-

Demand Collapse Confirmed: Processing data from Malaysia (−35% YoY) and Brazil (−17% YoY) signals deep demand destruction, with similarly weak figures anticipated from Europe and Asia tomorrow.

-

Price Resilience Paradox: Despite the catastrophic demand figures, cocoa prices are stabilising around $5,800/tonne, supported by still-tight supply fundamentals, extreme oversold technicals, and the start of the main harvest in West Africa.

-

Market Structure Shift: The shift from backwardation to contango suggests either an oversold spot price or a market pricing in sufficient supply for the coming season, hinting at a potential price stabilisation near current levels.

-

Demand Collapse Confirmed: Processing data from Malaysia (−35% YoY) and Brazil (−17% YoY) signals deep demand destruction, with similarly weak figures anticipated from Europe and Asia tomorrow.

-

Price Resilience Paradox: Despite the catastrophic demand figures, cocoa prices are stabilising around $5,800/tonne, supported by still-tight supply fundamentals, extreme oversold technicals, and the start of the main harvest in West Africa.

-

Market Structure Shift: The shift from backwardation to contango suggests either an oversold spot price or a market pricing in sufficient supply for the coming season, hinting at a potential price stabilisation near current levels.

Cocoa prices are holding steady at around $5,800 per tonne, showing remarkable resilience for the third consecutive session, especially today, despite the release of exceptionally negative processing data from Malaysia and Brazil, with weak figures also anticipated tomorrow from Europe and across Asia. This situation prompts a crucial question: has the market finally bottomed out, or is another wave of declines imminent?

Malaysia: The Litmus Test for Asia’s Woes

Data published by the Malaysian Cocoa Board and the Cocoa Manufacturers Group illustrate the scale of demand destruction across the Asian region:

Malaysia - Q3 2025:

- Cocoa grindings fell by 35% year-on-year (YoY) to 60,780 tonnes.

- A 13% drop quarter-on-quarter (QoQ) versus Q2 2025.

- First nine months of 2025: 215,169 tonnes (−24% YoY).

This marks the weakest Q3 result in years and serves as an alarm signal for the entire Asian market. As a key player in Asian cocoa processing, Malaysia traditionally reflects broader regional trends.

Asian Context:

- Q2 2025: Asian grindings fell by 16.3% YoY to 176,644 tonnes—the lowest level for Q2 in eight years.

- Q3 data for all of Asia, also due tomorrow, October 16, is likely to show a continuation of this negative trend.

- The region that recently drove chocolate consumption growth is now at the centre of a demand crisis.

Brazil - Q3 2025:

- Cocoa grindings declined by 17% YoY to 40.1 thousand tonnes.

- Grindings from January to September fell by 15% YoY to 144 thousand tonnes.

- Data published by APIC points to excessively high bean prices, low demand for cocoa butter, and very thin margins in the sector.

- However, Q3 delivery data was lower than in the corresponding period last year.

Europe: Is Cocoa Demand Seeing its Steepest Decline on Record?

Tomorrow, October 16, likely around 8:00 AM CET, the European Cocoa Association (ECA) will publish official Q3 2025 processing data. Expectations are unequivocally negative:

Forecasts for Europe Q3 2025:

- Cocoa grindings are projected to fall to the lowest Q3 level in at least a decade.

Continuation of the Downtrend: Q2 2025 showed a decline of 7.2% YoY to 331,762 tonnes.

- Germany, Europe's largest processor, recorded a 17% YoY drop—with some companies, like Hanseatisches Chocoladen Kontor, having completely exited the market.

Bloomberg indicates that cocoa processing factories globally are suffering the consequences of demand destruction. Although they are still processing expensive beans bought at the market's peak, cocoa butter prices—key to processor profitability—have fallen by approximately 75% this year. Margins turned negative in August, making full utilization of production capacity uneconomical.

North America: The Third Pillar of Weakness

Q2 2025 showed that North America also failed to avoid problems:

- Grindings fell by 2.8% YoY to 101,865 tonnes—the weakest result in two years.

