Oil

-

OPEC+ has decided to extend the agreement on production cuts through 2024, albeit with slightly modified levels

-

Additionally, Saudi Arabia is set to reduce production by 1 million barrels per day in July, with the possibility of an extension. This, combined with no changes in demand and supply from other countries, should lead to a relative balancing of the market. The oversupply in May amounted to approximately 1 million barrels per day

-

Citi indicates that the additional cut by Saudi Arabia is unlikely to drive prices up to high levels such as $80 or $90 per barrel, due to weaker-than-expected demand and higher production growth from non-OPEC countries

-

There is expectation for a significant increase in production from Mexico and Brazil

-

Citi emphasizes that China will be a key factor for the oil market, as it accounts for the largest portion of demand growth this year

-

The price level of $81 per barrel is crucial for Saudi Arabia as the country's budget is balanced at that level. This pertains to Brent crude oil. On the other hand, the $70 per barrel level for WTI crude oil may be important from the perspective of the United States, as it may lead to a desire to purchase barrels to replenish strategic reserves

-

According to Saxo Bank, a production cut of 1 million barrels per day by Saudi Arabia would require an approximate $8 increase in oil prices per barrel to maintain the country's revenue unchanged.

-

It is important to note that oil demand within Saudi Arabia itself is higher during the summer due to the use of air conditioning and fans. This may lead to export limitations during the summer and additional upward pressure on prices

-

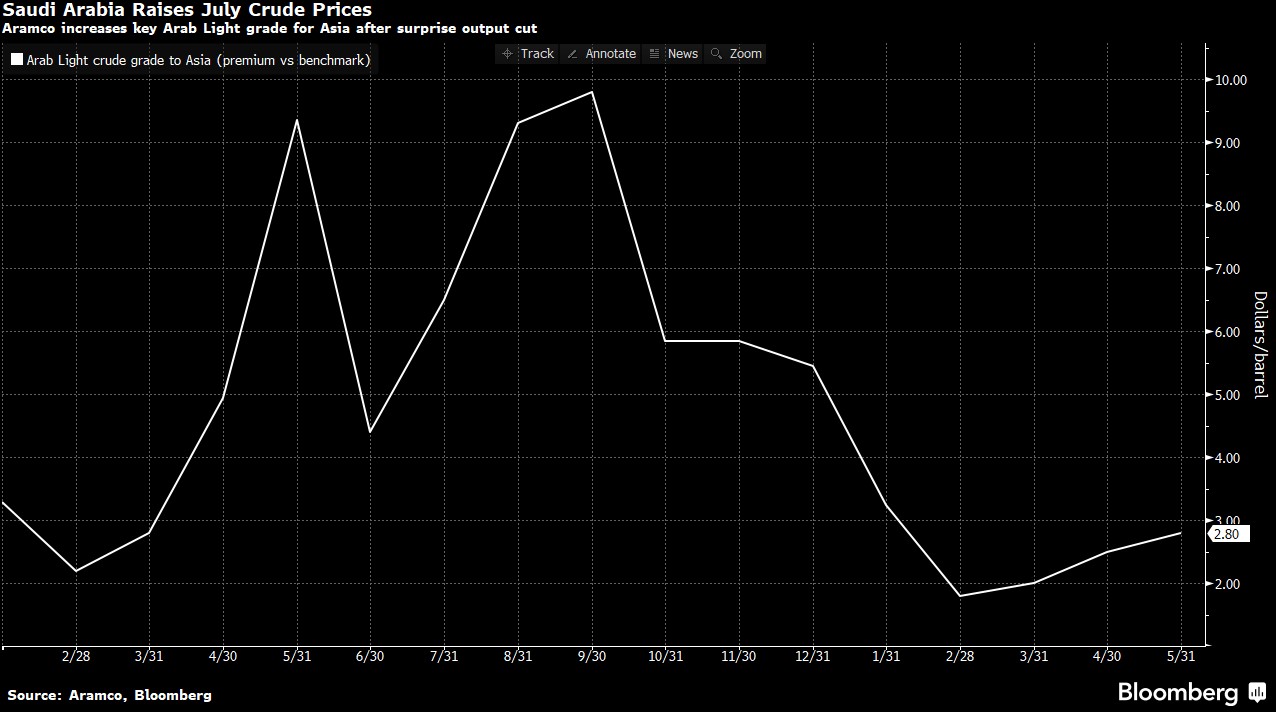

Saudi Arabia is raising export prices for oil deliveries to Asia, which currently stand at over $2.8 per barrel above the benchmark

