Cocoa

- Cocoa reaches $10,000 per ton, after starting trading at $4,200 at the beginning of this year

- However, Citi indicates that the increases are not only related to fundamentals but are also associated with speculative fund activity. Citi sees that after reaching its peak, the price may undergo a correction of 20-35%. The bank predicts a correction by the end of 2024 or early 2025

- Nestle shares lost 13.5% over a 12-month period. Hershey lost 24% over a 12-month period. Shares of companies related to chocolate production are struggling with declining margins

- Global stockpiles and stockpiles on exchanges are still not extremely low, but considering a 10% deficit for the 2023/2024 season, further stock declines can be expected

- We will receive data on cocoa processing for the first quarter of this year in April. Additionally, we will learn estimates regarding cocoa production in the so-called "mid-season"

- The mid-season begins in early April and ends in October-November. This is when the rainy season occurs. The largest harvest during the mid-season will take place from mid-May to the end of June

- Mid-season harvests in Ivory Coast are expected to be around 400-450 thousand tons. Last season, mid-season production amounted to 550 thousand tons. The Cocoa-Coffee Council has sold contracts for 250-350 thousand tons for the upcoming mid-season.

- Reuters reports that temperatures are currently dropping in West Africa, and there is an increase in rainfall, which should boost cocoa yields later in the year

Start investing today or test a free demo

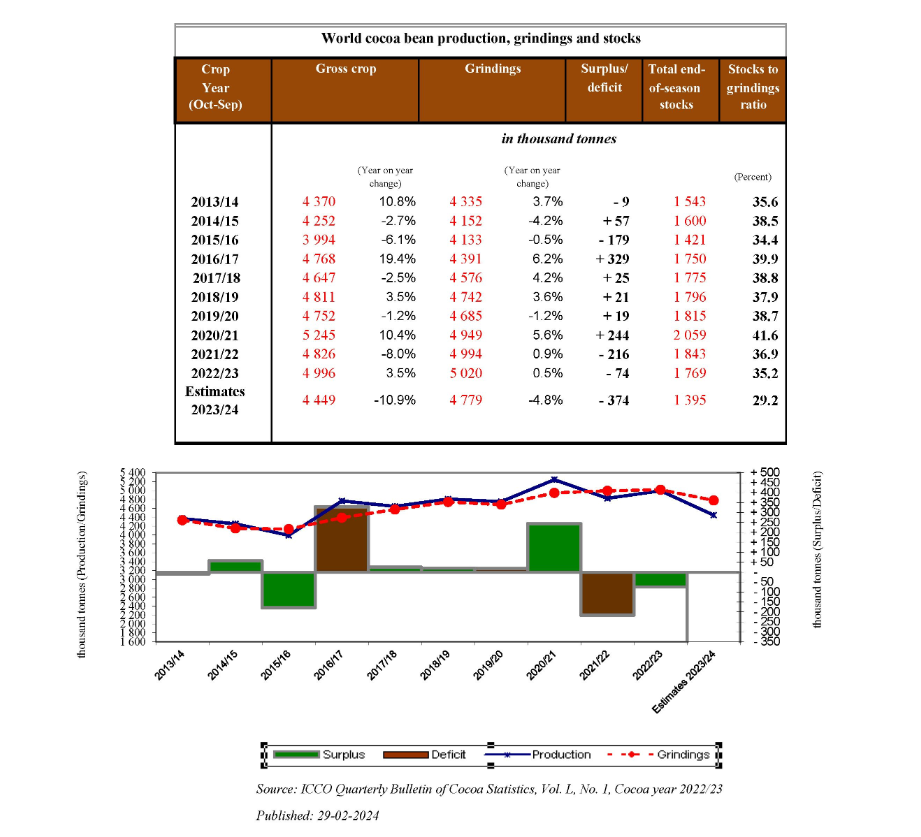

Create account Try a demo Download mobile app Download mobile appICCO report for the 2023/2024 season shows a deficit of nearly 400 thousand tons. Data on processing for the first quarter of this year will be crucial for prices. If processing reacts similarly to the expected production decline, there will be a chance for a price correction. Source: ICCO

