The FOMC meeting is a top event of the week. The US central bank will announce its next monetary policy decision tomorrow at 7:00 pm GMT. As it will be a quarterly meeting, a new set of economic forecasts and rate forecasts will be issued. Apart from that, the Fed is also expected to announce an acceleration in the pace of QE tapering. Recent data from the US has been solid and now the Fed may be more focused on bringing inflation back under control. Should Fed live up to market's expectations and trim pace of purchases further, dot-plot should show quicker path of rate hikes and it may trigger repricing in the markets.

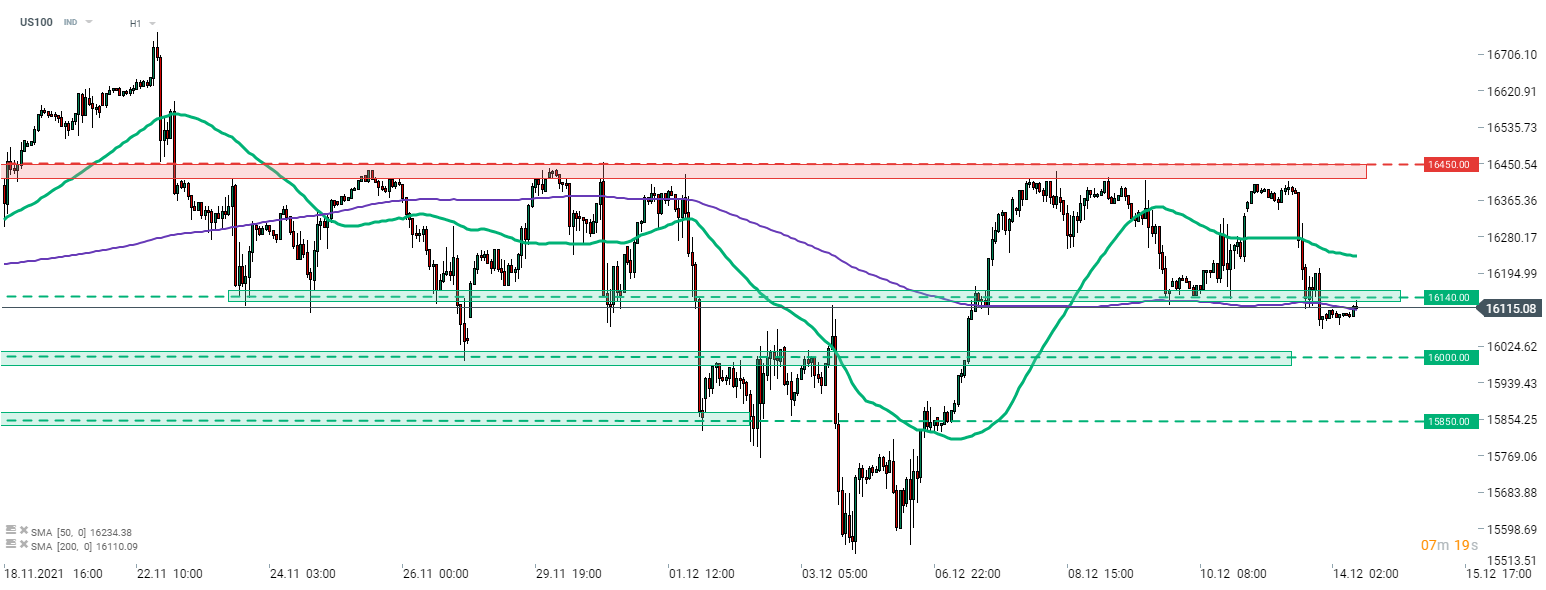

Growth stocks are usually the most vulnerable to interest rate changes with rate hikes having a negative impact. Taking a look at US100 chart, we can see that Nasdaq-100 index has been range trading since the beginning of November. Stock managed to break above the range at the end of November and reach a fresh all time high but has pulled back since. Moves have been limited by the 16,140-16,450 pts range since, spare for a false downside breakout at the beginning of December. Following yesterday's sell-off, the index has once again found itself below the lower limit of the range. US100 dropped below 16,140 pts and 200-hour moving average (purple line). An attempt to break back above those hurdles is made during European morning trade but has failed to bear fruit yet. In case bulls fail to push the index back above 16,140 pts, a new leg lower may be painted with 16,000 pts area being a potential target for sellers.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report