The debt market is slowly becoming the focus of investor attention at the moment, as a result of the fact that it is the immediate rise in US 10-year bond yields that is driving stock indices down. What is worth adding, however, is that until recently, these developments could be fully attributed to market sentiment toward the Fed's monetary policy, nevertheless, the situation is now becoming somewhat broader.

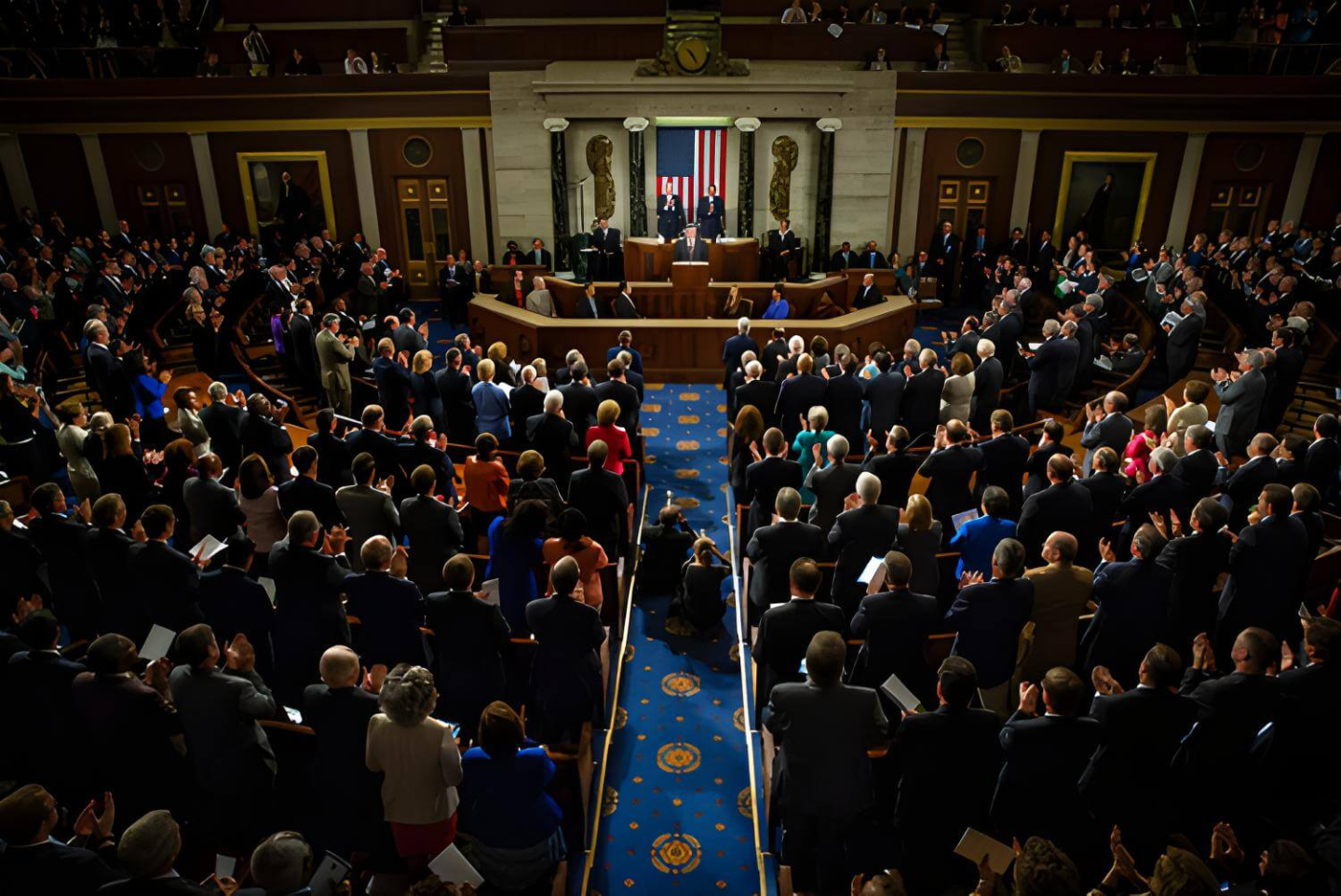

Kevin McCarthy was ousted from his position as Speaker of the House of Representatives, after Congressman Matt Gaetz of Florida filed a removal motion, which was later voted down in the House of Representatives. The topic of contention here was an agreement on a budget stopgap dismissing the specter of a government shutdown.

According to Goldman Sachs strategists, the historic removal of Republican Kevin McCarthy from his position as Speaker of the House of Representatives could increase the risk of a downgrade of the US credit rating and further lift equity markets.

The U.S. is struggling with mounting debt (see yesterday's chart below), and disagreements in Washington over issues of ongoing federal spending and financial/military support for Ukraine increase the chance of deepening discord and will once again increase the chance of a government shutdown in the future.

Source: ZeroHedge

Importantly, however, in the short term, simply removing McCarthy from office may be limited, as the government has until November 17 to secure funding. On the other hand, however, Goldman Sachs said McCarthy's departure increases the risk of a government shutdown a month from now.

Source: xStation5

MIDDAY WRAP: European indices under pressure from the Greenland dispute, Japan announces snap elections 🎙️

Economic calendar: Davos and quarterly earnings on Wall Street 🔎

Morning wrap (19.01.2026)

Economic calendar: Inflation in Europe and US manufacturing in the spotlight📌