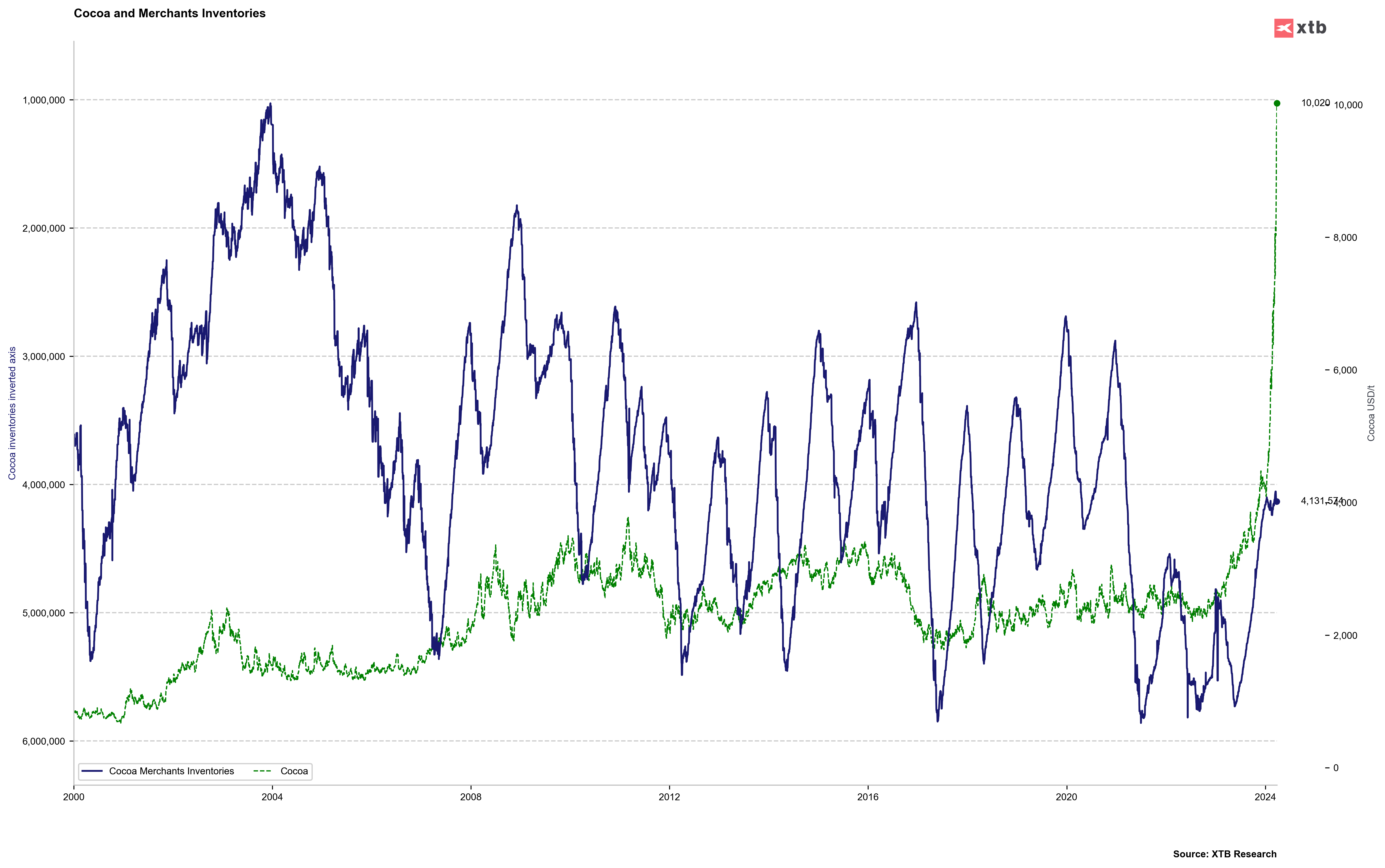

Cocoa inventories among merchants are stabilizing and are far from the extreme lows of the past 20 years. It is worth noting that a significant decline in cocoa stockpiles in the 2003-2004 season led to a substantial price increase to $2,000 per ton at that time. The increase was even tenfold, from around $200 per ton. Currently, however, production costs are significantly higher, and inventories are not as low as they were then. Source: Bloomberg Finance LP, XTB

Cocoa launched trading with a bullish price gap and testing $10,000 per ton. It looks like an exhaustion gap. If the gap is filled during today's session, a correction to even $8,200 is possible, where the previous small correction occurred. The $9,000 per ton level will also be important. Source: xStation5

Gold

- Gold is testing the vicinity of $2,200 per ounce again, even despite maintaining a fairly strong US dollar and limited yield decline