- Chocolate sales have been falling at a double-digit rate in recent weeks.

- Manufacturers like Hershey reported an 18% drop in volumes with only a 3% price increase.

- Q3 data expectations suggest a potentially worst quarter in 2 years.

Why Isn't Cocoa Falling Further?

The paradox of the current situation is that despite catastrophic demand data, prices remain relatively stable at $5,800−5,900 per tonne. Several factors may explain this resilience:

1. Still-Positive Supply Fundamentals

Although the situation has improved relative to the disaster of 2023/24, supply is still not fully secure:

- Nigeria (fifth-largest producer) forecasts a production drop of 11% YoY to 305,000 tonnes in 2025/26.

- Initial deliveries to Côte d'Ivoire ports for the 2025/2026 season appear weak, even compared to last year.

- The global surplus of 186,000 tonnes forecast for 2025/26 is still a relatively modest figure after three consecutive years of deficits.

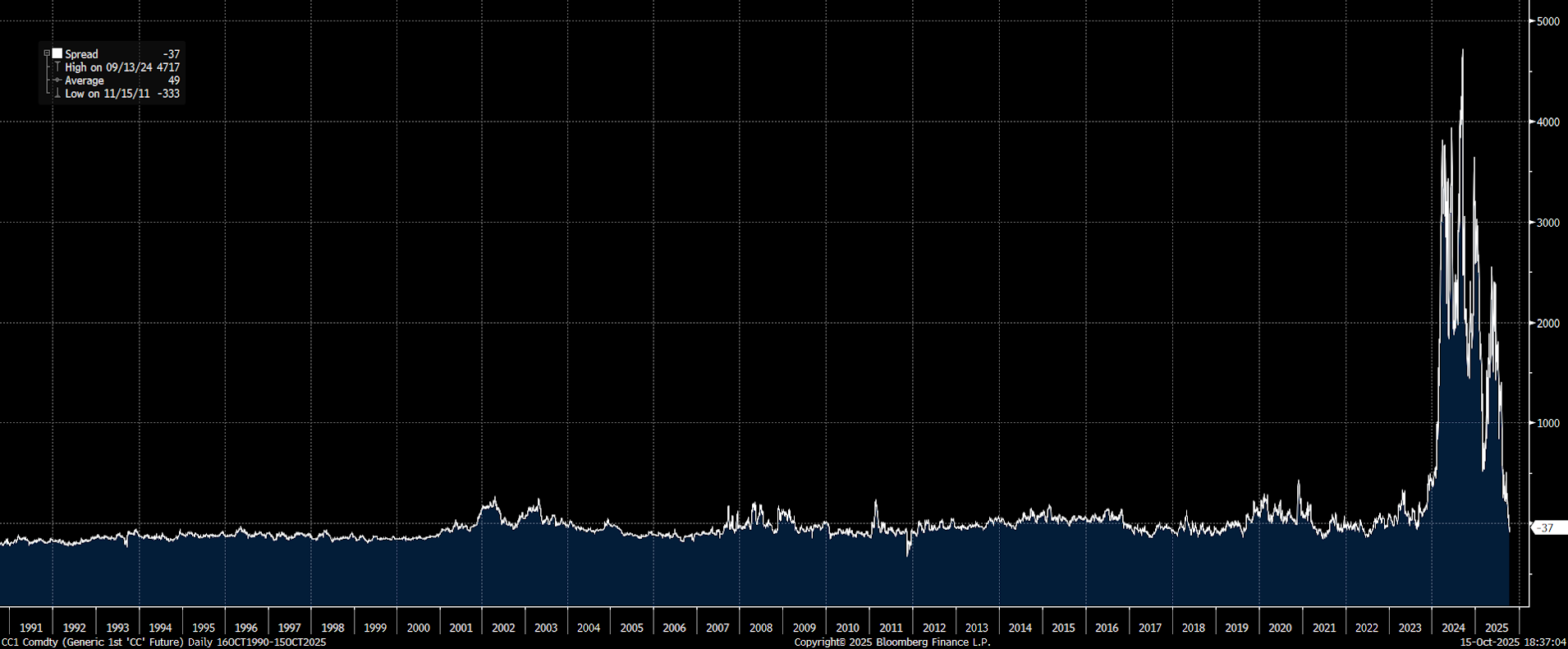

2. Extreme Oversold Conditions in the Futures Market

Analysts at Citi and Societe Generale warn that cocoa is "extremely oversold."