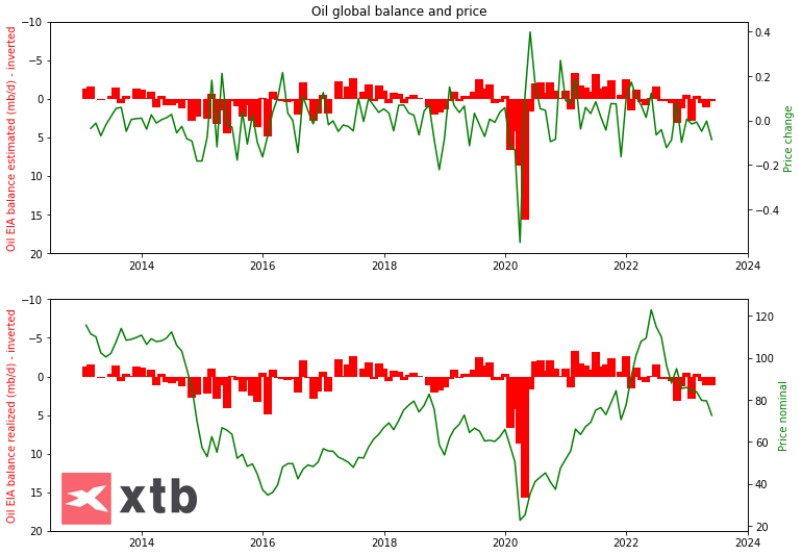

Global oversupply on the oil market amounts to around 1 million barrels per day currently. Should demand and supply remain unchanged, the market may get balanced following a 1 million barrel cut from Saudi Arabia. This should support prices at current or higher levels. Source: Bloomberg, XTB

Saudi export prices climb after reaching a local low in February. Nevertheless, the premium is relatively small suggesting that demand for Saudi oil is limited. It is also related to competitive cheap oil from Russia. Source: Bloomberg

Saudi export prices climb after reaching a local low in February. Nevertheless, the premium is relatively small suggesting that demand for Saudi oil is limited. It is also related to competitive cheap oil from Russia. Source: Bloomberg

