Moods on the global stock market are slightly weaker at the beginning of a new week. Majority of indices from Asia moved lower and the beginning of the European session does not look too optimistic either. US index futures are also trading a touch lower.

However, US indices may see some more action starting from this week as earnings season for Q2 2022 begins! As usual, major US banks will be the first ones to report. Reports from JPMorgan (Thursday), Morgan Stanley (Thursday) and Citigroup (Friday) are among top ones this week. Note that performance of the banking sector can help judge performance of the whole economy therefore reports from major Wall Street players may have a big impact on market sentiment.

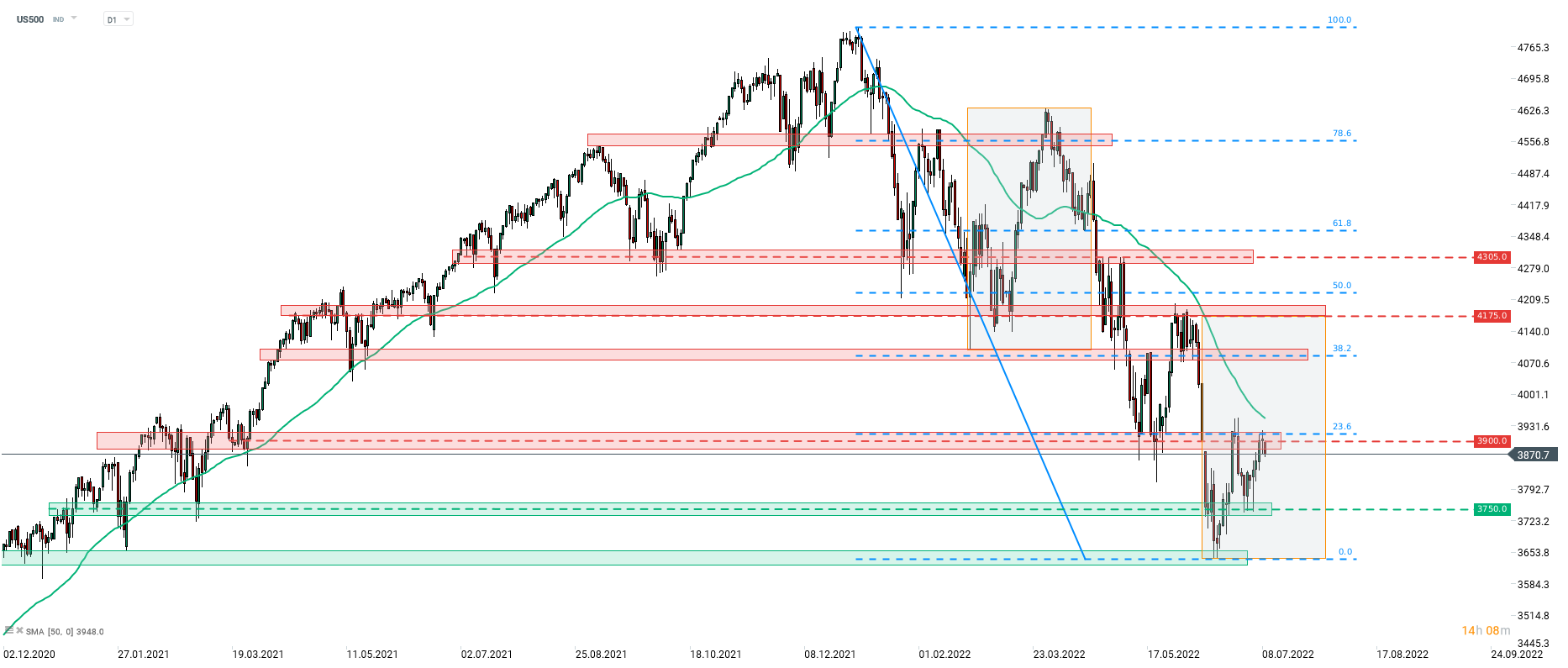

Taking a look at S&P 500 index (US500) at D1 interval, we can see that a recent upward correction has been halted at the resistance zone ranging around the 3,900 pts mark once again. This area is additionally strengthened by the 23.6% retracement of the downward impulse launched at the beginning of the year. A pullback can be observed today and should it continue, the first near-term support to watch can be found in the 3,750 pts area. On the other hand, should bulls regain control and manage to break above the aforementioned 3,900 pts zone, an upward move may extend. In such a scenario, a key mid-term resistance to watch can be found in the 4,175 pts area and is marked with the upper limit of the Overbalance structure.

Source: xStation5

Source: xStation5

Chart of the Day: JP225 (20.10.2025)

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

DE40: European markets decline due to concerns about the U.S. banking sector