Wall Street indices traded higher yesterday, with the move being driven by tech sector. Semiconductor stocks rebounded after last week's sell-off, supporting S&P 500 (US500) and Nasdaq-100 (US100). Things are about to get more interesting for tech stock traders as we are getting into a phase of Wall Street earnings season, when reports from Big Tech companies will be released. Alphabet will release its Q2 financials today after close of the Wall Street session, along with Tesla, which is also a member of Nasdaq-100 index. Those are two key earnings reports scheduled for today, but there are also that may help shape stock market sentiment.

Top Wall Street earnings today

- Comcast (CMCSA.US) - before market open

- GE Aerospace (GE.US) - before market open

- Alphabet (GOOGL.US) - after market close

- General Motors (GM.US) - before market open

- Coca-Cola (KO.US) - before market open

- Lockheed Martin (LMT.US) - before market open

- Philip Morris (PM.US) - before market open

- Spotify (SPOT.US) - before market open

- Tesla (TSLA.US) - after market close

- Texas Instruments (TXN.US) - after market close

- United Parcel Services (UPS.US) - before market open

- Visa (V.US) - after market close

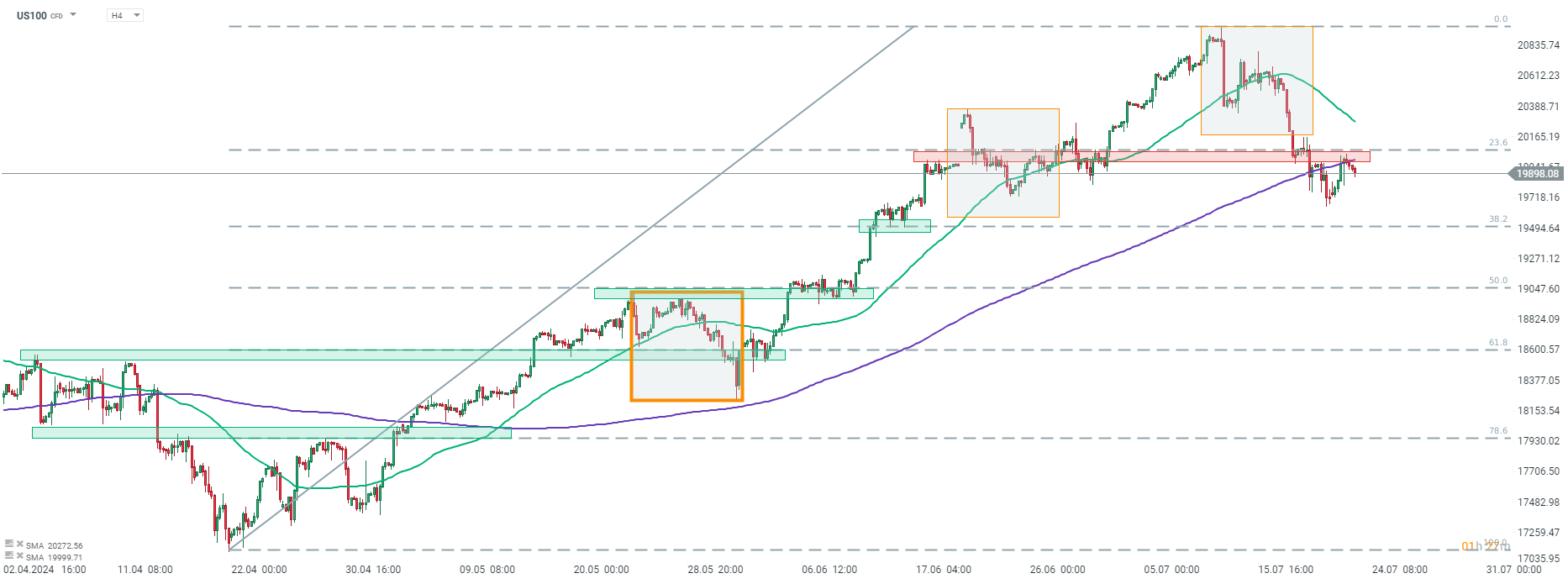

Taking a look at US100 index at H4 interval, we can see that the index recovered slightly yesterday, but the attempt to launch a bigger move was halted by the resistance zone ranging below 23.6% retracement of the upward move launched in the second half of April 2024. A point to note is that the index broke below the lower limit of the Overbalance structure last week, hinting that the trend has turned bearish. Nevertheless, earnings reports from Big Tech companies may help turn the tide and push the index back towards its all-time highs. In case bulls fail to regain control over the market and pullback deepens, the near-term support level to watch are marked with 38.2% and 50% retracements at 19,500 pts and 19,050 pts, respectively.

Source: xStation5

Source: xStation5

Dailu summary: Sell-off on Wall street 📉 Bitcoin and Ethereum extend downfall in panic

US100 loses 2% 📉

US Open: US100 slides 0.5% under pressure from IT sector 📉ServiceNow drops 6%

Polish stocks lead gains in Europe 📈W20 surges 2%