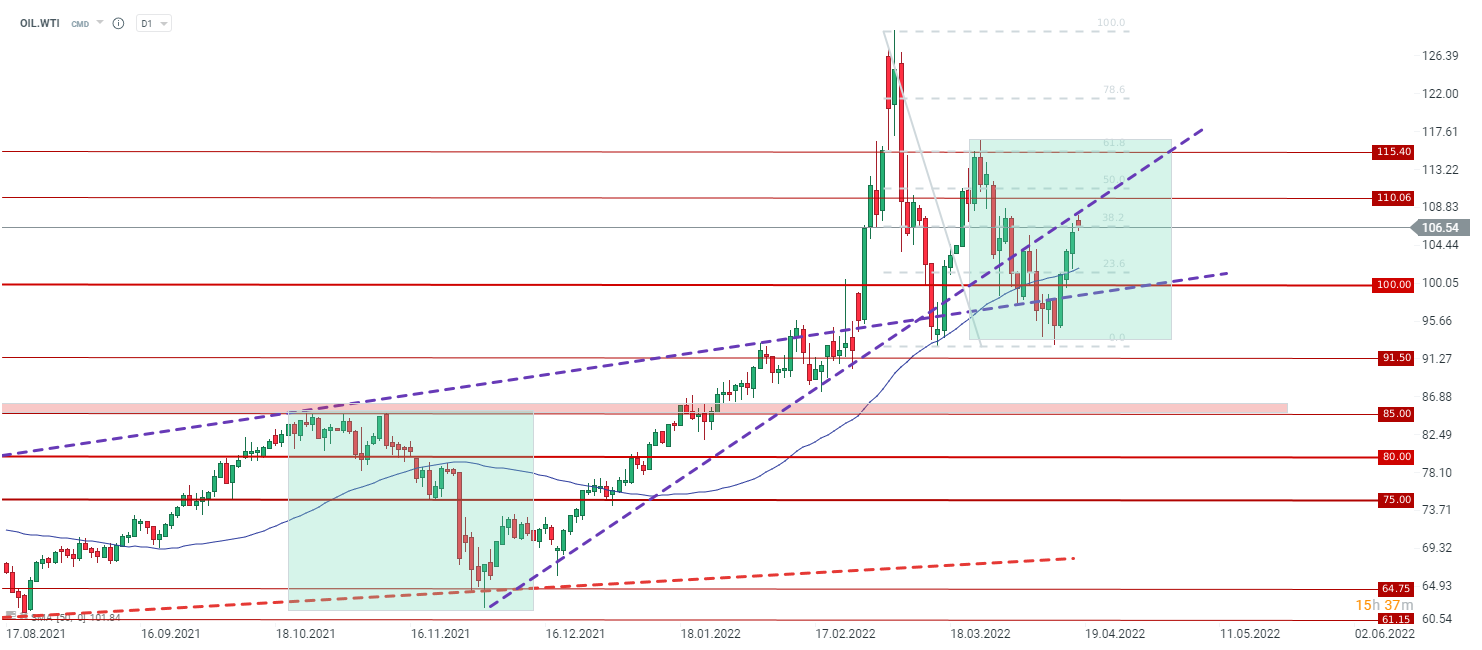

Oil gained about 1% at the open today, but just before the standard start of the European session (still almost all markets are closed), the price is just above the closing from last week. Last week on Thursday, the price was up almost 2.5%, and for the whole week, the price was up almost about 8%. Technically, we can see a failed breakout through resistance at the Fibo 38.2 retracement for WTI crude oil. Short-term support during today's session can be determined at $105. More important support is located at $101 along with the 23.6 retracement, while bulls will continue to target the area around the 50.0 retracement and the $110 per barrel level. Additionally, further gains may be limited by the previous uptrend line, which may act as resistance at the moment.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