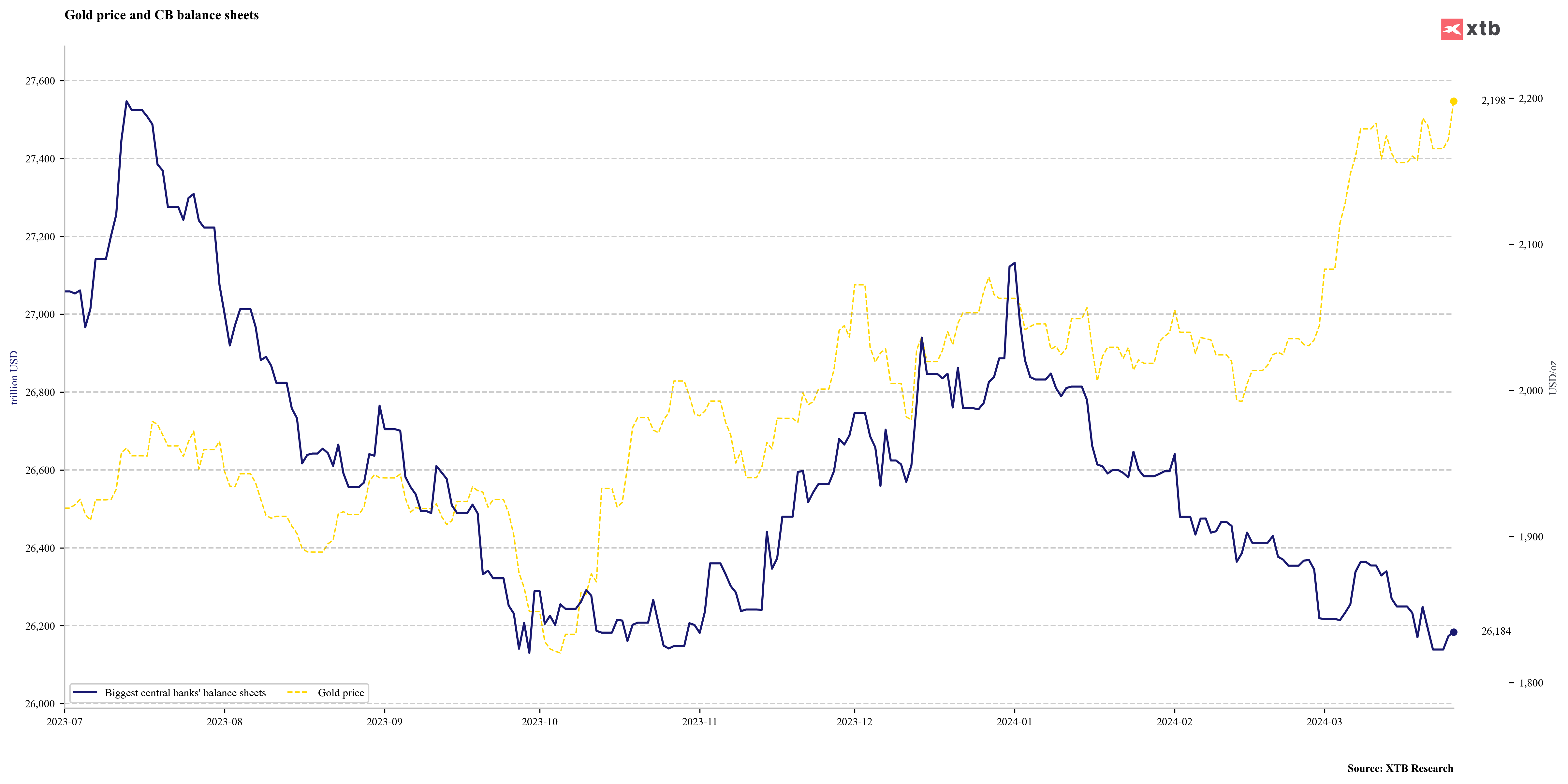

- Balance sheets of the largest central banks (Fed, ECB, BoJ, and PBOC) have recently declined quite noticeably to levels similar to those in October 2023 when the current wave of gold price increases began

