Credit Agricole (ACA.FR) stock rose over 3% after its Italian unit launched a voluntary public tender offer of €10.50 per share in cash for Italian bank Credito Valtellinese (CVAL.IT), corresponding to a total investment of €737 million. As a result of this transaction, Credit Agricole will acquire 100% of Credito Valtellinese shares. The acquisition is expected to generate a return on investment for Credit Agricole Italia's shareholders of more than 10% by the third year, Credit Agricole said. Should the transaction be concluded, then Credit Agricole Italia SpA would become the sixth largest retail bank in Italy.

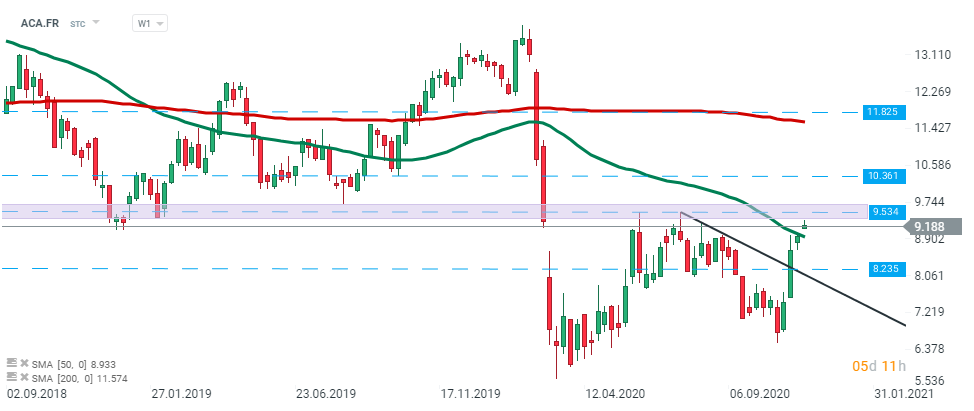

Credit Agricole (ACA.FR) stock managed to break above 50 SMA (green line) last week, however price bounced off the resistance zone located around €9.53 level. Should buyers fail to break above it, a near-term support lies at €8.23. Source: xStation5

Credit Agricole (ACA.FR) stock managed to break above 50 SMA (green line) last week, however price bounced off the resistance zone located around €9.53 level. Should buyers fail to break above it, a near-term support lies at €8.23. Source: xStation5

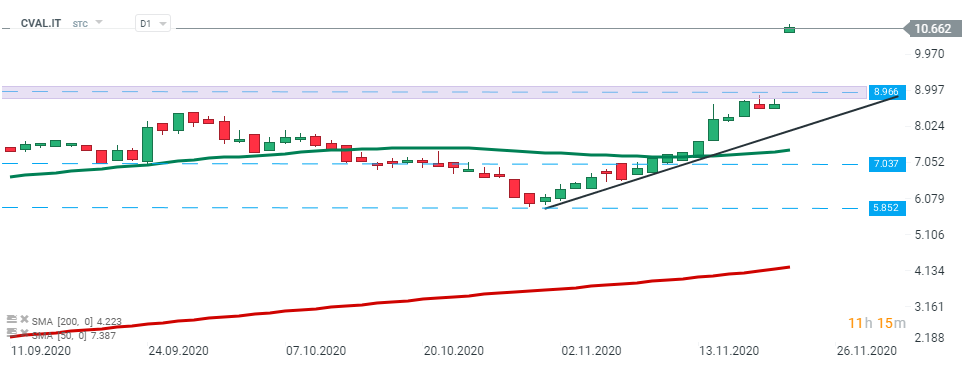

Credito Valtellinese (CVAL.IT) stock launched today's session with a massive bullish price gap and painted a fresh all-time high. However if the current market sentiment changes, then the nearest support lies at €8.96. Source: xStation5

Credito Valtellinese (CVAL.IT) stock launched today's session with a massive bullish price gap and painted a fresh all-time high. However if the current market sentiment changes, then the nearest support lies at €8.96. Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