Oil

-

In spite of a pick-up in new coronavirus Delta variant cases, global demand for oil drop just to slightly below 98 million barrels per day (according to Goldman Sachs)

-

OPEC+ production disappointed in August in spite of capacity to boost production by the cartel

-

Hurricane Ida caused massive disruptions to US oil production and those have not been resolved yet

-

Goldman Sachs maintains its view for $80 per barrel oil price in Q4 2021. Moreover, the Bank expects more upside in the first quarter of 2022 if OPEC+ maintains its current policy (gradual output hikes each month)

-

A point to note is that reference levels for Russian production were increased to 11.5 million bpd during the latest OPEC+ policy review. Russia has never produced so much oil therefore output increases in the coming months may not be as big as suggested by new agreement

-

OECD expects a slightly weaker economic rebound this year, especially in the United States. Forecasts for China were left unchanged. On the other hand, BofA expects a big slowdown in China, compared to previous forecasts, especially in 2022 and 2023

-

China may decide to put priority on "common prosperity" rather than economic growth

-

US dollar may be important factor for oil going forward, especially if Chinese Evergrande collapses and Fed decides to change its narrative

In theory, Russian production capacity may be as high as 12 million barrels per day next year. However, drills are operating at nearly full capacity and expanding production further will require launching new projects. This hints that peak production may be drawing near in one of the world's largest oil producers. Source: Rystad Energy

In theory, Russian production capacity may be as high as 12 million barrels per day next year. However, drills are operating at nearly full capacity and expanding production further will require launching new projects. This hints that peak production may be drawing near in one of the world's largest oil producers. Source: Rystad Energy

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app Brent (OIL) is once again trading near the $75 area. Hopes for further demand recovery amid quicker return to normal may help push crude prices to new highs. On the other hand, outlook for the next year remains mixed. US dollar is also an important factor for oil and unless EURUSD starts to recover, oil bulls may struggle to deliver another upward impulse. Source: xStation5

Brent (OIL) is once again trading near the $75 area. Hopes for further demand recovery amid quicker return to normal may help push crude prices to new highs. On the other hand, outlook for the next year remains mixed. US dollar is also an important factor for oil and unless EURUSD starts to recover, oil bulls may struggle to deliver another upward impulse. Source: xStation5

Copper

-

Copper may find itself under pressure should Chinese developer Evergrande collapse

-

This is the second-largest residential developer in China. Its collapse may trigger a domino effect and trigger more insolvencies

-

The latest data from China showed a significant drop in retail sales and a slow down in house price inflation

-

It should be noted that as much as a quarter of Chinese copper demand may come from the construction sector. China is responsible for 50% of global copper demand

-

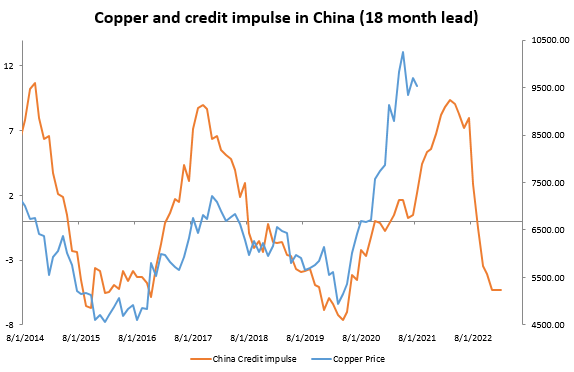

Taking a look at China's credit impulse, we can see that the outlook for industrial metals is not too upbeat. On the other hand, China may decide to stimulate its economy to help with Evergrande fallout

-

While the outlook for copper demand from the construction sector is mixed, copper stockpiles continue to drop in China and other parts of the world. It may hint a bigger demand for the commodity from other branches of the economy

Chinese credit impulse does not look too favourable for copper. Source: Bloomberg, XTB

Chinese credit impulse does not look too favourable for copper. Source: Bloomberg, XTB

Copper stockpiles drop in China as well as in other parts of the world. Source: Bloomberg

Copper stockpiles drop in China as well as in other parts of the world. Source: Bloomberg

