Citigroup (C.US) stock plunged nearly 4.0% after Bloomberg reported that one of the top investment banking companies warned of rising costs and declining revenue. Chief financial officer Mark Mason announced that he expected second-quarter expenses to increase to somewhere between $11.2 billion and $11.6 billion, according to Bloomberg. Meanwhile trading revenue is expected to decline by about 30% compared to previous year’s levels. Today's Fed meeting may turn out to be crucial for Citigroup and other financial companies in the short term. If the central bank maintains its dovish message, treasury yields may fall, which will be negative for financial stocks.

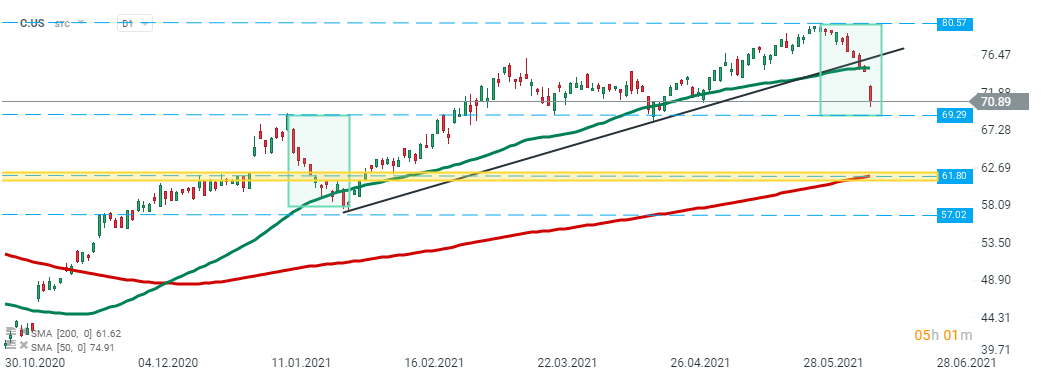

Citigroup (C.US) stock broke below upward trendline and 50 SMA (green line) this week and downward move is being continued today. Stock launched today's session with a bearish price gap and is currently approaching the lower limit of the 1:1 structure at $69.29. Should break lower occur, then downward move may accelerate towards major support at $61.80. Source: xStation5

Citigroup (C.US) stock broke below upward trendline and 50 SMA (green line) this week and downward move is being continued today. Stock launched today's session with a bearish price gap and is currently approaching the lower limit of the 1:1 structure at $69.29. Should break lower occur, then downward move may accelerate towards major support at $61.80. Source: xStation5

US OPEN: Wall Street awaits FOMC minutes

DE40: DAX hits a 2.5-month high 📈 Rheinmetall jumps on renewed Russia–Ukraine tensions

US OPEN: Start of the week with mild discounts, amid geopolitical tensions

US OPEN: US500 tests record highs as technology sector leads gains