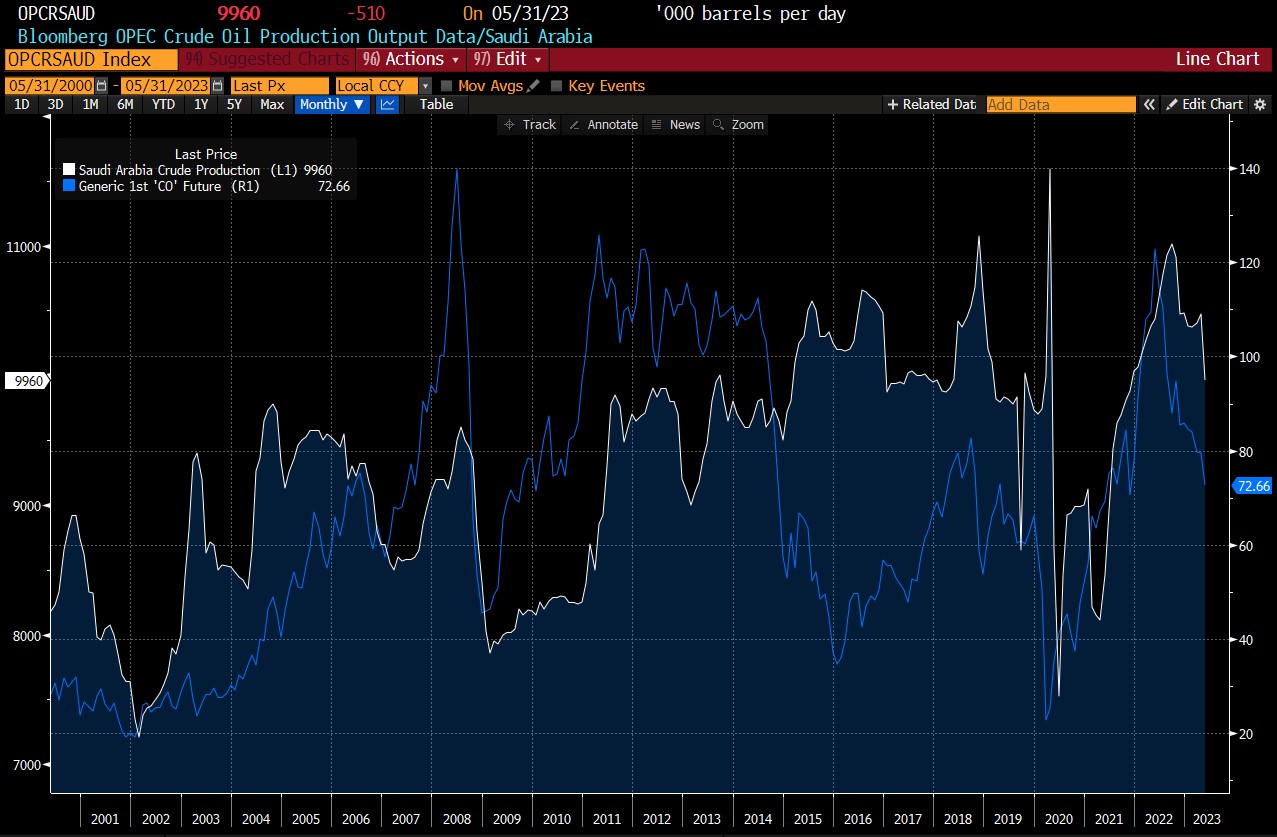

Saudi Arabia will lower production to around 9 million barrels per day. This would be the lowest level of production in 2 years. Taking a look at history, prices tended to jump when Saudi Arabia cut production to 8.8 or 8.0 million barrels. Source: Bloomberg

Saudi Arabia will lower production to around 9 million barrels per day. This would be the lowest level of production in 2 years. Taking a look at history, prices tended to jump when Saudi Arabia cut production to 8.8 or 8.0 million barrels. Source: Bloomberg

Natural Gas

-

There are significant concerns regarding excessively high temperatures, which led to a rebound in prices earlier this week

-

Gas prices in Europe also rebounded due to the theoretical increase in demand in Asia. However, strong, early-week rally is being erased today

-

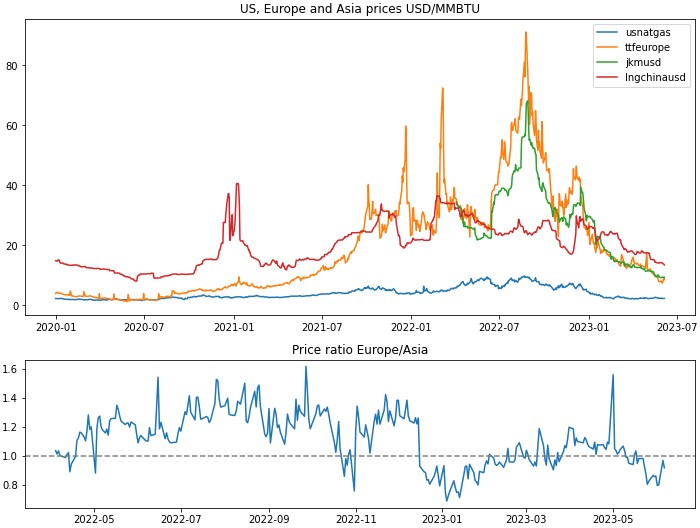

It turns out that the price increases in Europe were merely an adjustment to Asian prices

-

Meanwhile, in the United States, apart from weather-related concerns, there are no fundamental signals yet. Comparative inventories are even experiencing growth compared to last year's levels

Strong natural gas price increases in Europe at the beginning of this week were merely an adjustment to the situation in Asia. Source: Bloomberg, XTB