Natural Gas

-

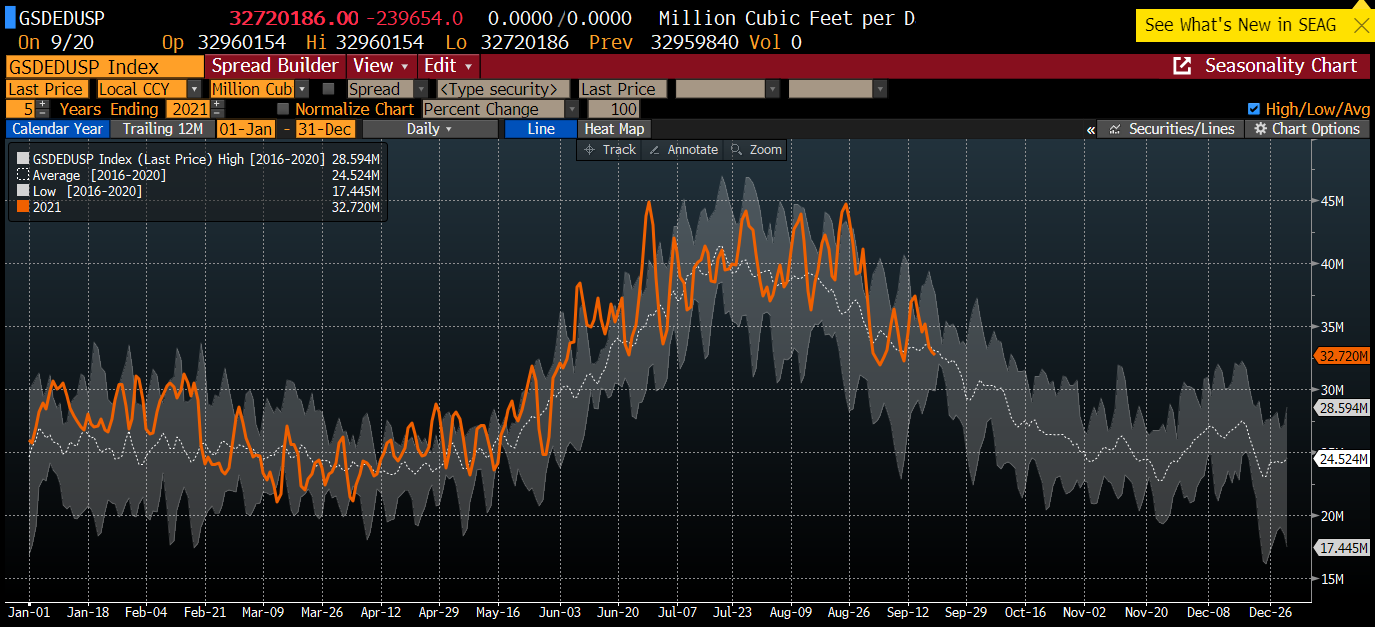

Natural Gas prices dropped 12% over the past couple of days. This is in-line with seasonal pattern that hint at a sideways move lasting until mid-October

