Weekend events in Venezuela shook the global news cycle, but so far they have had a limited impact on financial markets. At the time of writing, oil, precious metals, and the US dollar are posting modest gains.

- Maduro was detained in a US-led military operation.

- Trump stated that the United States now has “full access” to Venezuela’s resources and wants US oil companies to return to the country.

- Only minor damage to infrastructure was reported at the port of La Guaira, while PDVSA production remained intact.

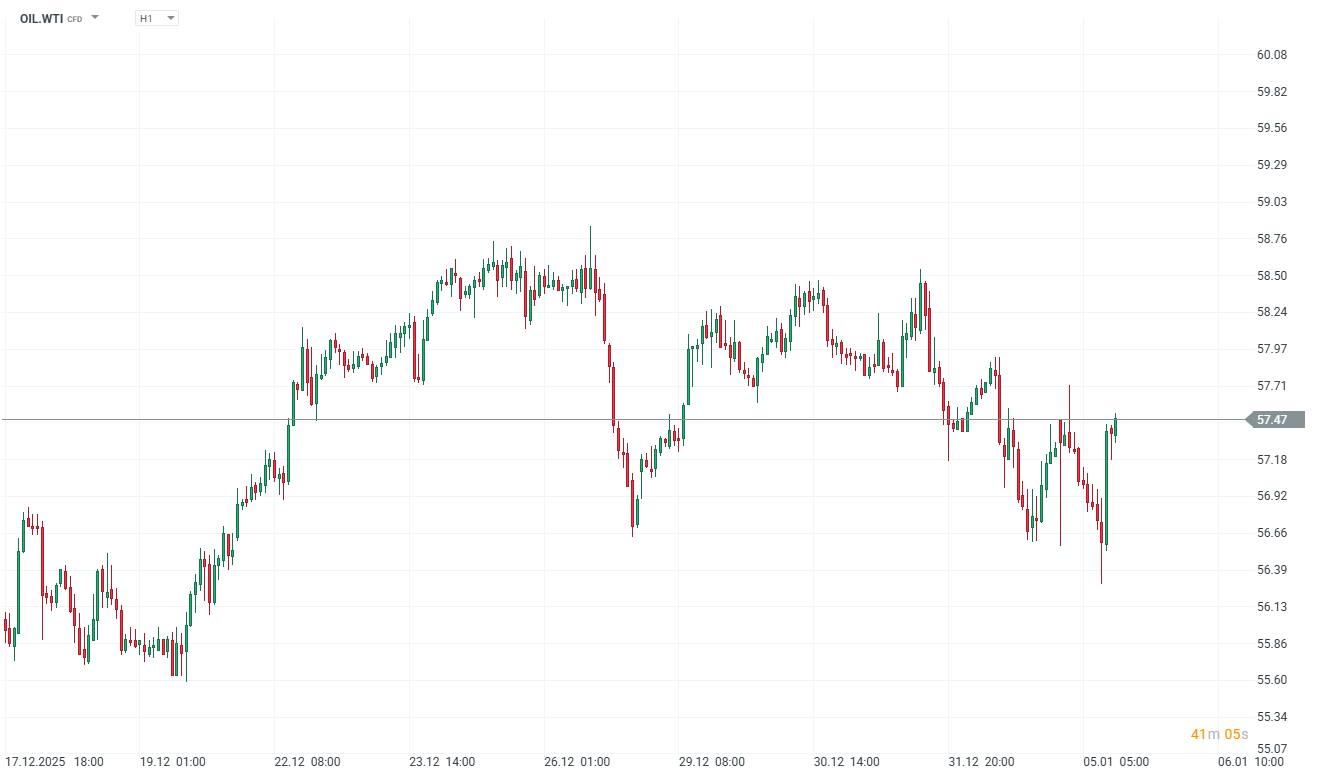

Oil initially fell by around 0.73% toward $56.30 per barrel, but later rebounded and is now trading near $57.45. The market is attempting to price in the likelihood of foreign capital flowing into Venezuela and the potential rebuilding of the country’s severely degraded oil sector by the United States. Venezuela currently accounts for only around 1% of global production after years of sanctions and underinvestment, yet it holds roughly 17% of the world’s oil reserves. Reports of capital initiatives — including a $2bn investment fund led by former Chevron executive Ali Moshiri — have strengthened expectations that production could gradually increase over a longer horizon. US oil majors are also rallying sharply, including Chevron (+7.70%) and Exxon Mobil (+4.45%), on speculation of potential involvement in Venezuela’s infrastructure reconstruction. However, viewed realistically, restoring output would require years of costly investment in wells, refineries, and transport infrastructure, and some estimates suggest that any meaningful increase in supply may not materialize before 2030 or later.

Given this long-term horizon, markets have assessed the near-term supply impact as limited. Industry commentary indicates that rebuilding Venezuela’s oil sector is a “very long-term project” that may face setbacks before delivering results, which helped ease fears of an immediate supply glut. At the same time, OPEC+ decided over the weekend to keep production unchanged, further stabilizing the supply outlook for the first quarter of 2026.

In summary, the weekend developments are currently having a more political than fundamental impact on markets. The main observable reaction so far has been heightened volatility in oil, a modest strengthening of the US dollar, and gains in precious metals — once again supported by rising geopolitical uncertainty.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)