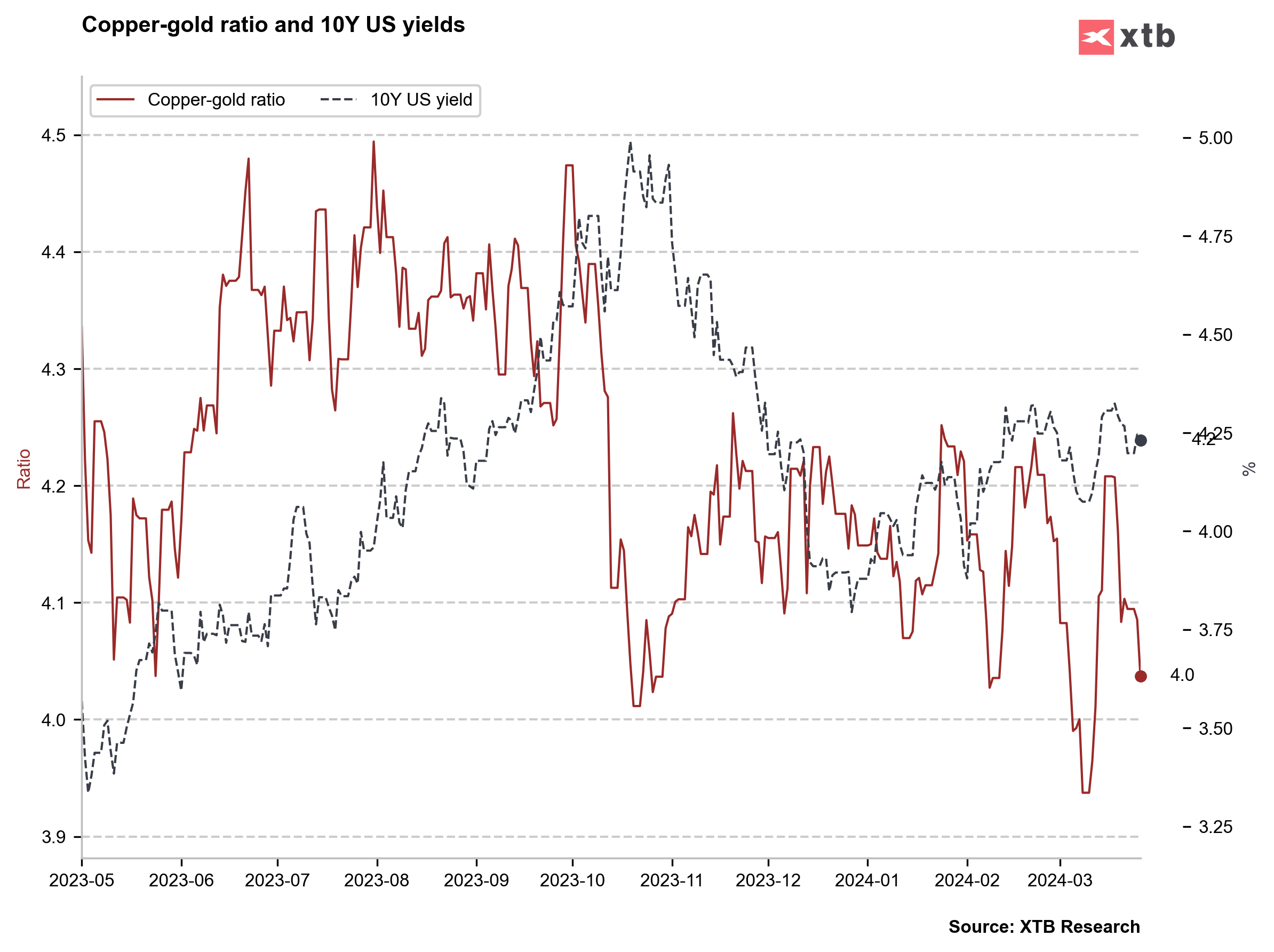

- The copper-to-gold price ratio indicates that current bond yields are significantly too high