-

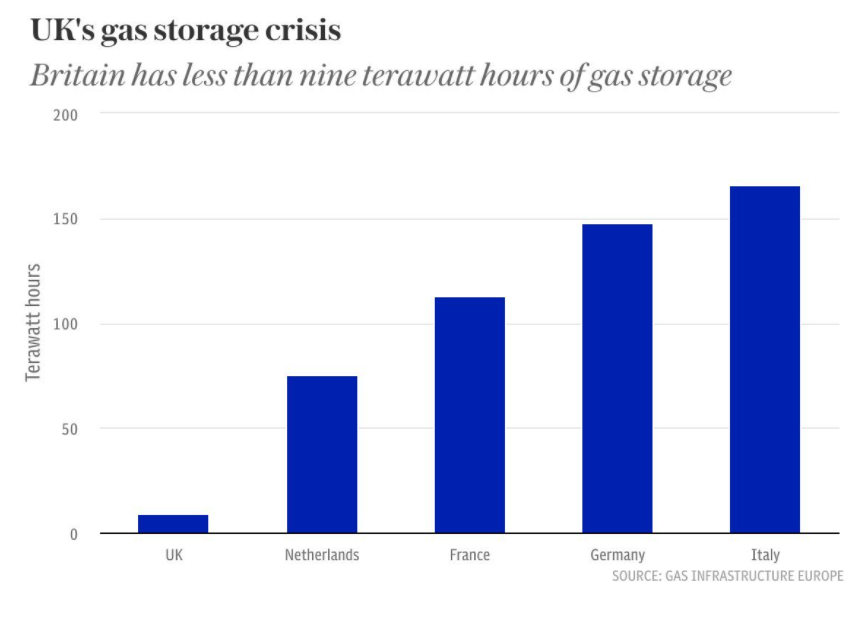

However, risk of an energy crisis in Europe is real, especially in the United Kingdom. Interestingly, European imports of Russian natural gas increased in the first half of 2021, compared to the first half of 2020

-

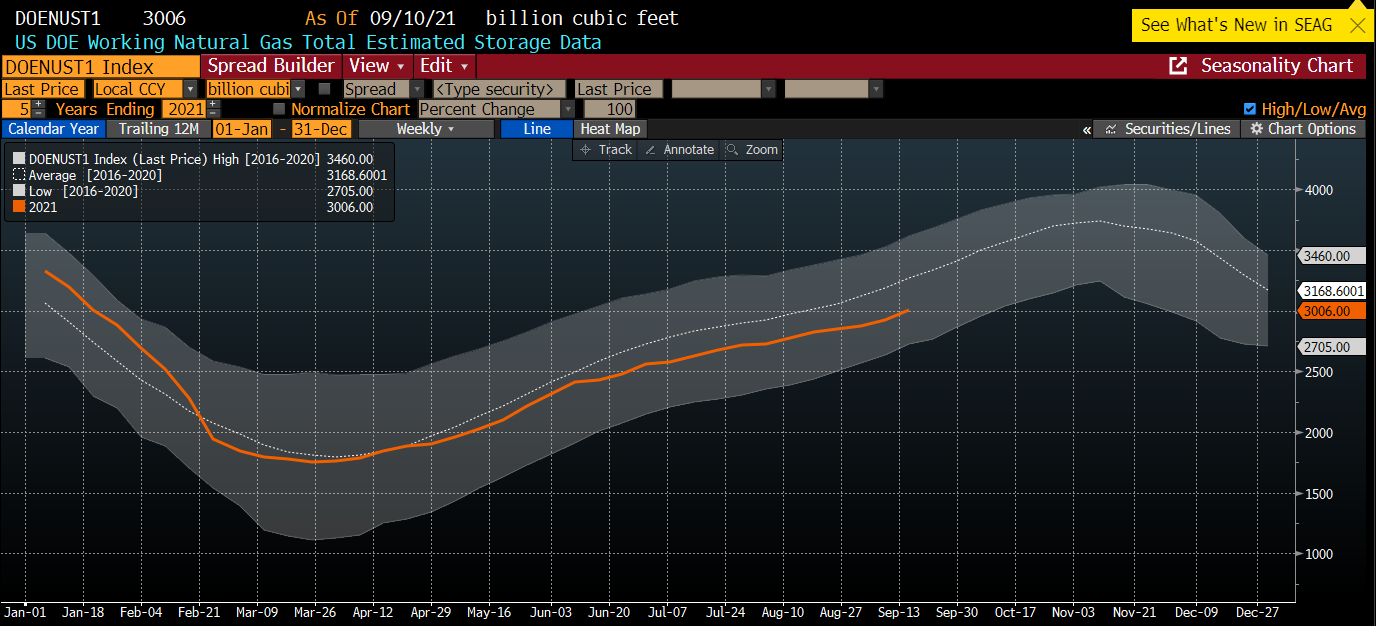

Fundamentals for US natural gas remain similar compared to previous years. Only difference was a slightly slower build-up in inventories

-

Heating season is just around the corner

Natural gas stockpiles in the United Kingdom sit at extremely low levels, which increases the odds of speculators becoming more active on this market. Source: Gas Infrastructure Europe

Natural gas stockpiles in the United Kingdom sit at extremely low levels, which increases the odds of speculators becoming more active on this market. Source: Gas Infrastructure Europe

Natural gas stockpiles rose at a below-average pace since late-April 2021. However, pace has increased slightly recently. Source: Bloomberg

