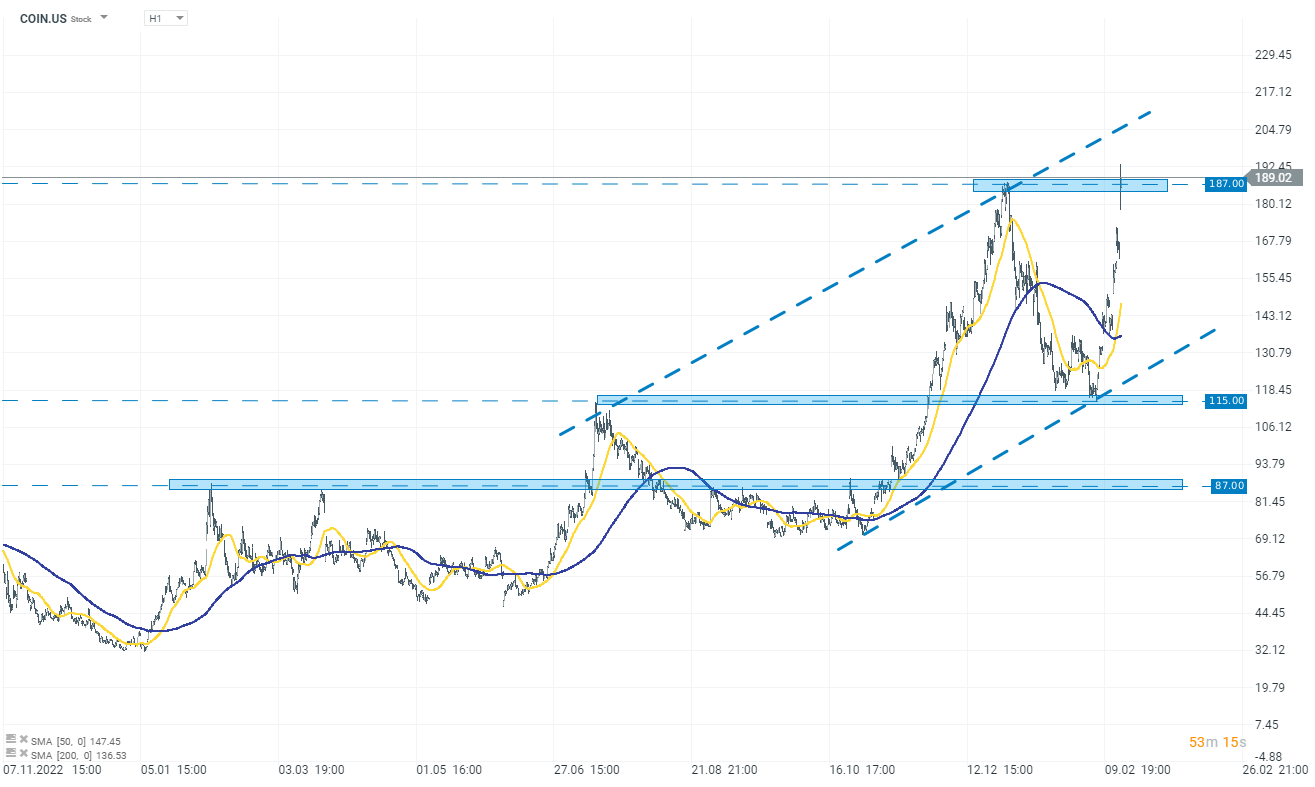

Coinbase (COIN.US) is gaining over 9.0% following a remarkable fourth-quarter performance that surpassed Wall Street's expectations. The cryptocurrency broker reported earnings of $1.04 per share on a revenue of $954 million, notably exceeding analysts' forecasts of 2 cents per share on revenue of $826 million. This positive earnings report led to an increase in Coinbase stock, even though the stock is down almost 5% this year. However, it has more than doubled in the past six months, outpacing gains in Bitcoin and other digital assets.

Company earnings and management commentary

Coinbase's rebound in the digital-asset market significantly boosted its trading revenue, leading to a 51% jump in revenue to $953.8 million, far above the expected $826 million. The net income stood at $273 million, a sharp contrast to the $557 million loss a year earlier. The company’s transaction revenue surged to $529 million, with consumer transaction revenue almost doubling and institutional transaction revenue more than doubling quarter-over-quarter. Coinbase attributed this profitability to strong market conditions and strategic initiatives, although the company urged caution in extrapolating these results for future performance.

Forecasts for the coming years

However, looking ahead, Coinbase is optimistic, with forecasts indicating continued momentum. The company anticipates first-quarter subscription and services revenue to be between $410 million and $480 million, significantly higher than the $367.3 million estimate. Analysts have adjusted their views on Coinbase, with upgrades and positive revisions in revenue estimates for 2024 and 2025. However, the challenges concerning competitive market and legal issues remain valid. The company expects sales and marketing expenses in the first quarter to be between $85 million and $100 million and projects a modest increase in headcount to support product growth, reflecting an overall positive outlook for the near future.

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