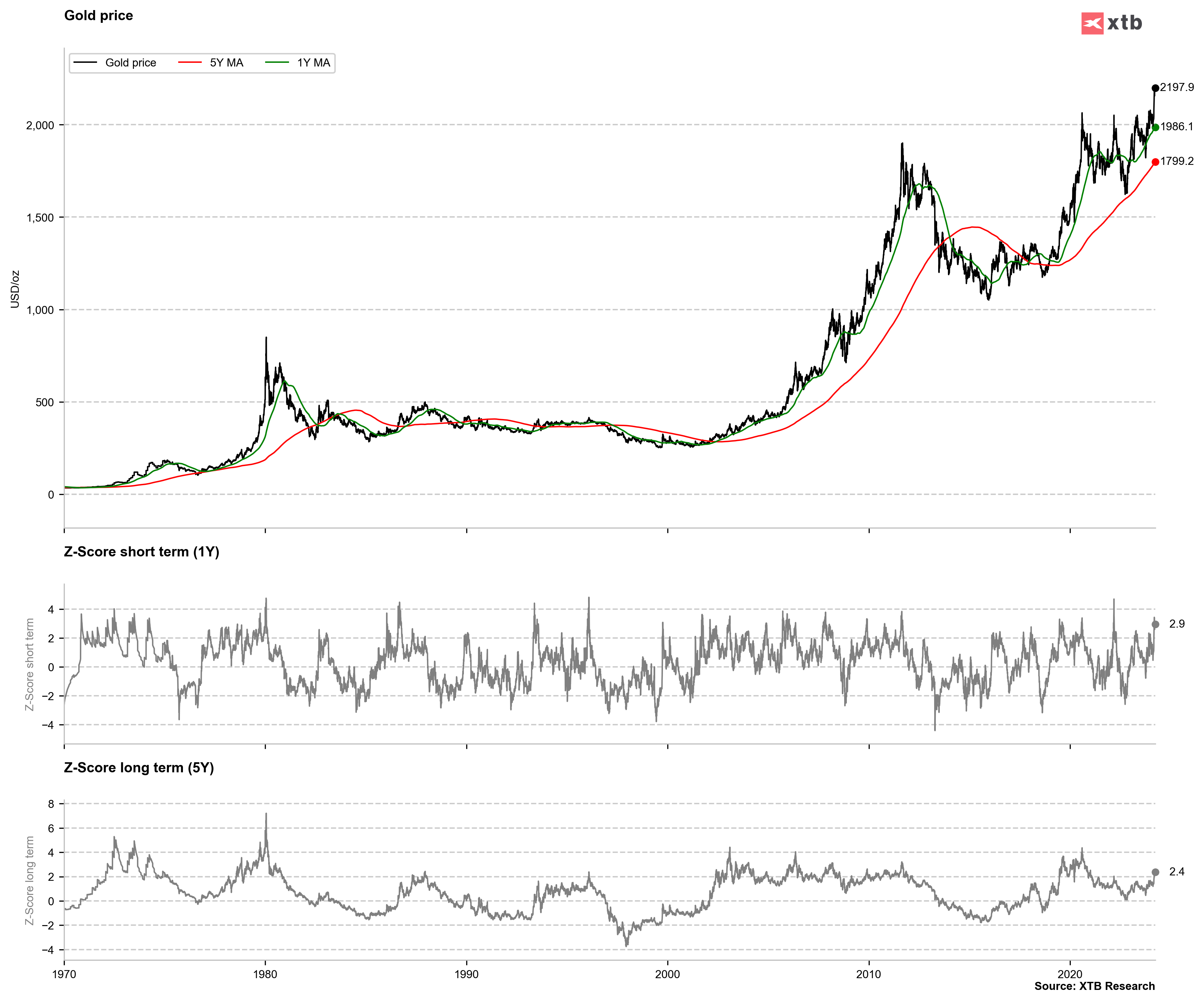

- Gold is not yet very expensive relative to the 5-year average, but it is slowly showing signs of overvaluation when looking at the 1-year average

- Theoretically, if the Fed starts a cycle of interest rate cuts in the middle of this year, the chances of reaching new historical highs will increase. Forecasts from banks this year range between $2,200 and $2,500 per ounce

- We will receive data on PCE inflation on Friday, which will be crucial for USD and yields, and thus also for gold

Central bank balances do not support such high gold prices. On the other hand, they have fallen to levels from which they began to rebound in the fall of last year. If more money starts flowing into the financial system currently, then there will be a chance to continue the rise in the gold market. On the other hand, the Bank of Japan may not increase purchases as it did before. Currently, hope rests in halting the reduction of the balance sheet before the Fed and ECB. Source: Bloomberg Finance LP, XTB

The copper-to-gold price ratio suggests a decline in yields. Source: Bloomberg Finance LP, XTB

Gold is not yet significantly overvalued looking at the 5-year average, but it is starting to be clearly overvalued looking at the 1-year average. If the deviation reaches 4 times, then we will have a bearish signal. Source: Bloomberg Finance LP, XTB

Coffee

- We have been observing a significant correlation between coffee and the Brazilian real recently

- The Brazilian real (BRL) remains under pressure due to recent interest rate cuts