- Speculators in the UK market have moved to a net short position for the first time since August 2022.

3. Psychological Support at the $6,000 Level

- The $6,000 level provided significant technical support—current prices around $5,800 are only slightly below this.

- Prices have already fallen by 54% from the peak of December 2024 ($12,906).

- Trading Economics forecasts stabilisation at $5,604 by the end of the quarter.

- The worst-case scenario involves a drop to $3,000, but this would require further supply improvement and continued demand destruction.

- It is worth noting that current prices paid to farmers in Côte d'Ivoire (around $4,000−5,000 USD) potentially limit the possibility of sustained drops below that level.

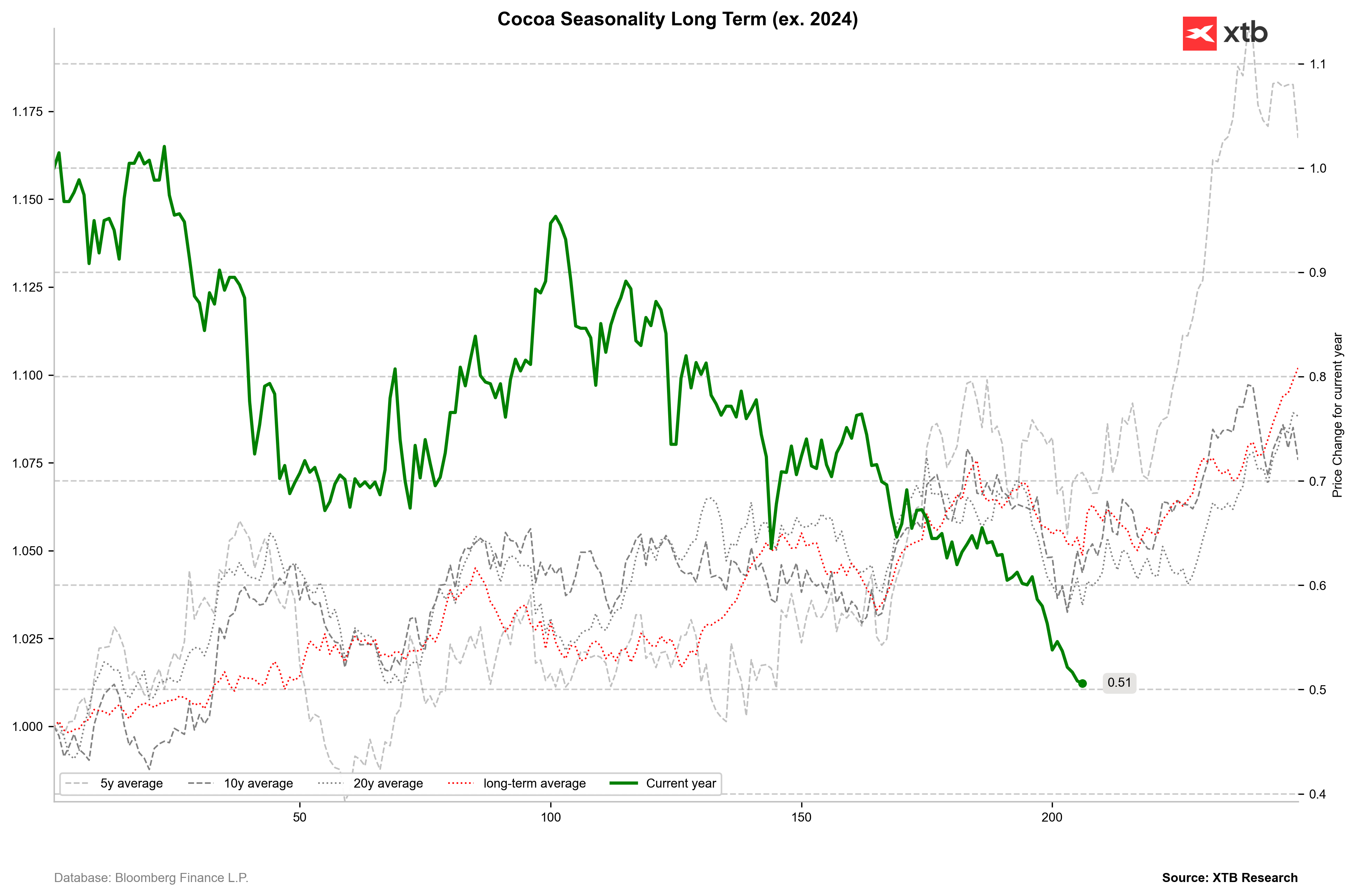

4. Seasonality - Start of the Main Harvest Season

- The main harvest season in West Africa is currently underway.

- Ghana has raised farmgate prices by 12% to 58,000 cedis ($4,640/tonne), following a similar move by Côte d'Ivoire.

- Higher prices may encourage farmers to sell faster but could also support the market price.

It is noteworthy that historically, the beginning of October usually brought a clear price rebound, linked precisely to the start of the harvest. If the harvest proves not to be as strong as initially anticipated (which led to the recent sell-off), the price could rebound quite quickly by as much as 10−20%. Nevertheless, the dismal processing data might indicate that the market is not ready for high prices. Source: Bloomberg Finance LP

It is noteworthy that historically, the beginning of October usually brought a clear price rebound, linked precisely to the start of the harvest. If the harvest proves not to be as strong as initially anticipated (which led to the recent sell-off), the price could rebound quite quickly by as much as 10−20%. Nevertheless, the dismal processing data might indicate that the market is not ready for high prices. Source: Bloomberg Finance LP

