Summary:

-

Turkish Lira comes back under pressure; Reports senior banker to quit

-

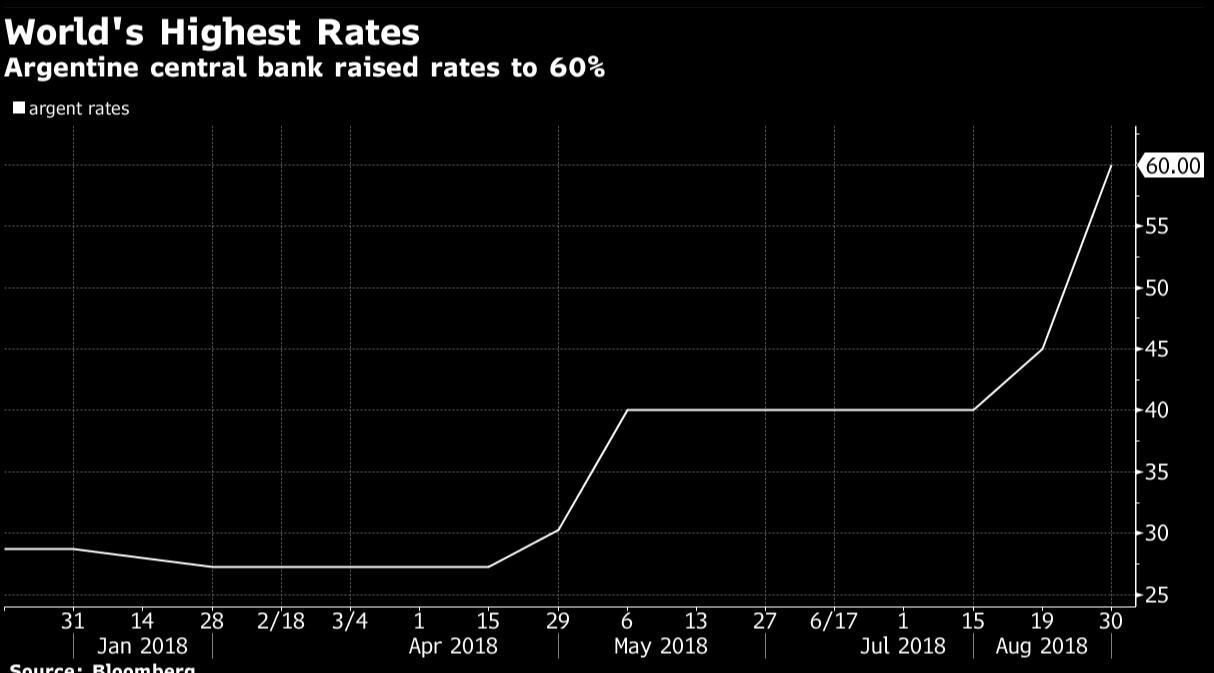

Argentina hike by 15% to 60% in attempt to stem Peso declines

-

Risk-off seen in FX but stocks and Gold showing little reaction

It wasn’t that long ago that fears surrounding a full-blown emerging market crisis gripped traders thoughts, and given the inadequate measures chosen in response by Turkey it is of little surprise that these have reemerged once more. Reports that the deputy governor for the Turkish central bank is set to resign have spooked markets once more with the Lira slumping and EURTRY coming back within a whisker of its all-time high. Despite this other markets are seemingly holding up fairly well with the DE30 little changed on the day. Will stocks suddenly wake up to the fears of contagion or will the crisis be contained to the Emerging Markets space?

Watch our short video below:

Elsewhere in the Emerging Markets (EM) space the weakness isn’t hard to see with the South African Rand lower by more than 2% and most currencies in the red. Argentina has taken drastic action in the past couple of hours in an attempt to stem the declines seen in its Peso, with the central bank raising the benchmark interest rate by 15% to 60%. This hike means that the rate is now the highest in the world and comes just a day after President Mauricio Macri announced he had requested the IMF to speed up disbursements from a $50B credit line.

The Argentinian central bank has taken aggressive measures to try and defend its currency the Peso, hiking the benchmark rate by 15% to 60% - leaving it at the highest in the world. Source: Bloomberg