Citigroup (C.US) stock plunged nearly 4.0% after Bloomberg reported that one of the top investment banking companies warned of rising costs and declining revenue. Chief financial officer Mark Mason announced that he expected second-quarter expenses to increase to somewhere between $11.2 billion and $11.6 billion, according to Bloomberg. Meanwhile trading revenue is expected to decline by about 30% compared to previous year’s levels. Today's Fed meeting may turn out to be crucial for Citigroup and other financial companies in the short term. If the central bank maintains its dovish message, treasury yields may fall, which will be negative for financial stocks.

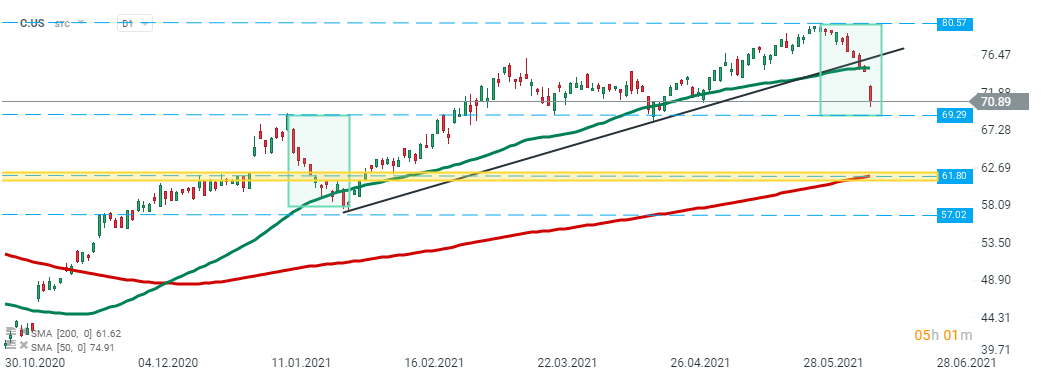

Citigroup (C.US) stock broke below upward trendline and 50 SMA (green line) this week and downward move is being continued today. Stock launched today's session with a bearish price gap and is currently approaching the lower limit of the 1:1 structure at $69.29. Should break lower occur, then downward move may accelerate towards major support at $61.80. Source: xStation5

Citigroup (C.US) stock broke below upward trendline and 50 SMA (green line) this week and downward move is being continued today. Stock launched today's session with a bearish price gap and is currently approaching the lower limit of the 1:1 structure at $69.29. Should break lower occur, then downward move may accelerate towards major support at $61.80. Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals