Shares of Crowdstrike (CRWD.US) shares plunged nearly 20.0% on Wednesday as weak financial outlook overshadowed upbeat quarterly results.

-

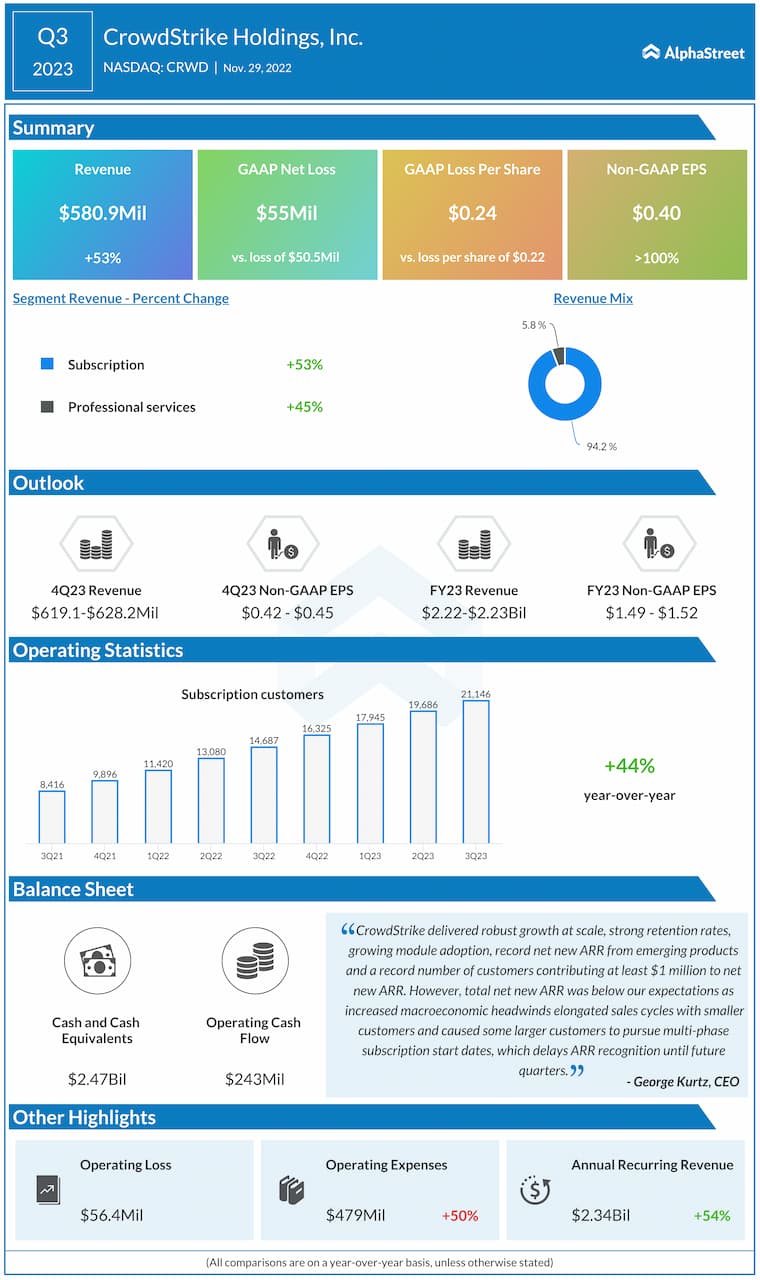

Company earned 40 cents per share, beating FactSet estimates of 32 cents.

-

Revenue increased 52.8% YoY to $580.9 million and topped market projections of $575.1 million.

-

However the cybersecurity company said that due to longer sales cycles to its budget-focused customer base its Q4 revenues would likely range between $619.1 million to $628.2 million, well below the $633.9 million consensus call.

-

Crowdstrike warned of “increased macroeconomic headwinds” for the sector in the coming year.

-

"Organizations are responding to macroeconomic conditions by adding extra layers of required approvals and extending the time it took to close some deals," said company's CEO George Kurtz.

Crowdstrike key quarterly figures. Source: AlphaStreet

Crowdstrike key quarterly figures. Source: AlphaStreet

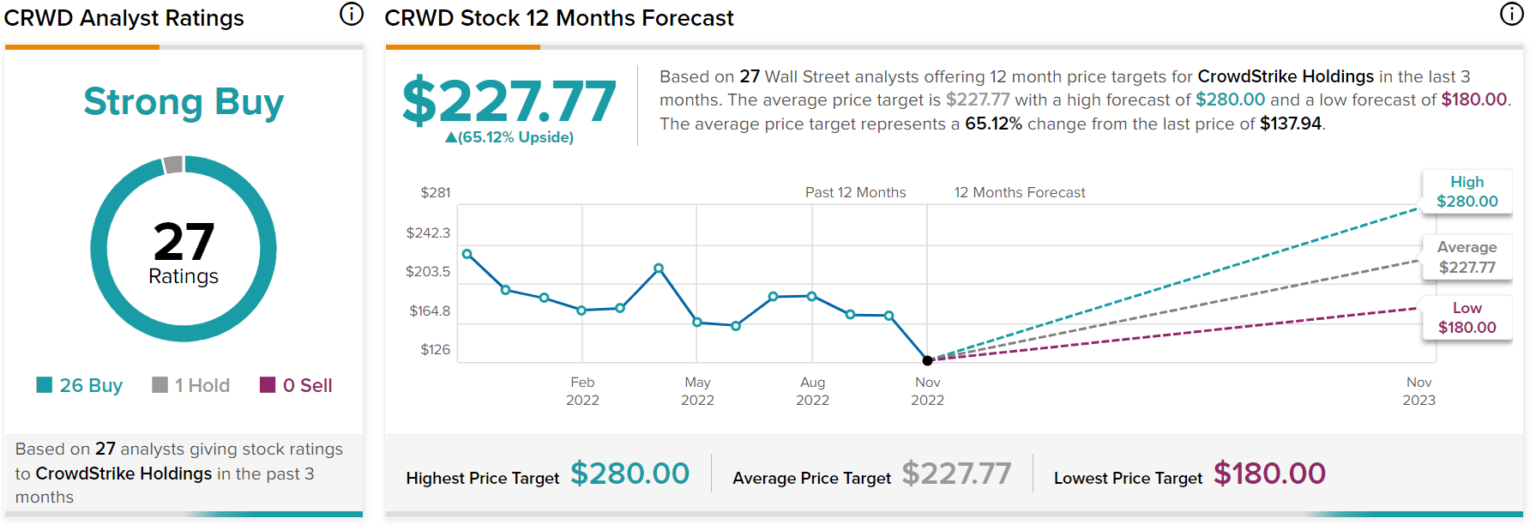

Before earnings announcement Crowdstrike stock had a strong buy rating based on 27 analysts recommendation with a price target of $227.77, which implies over 107.00% upside potential from current price levels. Source: Tipranks

Before earnings announcement Crowdstrike stock had a strong buy rating based on 27 analysts recommendation with a price target of $227.77, which implies over 107.00% upside potential from current price levels. Source: Tipranks

Crowdstrike (CRWD.US) stock launched today’s session with a massive bearish price gap and is trading below recent lows at $120.00. If current sentiment prevails, support at $89.20 may be at risk. This level is marked with 78.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Crowdstrike (CRWD.US) stock launched today’s session with a massive bearish price gap and is trading below recent lows at $120.00. If current sentiment prevails, support at $89.20 may be at risk. This level is marked with 78.6% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