- A lifeline for the BRL could be the start of interest rate cuts in the US

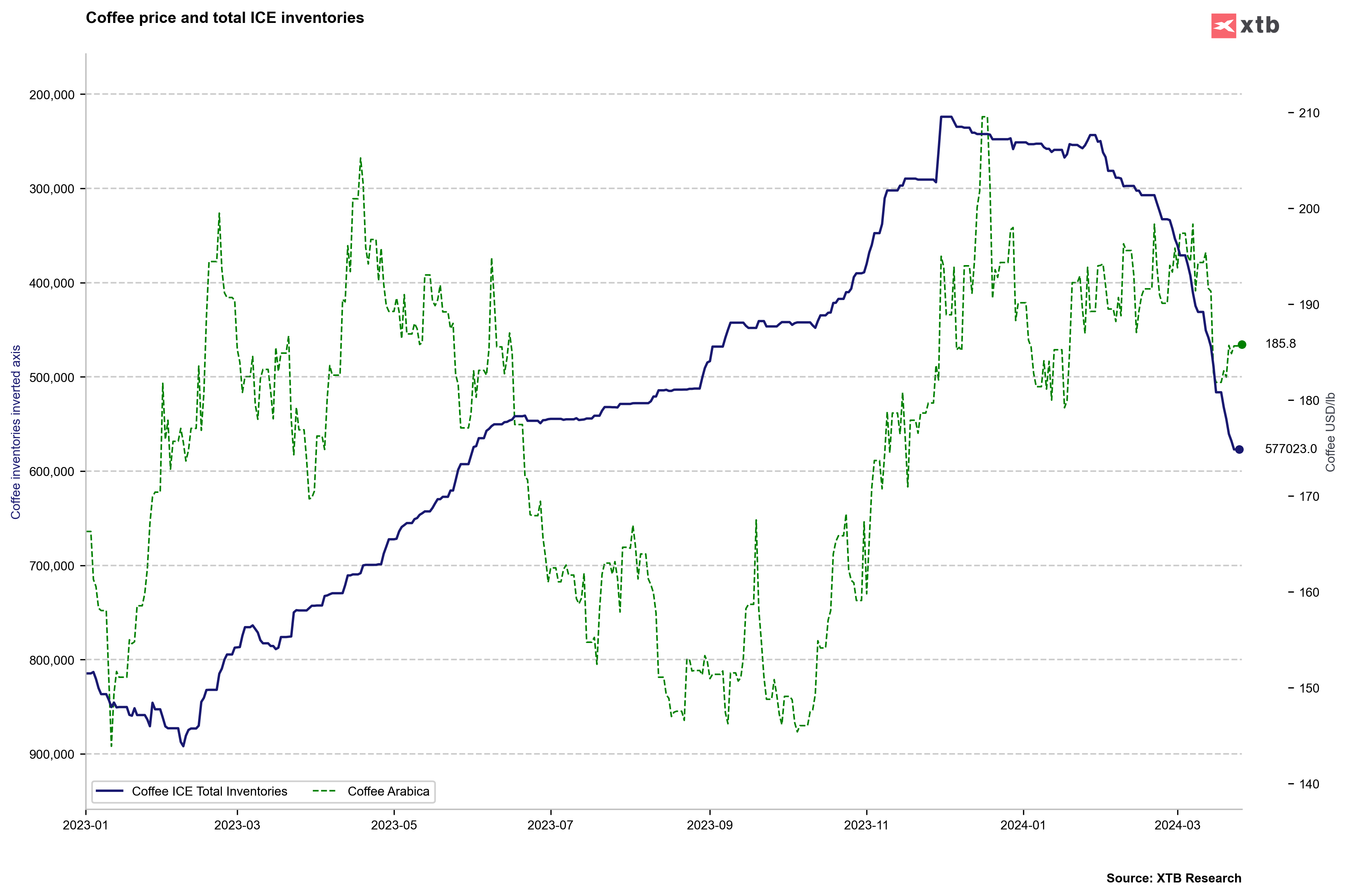

- Coffee stockpiles began a notable rebound in February of this year, which may be related to a lack of increased demand or an attempt to rebuild heavily drained stocks

- At the same time, we are witnessing quite significant increases in Robusta prices, reaching historical highs, and downward pressure on Arabica coffee, which is associated with the prospect of maintaining high production in Brazil

- In Vietnam, where mainly Robusta is produced, very dry weather persists

- Despite the lack of sufficient rainfall in Brazil, production is expected to increase by 5% to 58 million bags this year in the country

Stocks are clearly increasing according to ICE, which may be a factor limiting potential gains. On the other hand, from a long-term perspective, stocks remain extremely low. Source: Bloomberg Finance LP, XTB

Arabica coffee correlates quite strongly with the Brazilian real, which has recently been under pressure from interest rate cuts. Source: Bloomberg Finance LP, XTB

