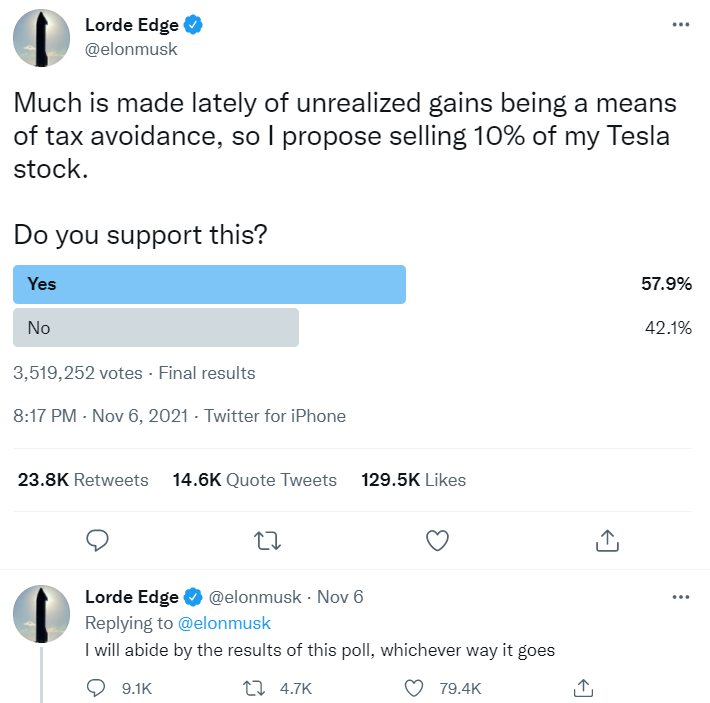

Nasdaq-100 (US100) futures are underperforming other index futures from Wall Street this morning. While the scale of the drop is quite minor (around -0.3% at press time), it stands out among other US indices that trade more or less flat. Elon Musk, CEO of Tesla, can be named as the reason behind the underperformance of the tech sector. Musk set up a poll on Twitter on Saturday, asking his followers whether he should sell 10% of his Tesla holdings (worth around $21 billion) and said that he will abide with what the public says.

Selling such a big stake can create a massive downward pressure on share price and today's moves reflect such expectations. However, average trading volume for Tesla is slightly over 21.5 million shares, or around $26.23 billion using current market price. This means that should Elon Musk decide to spread stock sales over 2 or 3 weeks, its impact on the market may be almost unnoticeable. There is a huge demand for Tesla shares, thanks to the recent steep rally, and market is likely to absorb shares to be offered by Musk without much of an issue.

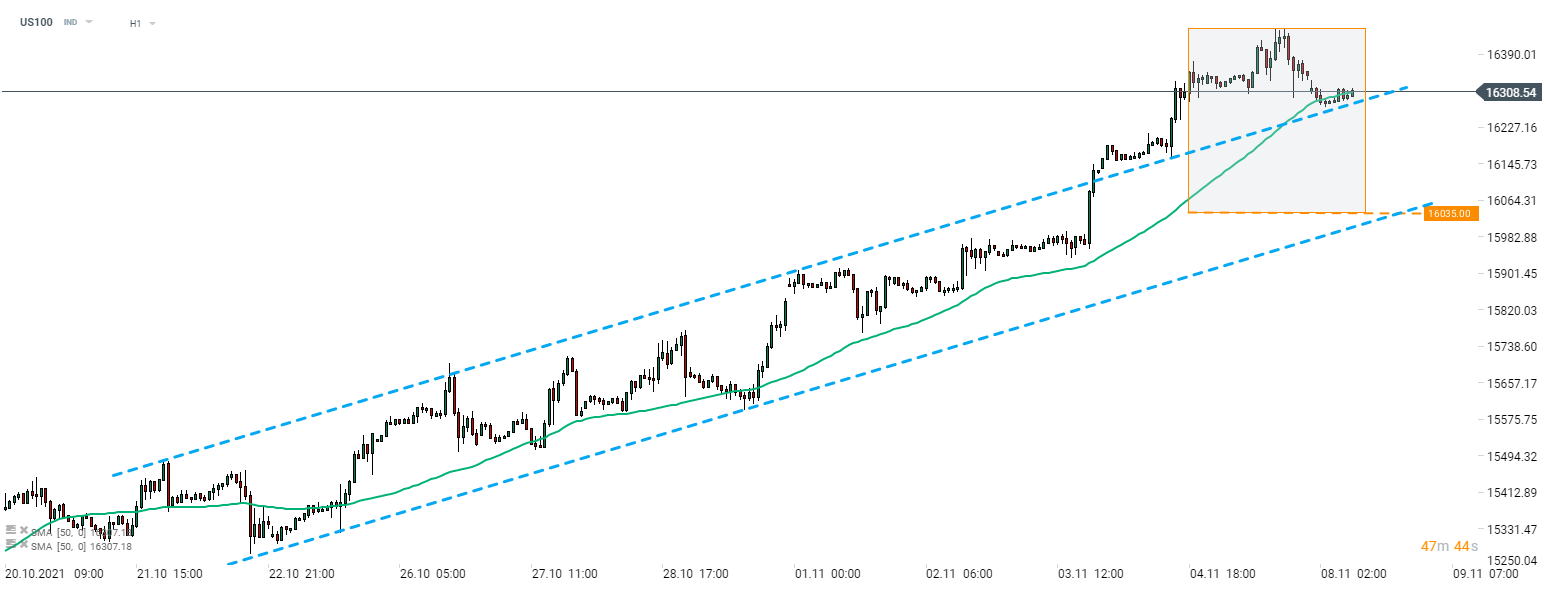

A look at the US100 chart at H1 interval shows that the index has deepened pullback start on Friday evening today. Index reached the 50-hour moving average and tested the upper limit of an earlier-broken upward channel. It looks like the decline has been halted for now. Should the downward move resume and the index breaks back into the range of the aforementioned channel, the next support to watch can be found near the lower limit of the channel, that also coincides with the lower limit of a market geometry at 16,035 pts (equality with correction with 7-12 November).

Source: xStation5

Source: xStation5

Results of a poll suggest that Elon Musk will sell 10% of his Tesla holdings. Source: Twitter

Results of a poll suggest that Elon Musk will sell 10% of his Tesla holdings. Source: Twitter

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report