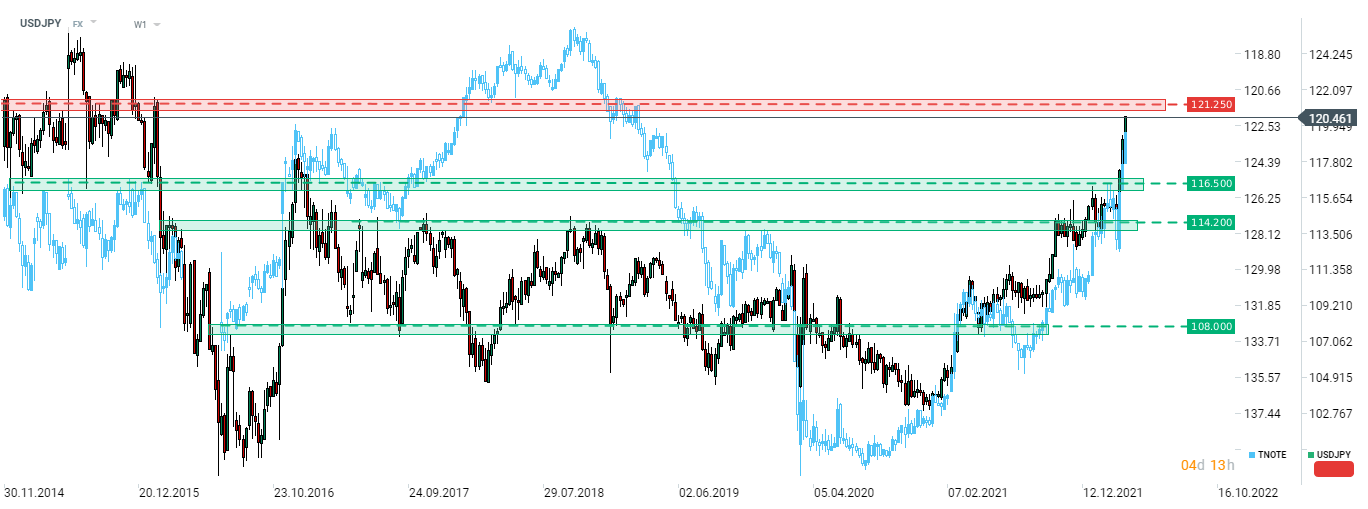

USDJPY is an almost constant upward move since the beginning of 2022. In spite of pick-up in geopolitical tensions, JPY fails to act as a safe haven and is the worst performing G10 currency year-to-date. Meanwhile, the US dollar is having a great start to the year as the Fed's tightening cycle and safe have flows keep currency in demand. USDJPY is one of the pairs that best reflect changes in US yields and as those were on the rise so was the pair. Result of these factors is the first break of the USDJPY above 120.00 mark since early-2016.

Taking a look at the USDJPY chart at a weekly interval, we can see that the pair broke above a long-term resistance zone in the 116.50 area at the beginning of March and is now slowly approaching resistance in the 121.25 area. Blue overlay on the chart below is an inverted TNOTE chart and shows that upward move on the pair mimicked changes on the bond market. Having said that, keeping track of US yields may be the best way of trading USDJPY right now. Traders should keep on guard this afternoon as a number of Fed members will be delivering speeches.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️