Natural Gas

- The price of gas remains above the 14-session average but below the 50-session average. However, the breakout above the 14-session average was triggered by a recent rollover

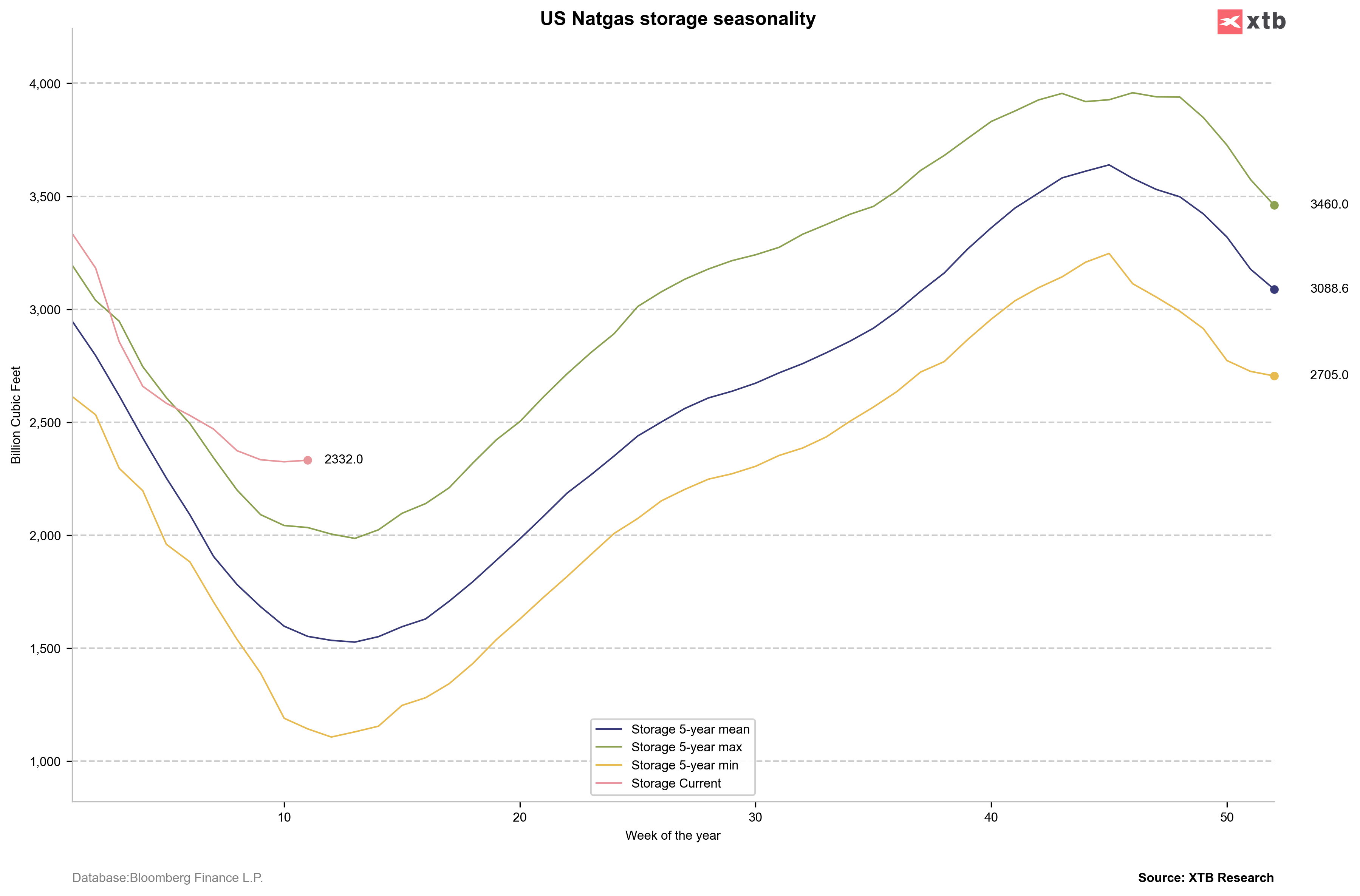

- The heating season has essentially ended. Inventory levels remain significantly above 2000 bcf