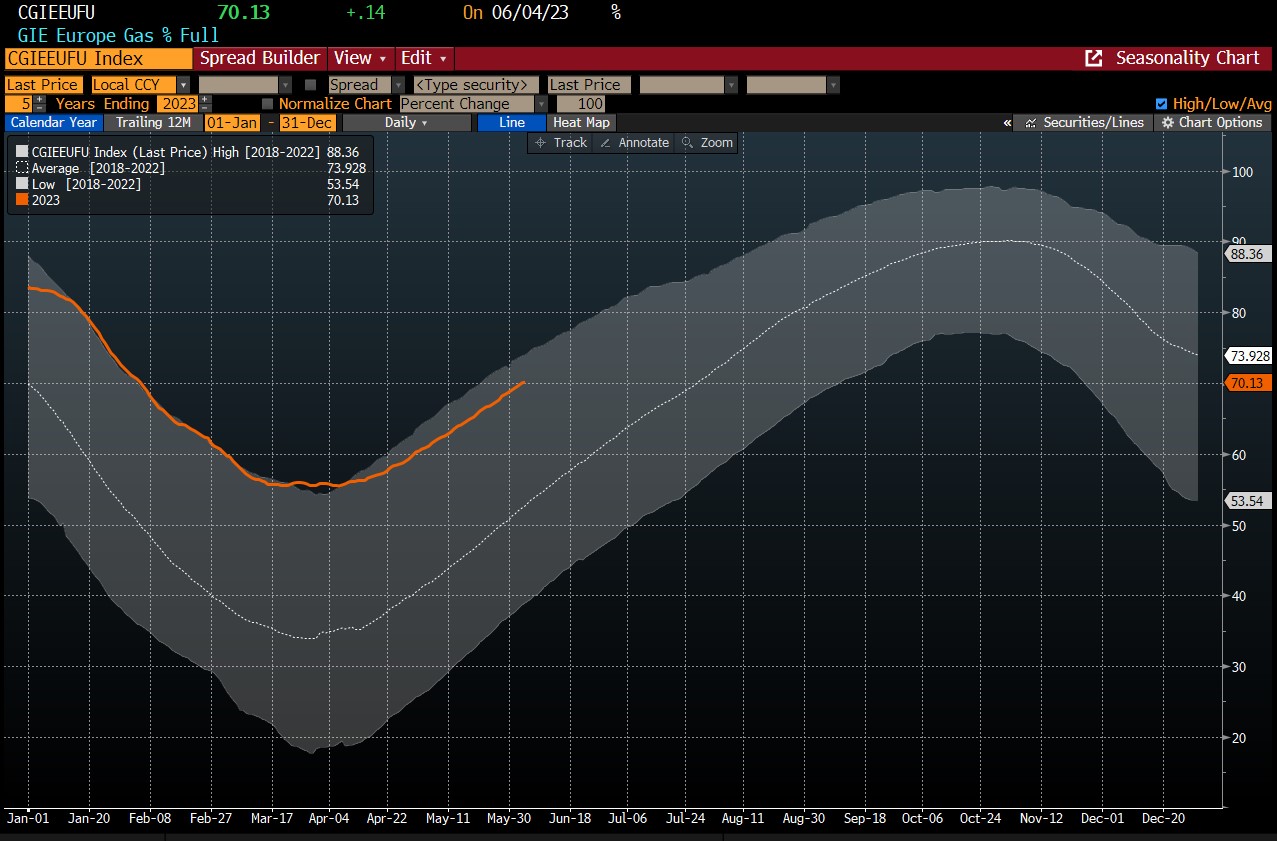

European gas inventories are being filled up. Currently, inventories are around 70% full up from around-40% in this period of the year in 2021. Source: Bloomberg

European gas inventories are being filled up. Currently, inventories are around 70% full up from around-40% in this period of the year in 2021. Source: Bloomberg

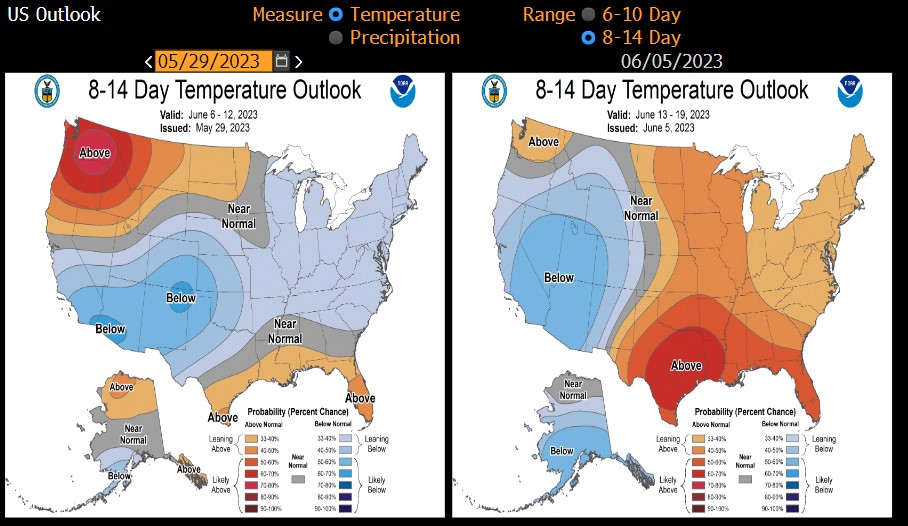

Weather in the United States is set to improve in the next 8-14 days with temperatures expected to be above-average for this period of the year. Source: Bloomberg