Natural gas stockpiles rose at a below-average pace since late-April 2021. However, pace has increased slightly recently. Source: Bloomberg

US heating season is just around the corner. Demand for natural gas will depend on temperatures and those will determine future price trends. Source: Bloomberg

US heating season is just around the corner. Demand for natural gas will depend on temperatures and those will determine future price trends. Source: Bloomberg

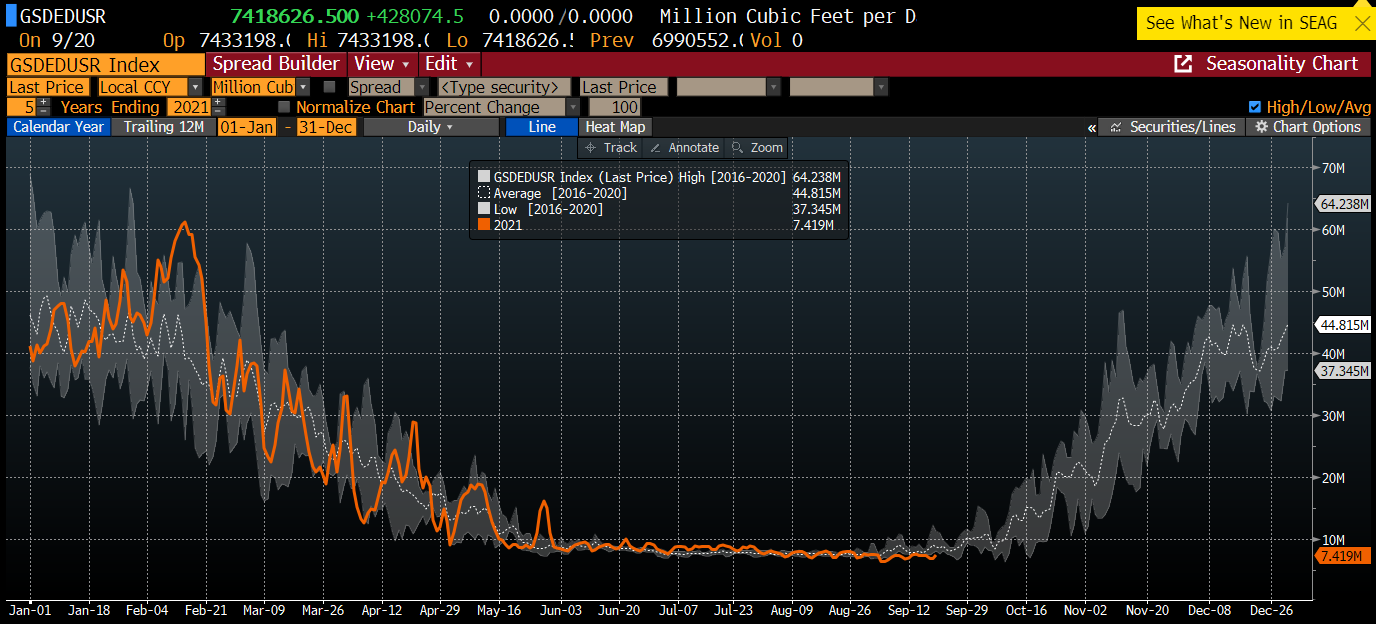

Use of natural gas in electricity production has been above-average in the past two months but the situation began to stabilize. Source: Bloomberg

Use of natural gas in electricity production has been above-average in the past two months but the situation began to stabilize. Source: Bloomberg

Silver

-

In spite of recent negative sentiment towards precious metals, silver prices managed to hold above a key $22 support

-

US dollar remains a key factor for silver

-

Silver demand from ETFs has been muted recently. Net speculative positioning sits at relatively low levels, what may give some hope for bulls

-

On the other hand, US tapering has been a negative for precious metals prices in the past

ETFs have been net sellers of silver in the past few months but it should be noted that sales were minor. On the other hand, net speculative positioning dropped to extremely low levels compared to the previous dozen or so months. Source: Bloomberg

ETFs have been net sellers of silver in the past few months but it should be noted that sales were minor. On the other hand, net speculative positioning dropped to extremely low levels compared to the previous dozen or so months. Source: Bloomberg