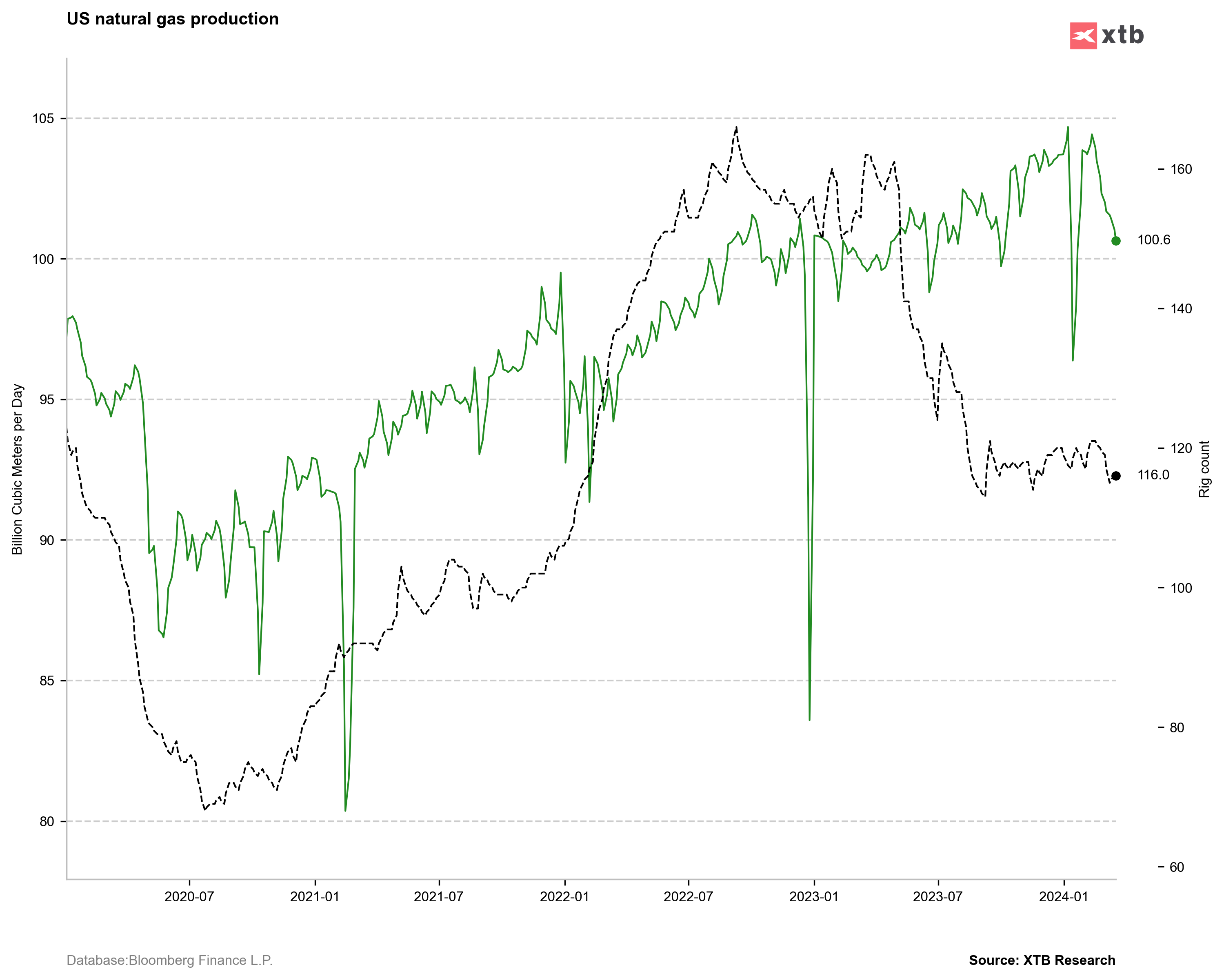

- On the other hand, we are observing a quite noticeable decline in gas production recently, which may affect the potentially slower replenishment of stocks in summer. According to forecasts, summer is expected to be quite hot, increasing demand for gas from power plants

- The futures curve remains in a significant contango. Futures contracts for the end of this year trade around $3.5/MMBTU. Achieving a positive return from a long-term long position in the gas market may be challenging, considering the steep curve

- However, if the production decline is steady and production remains permanently below 100 bcfd, then the chances for price increases may arise later in the year

Continued stagnation in the US natural gas market (NATGAS). However, bullish prospects are not dismissed until the price falls below the 14-day moving average. Source: xStation5

Gas inventories remain extremely high compared to the 5-year average. However, the pace of inventory replenishment in the later part of the year will be crucial. Source: Bloomberg Finance LP, XTB

Gas production has recently experienced a sharp decline. Source: Bloomberg Finance LP, XTB