Weather in the United States is set to improve in the next 8-14 days with temperatures expected to be above-average for this period of the year. Source: Bloomberg

Comparative inventories are slightly lower compared to a year ago, signaling that local low may not have been reached yet. Source: Bloomberg, XTB

Comparative inventories are slightly lower compared to a year ago, signaling that local low may not have been reached yet. Source: Bloomberg, XTB

Wheat

-

Concerns about high temperatures affecting crop conditions may cause yields in the United States to potentially be lower than expected

-

The quality of crops in the U.S. has improved slightly, but in historical terms, it remains at a very low level, with only 36% rated as good or excellent. In contrast, in France, over 90% of crops fall into those two categories

-

At the same time, it should be noted that similarly good yields for winter wheat are expected in Russia. On the other hand, the progress of spring wheat sowing in Russia is significantly below the seasonal average

-

Nevertheless, in regions heavily impacted by the dry air brought by El Niño (such as Spain, the U.S., and Australia), production outlook is limited. Wheat production in Australia is expected to be around a third lower in the upcoming 2023/2024 season. May of this year was the second-driest month in the country's history

-

Speculators still maintain a significant number of short positions in wheat. If data regarding winter wheat yields prove to be disastrous, we may see a rapid exit of short positions

-

Seasonality shows that wheat should experience a seasonal low around mid-year

-

Of course, wheat market remains in a fairly clear contango

Quality of US crops has been very poor as of late but has recently climbed to levels not seen since 2021. Source: Bloomberg, XTB

Seasonal patterns for wheat show that price recovery may occur around mid-year, following a recent drop that was one of the biggest on the record. Source: Bloomberg, XTB

Gold

-

Risk associated with a potential US bankruptcy has faded

-

The next Fed decision remains a source of uncertainty for GOLD traders as it may bring another rate hike and another jump in yields

-

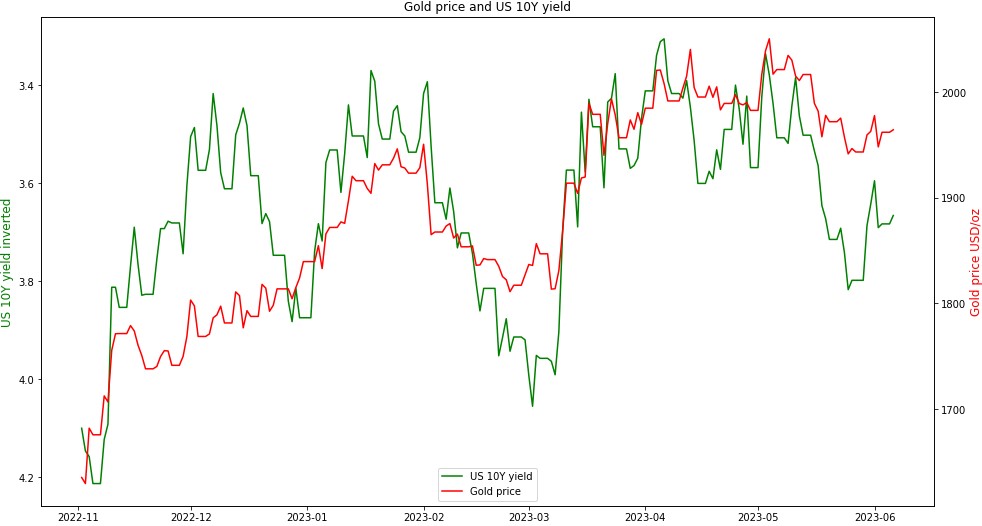

Taking a look at recent drop in yields (inverted axis), situation starts to resemble the one from March, when prices rallied to record highs. Should price react similarly now, gold could rally to as high as $2,160 area

-

Seasonal patterns suggest price recovery to occur at the beginning of July

Yields suggest that gold price may continue to move higher. Source: Bloomberg, XTB

Should current upward move on GOLD be similar to the one from March, price could rally to as high as $2,160 per ounce - a new record high. Upcoming Fed decision will be key for future gold price moves. Source: xStation5

NATGAS gains 12% 🚨📈

GOLD returns to ATH levels 📈

Morning wrap (20.10.2025)

VIX drops 10% amid Wall Street rebound attempt🗽