Cryptocurrencies open the week with declines, as profit-taking continues across the market. Ethereum was hit particularly hard, retreating nearly 10% from last week’s multi-year highs. ETH dropped to $4,250, while Bitcoin hovers around $115,000. Markets are closely watching the outcome of Trump’s talks with Zelenskyy and upcoming economic data—especially from the U.S.—scheduled for release this week. On Friday, the Jackson Hole symposium will begin.

- Beyond Ethereum, Algorand and Avalanche are also down by 5–7%, though it is still difficult to speak of broad market panic.

- Over the past 24 hours, nearly $240 million in long positions have been liquidated out of a total of roughly $340 million.

- On-chain data from CryptoQuant points to profit-taking among so-called whales (addresses holding more than 10,000 BTC), with exchange inflows rising sharply.

- As BTC prices fell, open interest in options markets also climbed, which may indicate growing interest in “trend tracking” strategies and the buildup of significant short positions.

Looking at U.S. equity indices, we see relatively mild downward pressure before Wall Street opens. In the short term, the biggest risk for 'crypto bull market' seems to be hotter inflation numbers and more hawkish Fed. Also, no deal between Ukraine and Russia may be welcome as 'inflationary' due to a sanctions on Russian energy resources: oil and gas.

Bitcoin and Ethereum Charts (D1)

The BTC price has fallen below the 50-day EMA, though it is still uncertain whether it can reclaim this level today. Historically, the EMA50 (orange line) has been important for momentum. In bull markets, it has often acted as support, with prices tending to rebound above it.

Source: xStation5

Momentum indicators for Ethereum appear more overheated. In the event of a deeper correction, the $4,000 level could serve as the first key support. Resistance remains around $4,800—the peak from the 2021 bull run—reinforced by recent selling pressure.

Source: xStation5

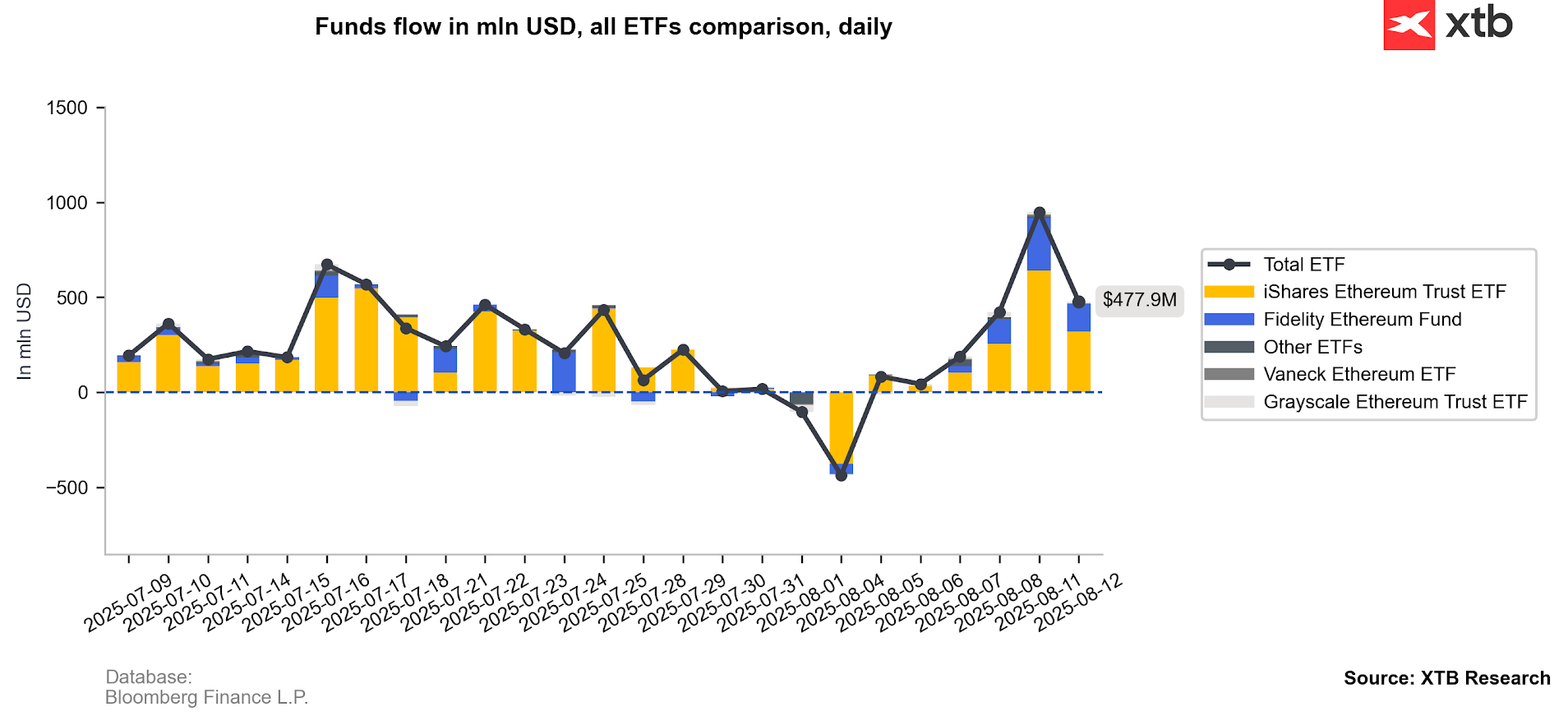

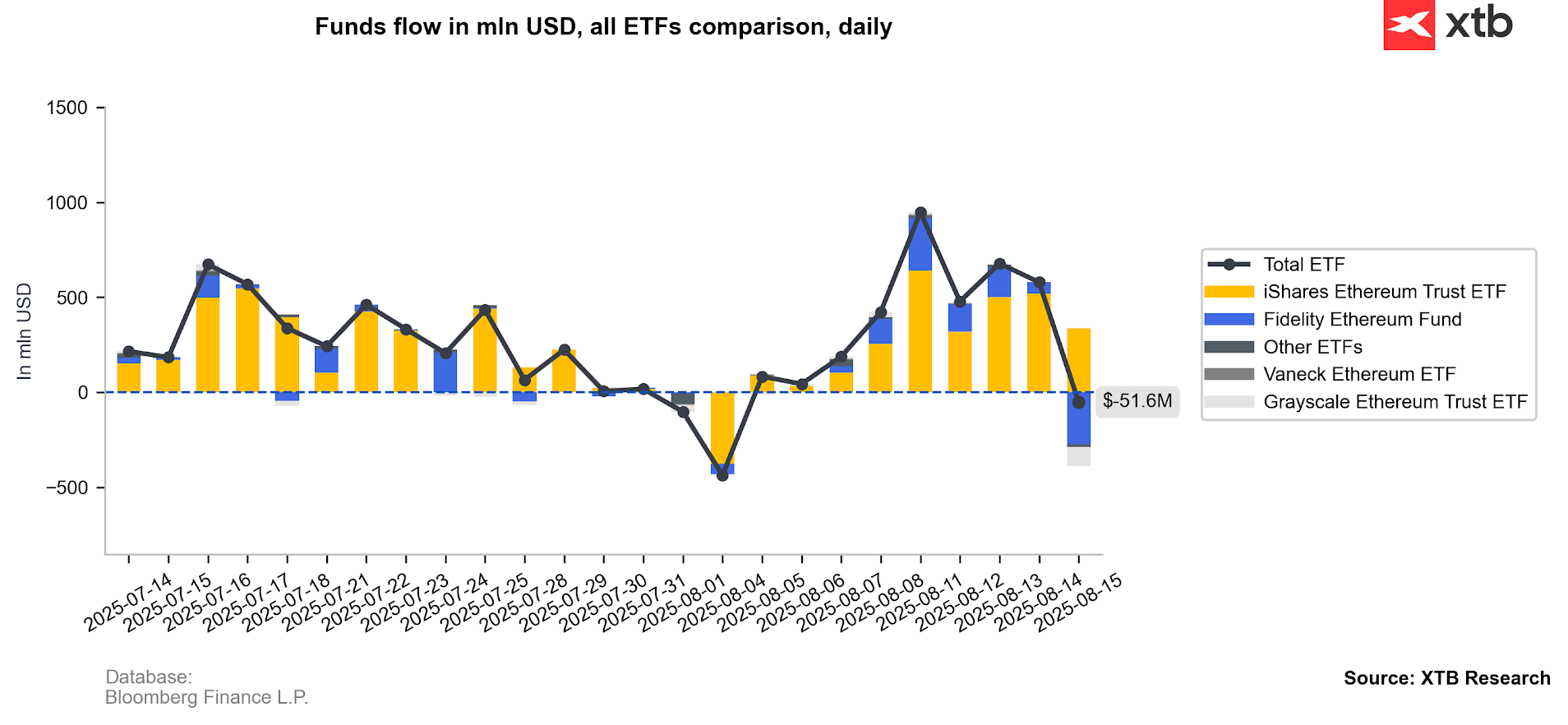

ETF Inflows

Bitcoin funds saw nearly $500 million in inflows last Friday. In contrast, Ethereum ETFs experienced outflows of over $50 million, suggesting profit-taking—likely from a single large entity, as the selling was concentrated almost exclusively in the Fidelity Ethereum Fund.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Crypto news: Bitcoin gains despite sell-off on global markets amid oil spike 📈

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

Daily Summary – Indices rebound as oil markets await further developments