Fed Chair Jerome Powell said yesterday that it would make sense to moderate the pace of policy tightening in the light of recent macroeconomic data. He said that economic momentum has decelerated below trend but such a situation would need to last for inflation to come down. As price growth in the US economy remains elevated, Powell sees need for further rate hikes but his comment on moderation of the pace made markets believe that 50 bp rate hike is now the base case scenario for December meeting (December 14, 2022). Money markets now price in less around 2% chance of a rate hike bigger than 50 bp rate hike, down from 15% prior to Powell's speech.

Stock markets rallied as Powell hit the dovish note, pushing Nasdaq-100 (US100) over 4% higher yesterday. While the tech index saw the biggest reaction to Powell's speech, it should be noted that it is Dow Jones that has been the top performing Wall Street index as of late. Dow Jones (US30) jumped 20% off the October low, compared to an around-15% rebound for other three major indices (Nasdaq, S&P 500 and Russell 2000).

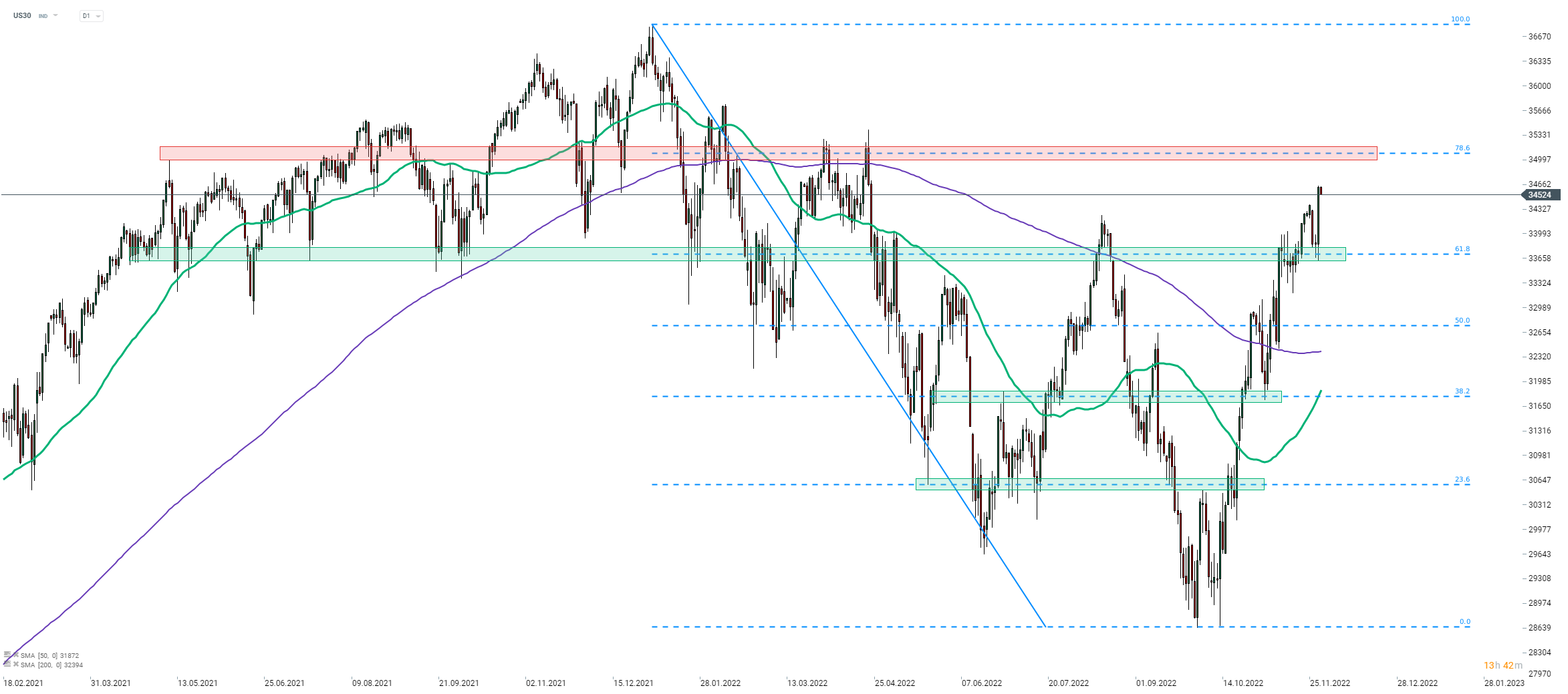

Taking a look at US30 chart at D1 interval, we can see that the index jumped above recent local high and reached the highest level since late-April 2022, a 7-month high! A small pullback can be observed today. Should bulls regain control and push the index higher again, the first major resistance zone to watch can be found in the ranging around 78.6% retracement of the downward move started in January 2022 (35,100 pts area).

Source: xStation5

Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)