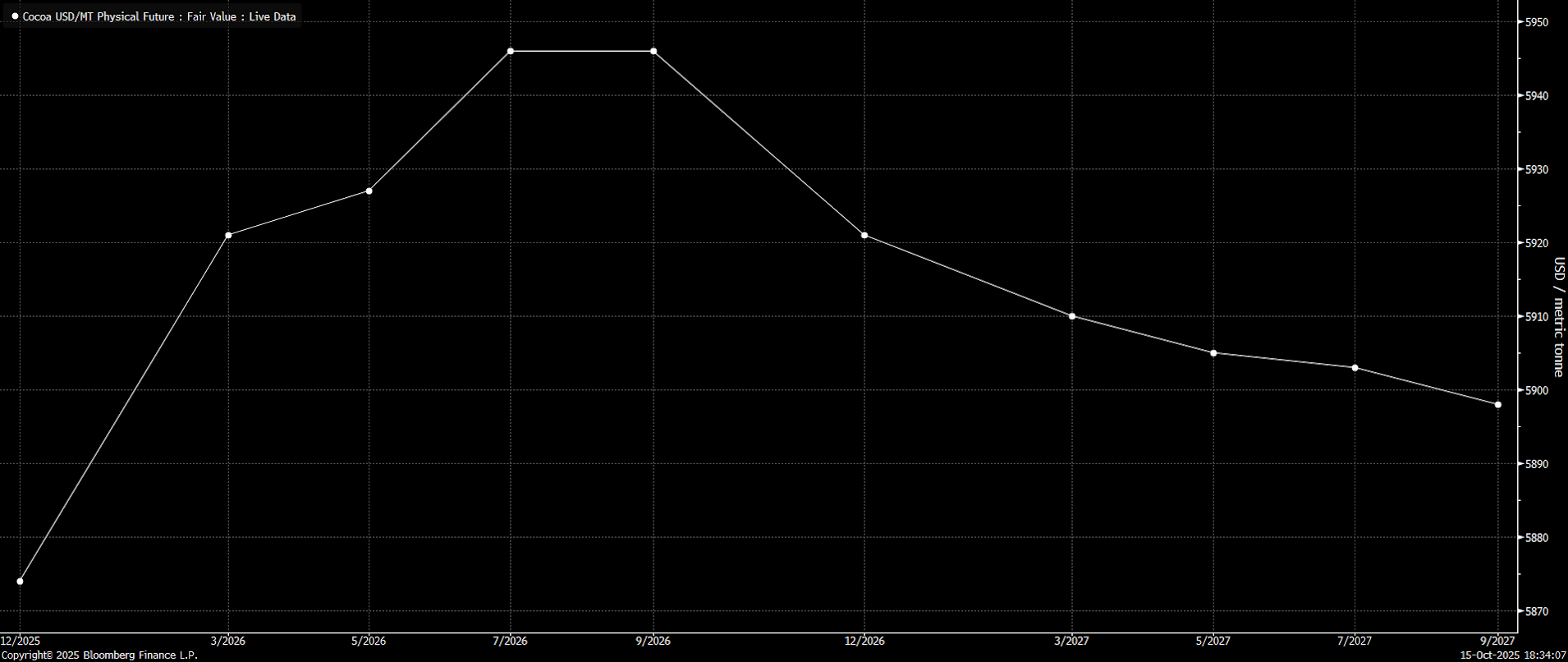

Market Structure Shift

It is worth noting that the market has slipped into contango until September next year, having been in backwardation just a month ago. This could signify two things: on one hand, it might imply the spot price (nearest contract) is too oversold, or it could reflect the market's confidence regarding the immediate season lasting into next year. Source: Bloomberg Finance LP

It is worth noting that the market has slipped into contango until September next year, having been in backwardation just a month ago. This could signify two things: on one hand, it might imply the spot price (nearest contract) is too oversold, or it could reflect the market's confidence regarding the immediate season lasting into next year. Source: Bloomberg Finance LP The price has returned to relative normalcy. The difference between the current contract and the contract for one year out indicates contango, albeit a very small one by current pricing standards. Nevertheless, the differences between contracts over the 12-month perspective have returned to the normal situation noted over the last few decades. This may suggest that prices should stabilise at roughly the current levels. Source: Bloomberg Finance LP, XTB

The price has returned to relative normalcy. The difference between the current contract and the contract for one year out indicates contango, albeit a very small one by current pricing standards. Nevertheless, the differences between contracts over the 12-month perspective have returned to the normal situation noted over the last few decades. This may suggest that prices should stabilise at roughly the current levels. Source: Bloomberg Finance LP, XTB

Conclusion and Outlook

The cocoa price has stopped falling for three days. Tomorrow is a key session, and further declines cannot be ruled out. However, it is worth remembering that demand destruction has been long anticipated. A price drop toward $4,000-5,000 USD would be a positive signal for the entire processing sector, but a rebound cannot be ruled out in case of poor delivery data. It is important to remember, however, that the futures market is very illiquid, so a return to large market moves is still possible. Source: xStation5

The cocoa price has stopped falling for three days. Tomorrow is a key session, and further declines cannot be ruled out. However, it is worth remembering that demand destruction has been long anticipated. A price drop toward $4,000-5,000 USD would be a positive signal for the entire processing sector, but a rebound cannot be ruled out in case of poor delivery data. It is important to remember, however, that the futures market is very illiquid, so a return to large market moves is still possible. Source: xStation5

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽

🚩Silver loses 3%

Rheinmetall earnings: Formidable growth, but the market expected more

Oil slightly up amid Iran tensions and US EIA inventories report