The dollar extends its downward trend, reaching its lowest level since the beginning of the year. The dollar's decline is being supported by growing expectations of a Fed pivot at the September FOMC meeting.

Although there are still several important macroeconomic reports to be released before the meeting, such as labor market data, FOMC bankers are already suggesting a 25 basis point rate cut. Yesterday, we heard opinions from Kashkari, Daly, and Goolsbee. The first two bankers acknowledged that cuts in September would be justified, and progress in combating inflation is noticeable. Meanwhile, Goolsbee, who usually leans dovish, remained relatively neutral, noting that the labor market could be a key argument for rate cuts. Today, we will learn opinions from two more bankers, Bostic and Barr.

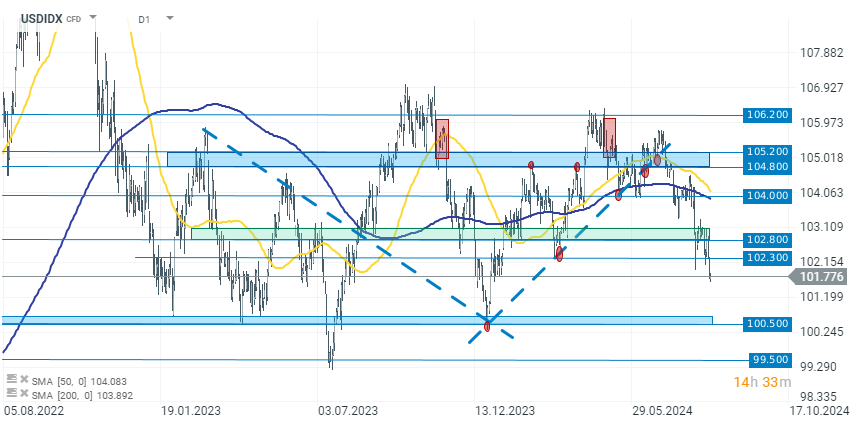

Nevertheless, the start of a rate-cutting cycle in the U.S. is approaching inevitably, which should support the continued downward trend. At the end of 2023, a local low near 100.5000 was established based on rate-cut speculation. Currently, the start of an actual easing cycle in September is highly likely, and almost certain within the next two meetings. Therefore, the chances of breaking out of the nearly two-year consolidation channel on the USDIDX are now higher.

USDIDX (D1 interval)

The dollar index lost nearly 0.50% yesterday. The next likely target for the downward move appears to be levels around 100.5000.

Source: xStation 5

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

3 markets to watch next week (05.12.2025)

US100 gains after PCE data 📈

Santa Claus Rally – myth, statistics or a real market opportunity in 2025?