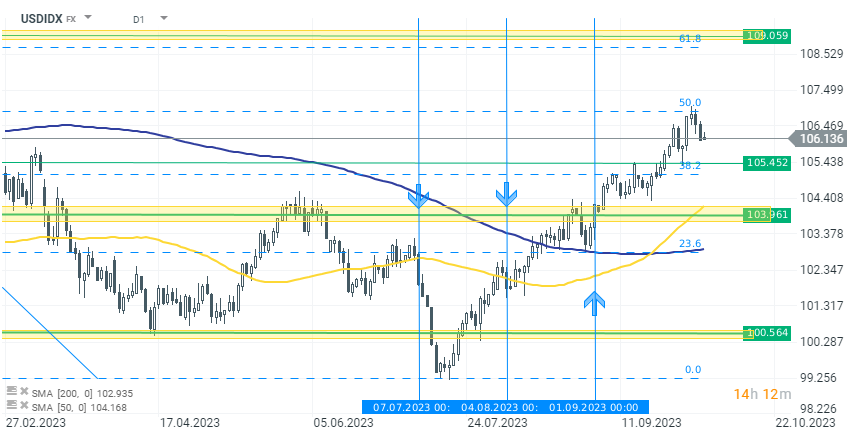

The US dollar upward momentum is weakening and has currently halted its uptrend precisely at the 50% Fibonacci retracement level from the recent highs achieved in September 2022. Seasonally, October favors higher-risk assets, which also affects the capital outflow from safer assets like the dollar. A year ago, during the same period, around the end of September, we experienced a local peak after significant increases caused by the sudden tightening of the Fed's monetary policy and deteriorating prospects. This year, during a similar period, we saw a similar sentiment in the markets. Now, we are entering the next month with the dollar already starting a minor correction.

In addition, today the market's attention will be focused on the NFP employment report, which, after a weaker ADP report on Wednesday, is expected to confirm a lower employment increase. The last three NFP report publications have been highlighted on the dollar chart. The first two of them turned out worse than market expectations, which, as can be seen on the dollar chart, initiated several days of declines. After the July 7th report, there was even a 5-day correction of about 4.0%. However, the September report, which turned out better than expected, led to increased expectations for interest rate hikes, consequently strengthening the dollar and providing more fuel for growth.

For a week now, the dollar has halted its growth and is in a slight correction awaiting data. Given the weak ADP report, there are reasons to expect an equally weaker NFP report. In such a case, the current correction on the dollar index may intensify, and the next decline zone could be at the level of 105. Source: xStation 5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Three markets to watch next week (06.03.2026)