A lot of attention at the start of a new week is paid to oil, which launched today's trading with a big bearish price gap amid signs of potential de-escalation in the Middle East. However, there is also another group of commodities that is standing out today - precious metals. Gold continues to rally even in spite market expectations for Fed policy moves becoming less dovish after Friday's strong jobs data.

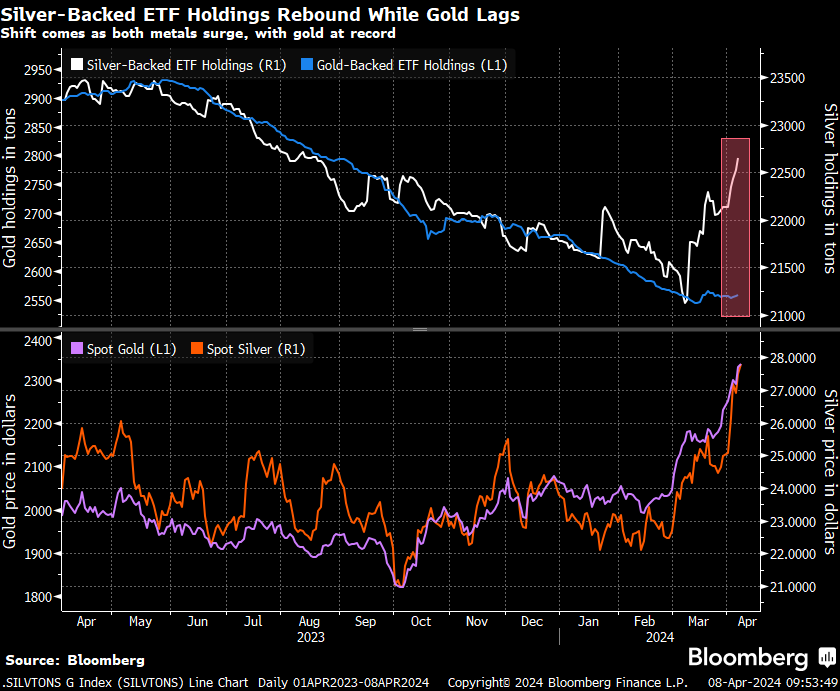

While gold is drawing the most attention among precious metals as it is trading at record highs, silver also deserves a note. SILVER is the best performing precious metal today, gaining around 1.7% at press time. Gold seems to be driven mostly by expectations of easier monetary policy from major central banks, especially Fed, as data on ETF holdings does not show any increase in demand for gold from such institutions. The situation looks different when it comes to silver, with ETFs noticeably increasing their physical silver holdings since the beginning of March.

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Taking a look at SILVER chart at D1 interval, we can see that the commodity broke above the $26 resistance zone last week and continued to rally afterward. Precious metal tested resistance zone ranging above $28 mark today and reached the highest level since June 2021. However, bulls were unable to break above the area and a small pullback occurred. Nevertheless, price remains nearby and another attempt to break above the $28 area cannot be ruled out. However, it should be noted that 14-day RSI indicator sits above 70.0 level, which was associated with local highs in the past, so bulls should stay on guard.

Source: xStation5

Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?