Cocoa has been losing heavily since the beginning of this week, extending the declines that began on June 14. Today there was a near test of the $7,000 level, although just 10 days ago levels of $10,000 per ton were quoted. In addition, the current weather in Africa is expected to favour trees at the end of the middle season, and recent rains are expected to lead to improved conditions ahead of the season proper, which begins in September/October.

- Ghana said it expects a marked rebound in production next season on 24/25 compared to 23/24, with the rebound in production expected to be between 425,000 tons and 700,000 tons. On the other hand, Ghana intends to delay deliveries of cocoa from this for next season, due to uncertainty about current supply.

- Deliveries to Ghana's ports are down more than 30%, while supplies to Côte d'Ivoire are down almost 30% compared to last year. Cocoa stocks in Europe and the U.S. are falling strongly, which may suggest that processing in Q2 will not perform less well, despite sharply higher prices than a year ago.

The price has fallen almost to the $7,000 per ton level. If the 1:1 correction were to be realized, then cocoa could retreat as low as $6100 per ton. The $7000 level is additionally the 61.8 Fibo retracement of the entire upward wave from this year, while the area around $6000 is the 61.8 abolition of the upward wave started in 2022. After a slight rebound in long cocoa positions, the current report shows a net decline in positions. Source: xStation5

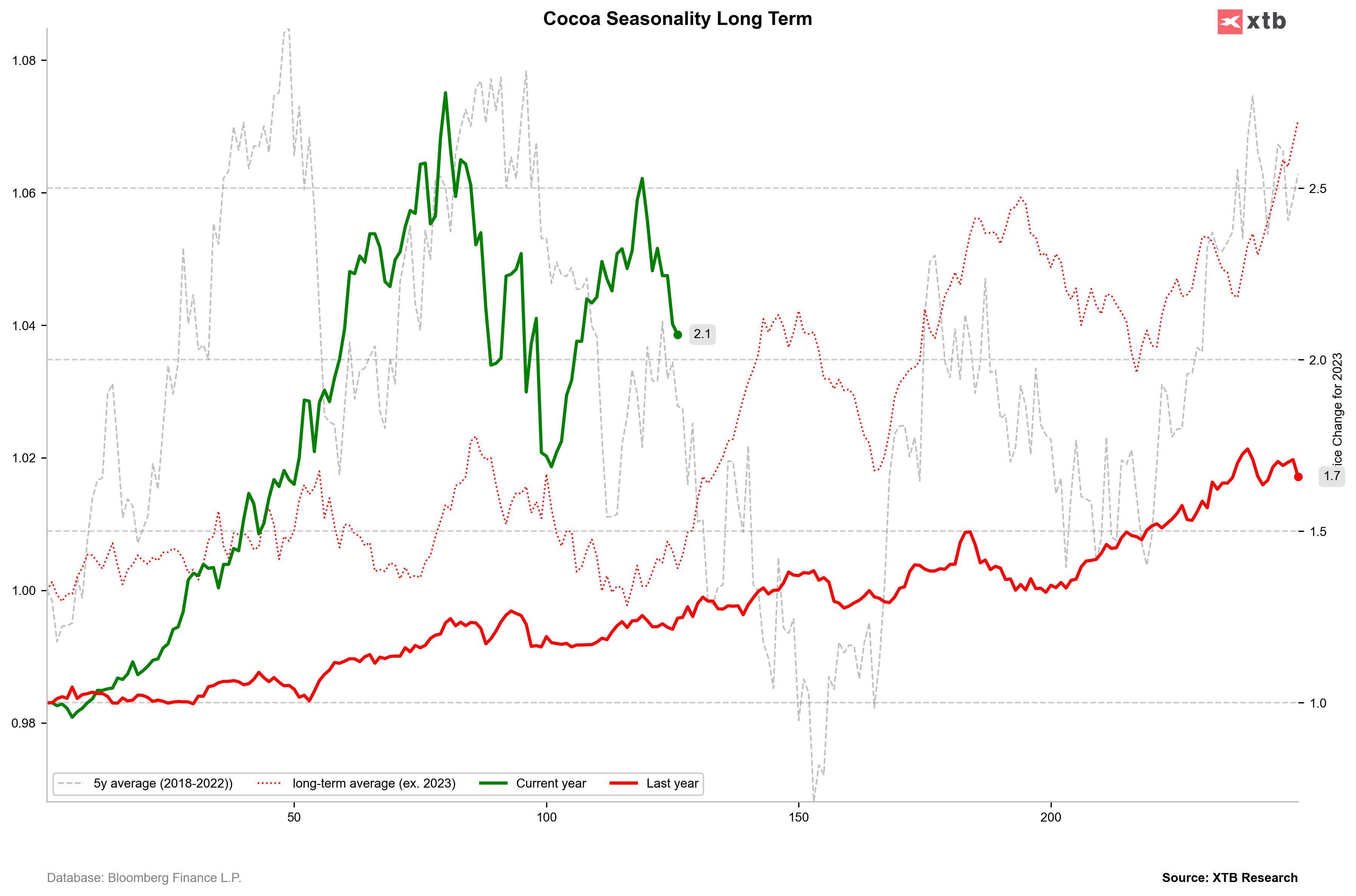

Short-term seasonality indicates that cocoa prices may fall in the near term, but should rebound by early August. Longer-term seasonality, on the other hand, points to a potential local peak in late July/early August and then a slight correction in August before a rebound associated with the assessment of the season proper, the official start of which is October 1. Source: Bloomberg Finance LP, XTB

Daily Summary: Middle East Sparks Oil Market

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