USDCAD could be one of the FX pairs that may experience some elevated volatility today. This is because there is Canadian CPI report for May scheduled for release at 1:30 pm BST, followed by US Conference Board consumer confidence index for June.

Canadian report is expected to show a small deceleration in headline CPI inflation from 2.7% in April to 2.6% YoY in May, as well as deceleration in core CPI inflation from 1.6% to 1.4% YoY. Conference Board index is expected to show a deterioration from 102.0 in May to 100.2 in June. While US data is likely to have an only short-term impact on USD, Canadian inflation report will be watched more closely as release confirming expected slowdown or showing a bigger-than-expected slowdown in price growth may encourage Bank of Canada to proceed with more rate cuts, following a 25 basis point reduction at last meeting.

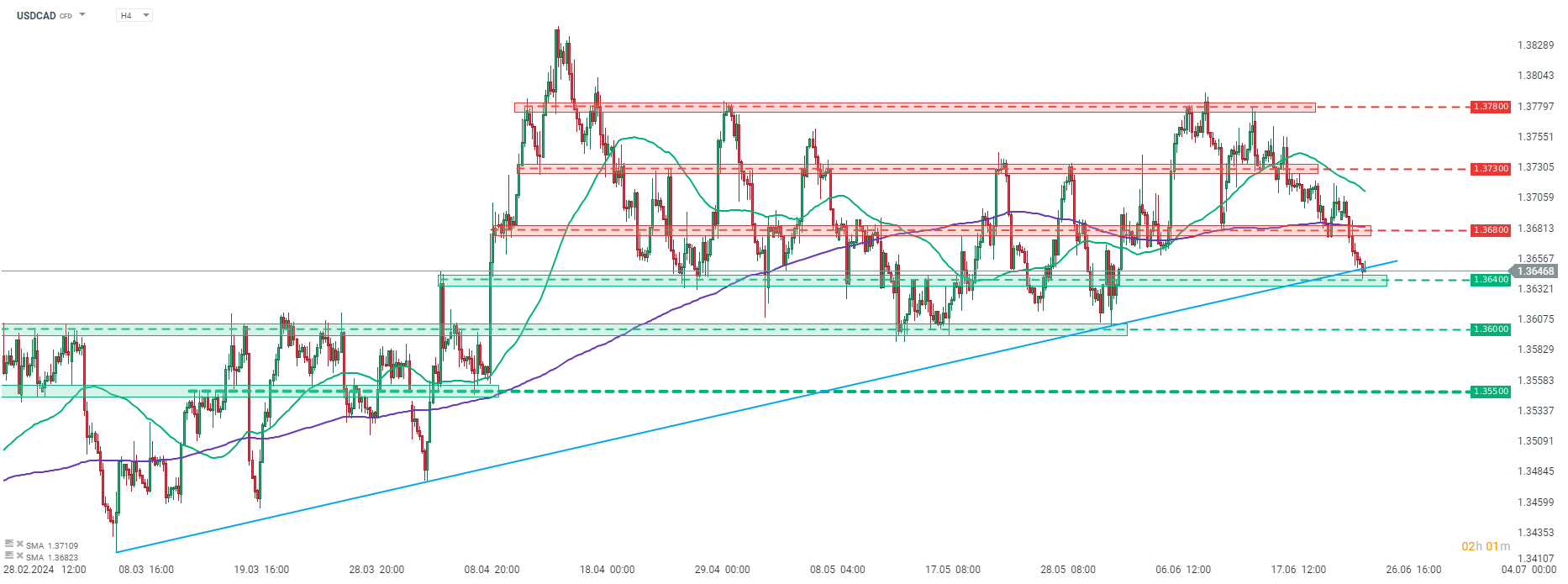

Taking a look at USDCAD chart at H4 interval, we can see that the pair has been trading sideways since mid-April. Pair has recently pulled back from the 1.3780 area and is now testing 1.3640 support zone, marked with previous price reaction and an upward trend line. A dovish surprise in Canadian data may help the pair recover some ground. In such a scenario, the first near-term resistance level can be found in the 1.3680 area, marked with 200-period moving average (purple line) and previous price reactions.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)