OIL.WTI

-

Oil WTI price remains limited by the downward trend line (the trend started in early-July)

-

Moreover, the 50-day moving average has been in a downward trend since mid-August. 50-SMA and 100-SMA may soon paint a “death cross” on the chart

-

Despite recently stronger US dollar, oil prices remain at relatively high levels, which may be associated with rising prices of other commodities, including industrial metals or natural gas

-

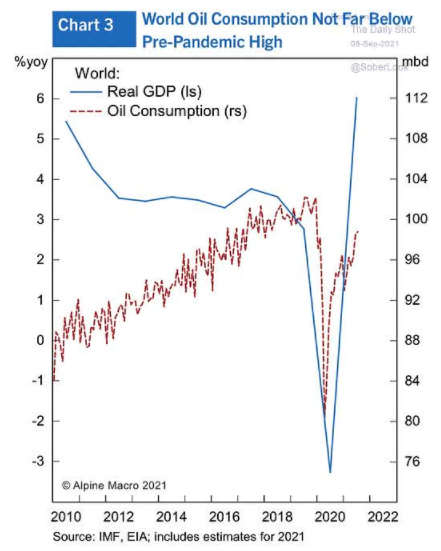

Global oil consumption is still on the rise amid economic recovery and is just slightly below pre-pandemic highs

-

Temporary blocked Suez Canal impacted oil prices slightly. However, the problem has been solved quickly

-

China releases its strategic reserves, which led to oil prices falling (markets were speculating about the possibility of such move, also in terms of other commodities)

-

In some European countries traffic data looks even better than in 2019 (particularly in Spain)

-

The number of US airline passengers sits in the 1.5-2 million per day range. The 7-day moving average sits 15% below 2019-levels. The number of passengers in July-December 2020 sat in the 0.5-1 million range

-

Total oil inventories in the US are at lowest levels since 2015

Oil consumption is rebounding along with economic growth. Source: Twitter @JKempEnergy

Total oil, gasoline and distillate inventories fell to lowest levels since 2015. As far as the change in inventories, the situation looks similar to 2017. In 2018 WTI prices climbed to 75 USD per barrel, similarly to July 2021. Source: Twitter @BrynneKKelly

WTI prices reached 70 USD area, where the downward trend line may be found. However, there are more and more signals on the demand side and there is a chance that the EURUSD pair will rebound, which could ultimately help bulls in breaking above this resistance. Source: xStation5

Natural gas:

-

Natural gas prices smashed through 2018-highs, but the seasonality indicates that this year’s highs may be reached in mid-November

-

There are perspectives that the demand would rise further (domestic and export) while the world is still facing supply-issues after Ida Hurricane

-

Lack of additional supply before the heating season leads to fears of gas availability amid potential weather disturbances (think about extremely cold winter in the US last year)

-

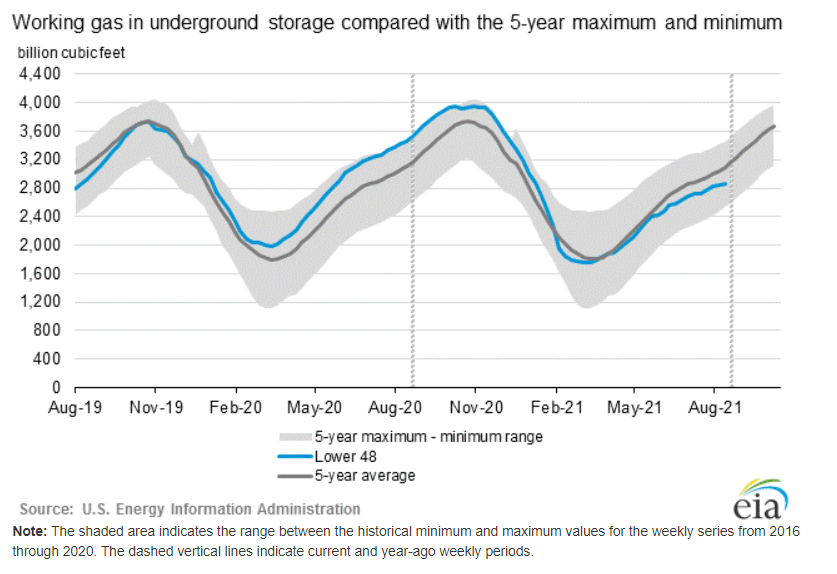

Natural gas storage is currently sitting 7% below the 5-year average

-

However, the demand outlook for the next year in the country remains limited. EIA expects that the demand will remain flat wile supply will rise by 3.8 bcf/d

-

EIA’s price model assumes averaged price well above 4 USD MMBTU by the end of this year, also does not rule out prices near 10 USD MMBTU (based on seasonal volatility). At the same time, the price is unlikely to fall below 2 USD MMBTU (Henry Hub spot prices)

-

Natural gas prices in Asia and Europe are at significantly higher levels than in the US

Natural gas storage is rising less than the 5-year average would suggest. Source: EIA

Natural gas prices are near the 5 USD MMBTU level. At the same time, the seasonality indicates that we may be only halfway through the upward move. Source: xStation5

Daily Summary – Wall Street Rally Driven by Powell’s Promises

Cocoa Prices Stabilize Ahead of Processing Data: Has the Negative News Been Priced In?

GOLD surges 1.4% 📈

Daily Summary: Powell pulls markets back up! 📈 EURUSD higher