Today 'stimulus' measures announced by PBoC on conference in Beijing are improving sentiments around cyclical-driven assets such as container shipping stocks such as Maersk (MAERSKB.DK), Hapag-Lloyd (HLAG.DE), ZIM (ZIM.US) and dry bulk operators such as Star Bulk Carriers (SBLK.US), which gains almost 4% in US pre-market. Improving sentiments around the second-largest world economy are driving some 'sleeping' assets.

- Today, we can also see rising Brent Crude (OIL) and industrial metals, such as copper, aluminum and zinc. Also, mining companies such as Antafogasta (ANTO.UK), Rio Tinto (RIO.UK) and Anglo-American (AAL.UK) are rising today, dominating British FTSE Index.

- People Bank of China announced cutting rates and multiple policies oriented on consumers and stock market, sending the world money managers signal, that China is determinate to achieve GDP growth and strengthen demand across the national economy.

Also, announced aggressively monetary policy easing in US Federal Reserve and European Central Bank rate cuts improved sentiments around procyclical maritime operators stocks.

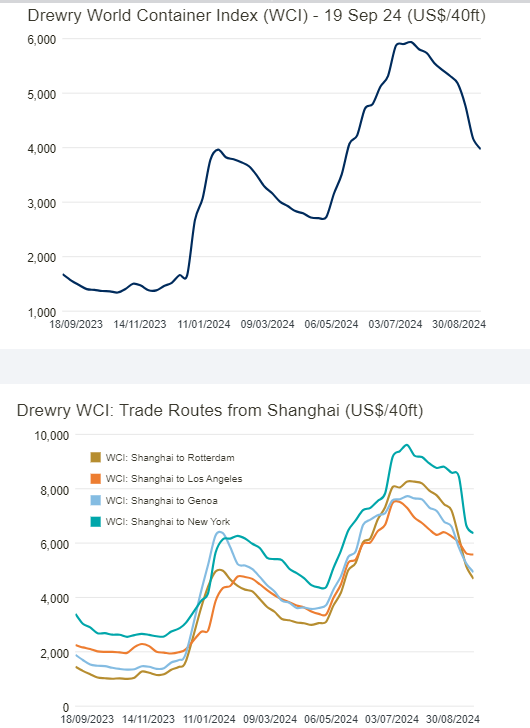

Shipping prices for standard 40 ft container dropped, however shipping sector didn't react to that, because lower rates were impact especially by lower oil prices and easing geopolitical tensions; this year WCI rally wasn't driven by strengthening demand; rather by solid conditions in developed economies and risk factors. Source: Drewry

MAERSKB.DK

Maersk stock price rises today above EMA200, located at 11284 DKK. Next important resistance zone is located now at 12607 DKK, at 61.8 Fibonacci retracement of the upward wave since 2020.

Source: xStation5

Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