• Growing correlation between Bitcoin and gold

• Ripple become the third most valuable crypto asset

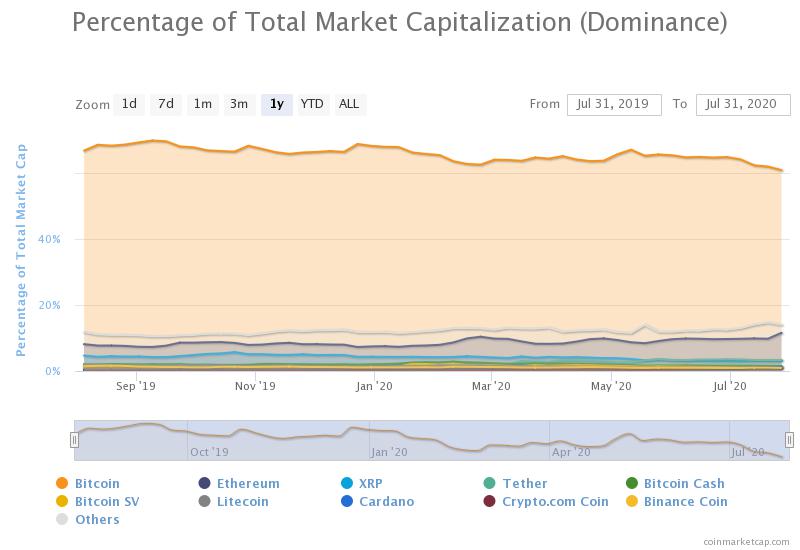

Bitcoin's market dominance decreased to 62.3%. The capitalization of all digital assets in circulation increased to 327.9 billion from reached almost $284 billion last week, while an average daily trading volume is registered at $82 billion. Source: Coinmarketcap

Bitcoin's market dominance decreased to 62.3%. The capitalization of all digital assets in circulation increased to 327.9 billion from reached almost $284 billion last week, while an average daily trading volume is registered at $82 billion. Source: CoinmarketcapAccording to James Li, a research analyst at CryptoCompare:

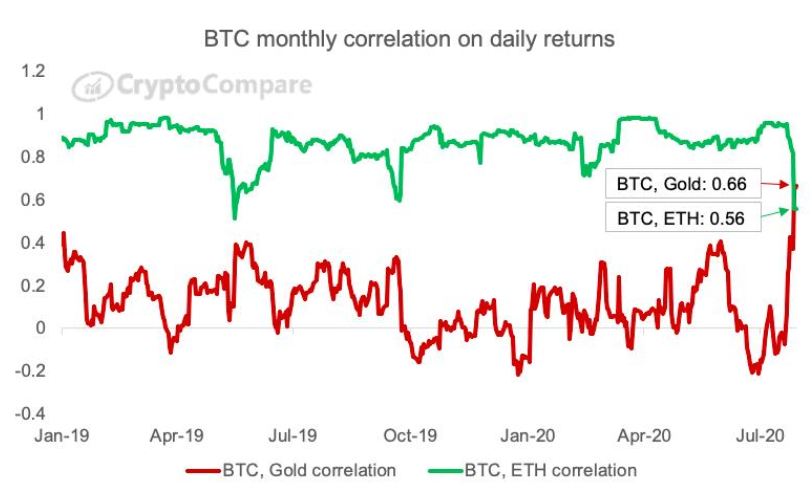

"Last time Bitcoin had a moderate correlation with gold (around 0.5) was towards the end of 2018. That was when a month earlier in November 2018 bitcoin suffered a 50% drop (at the height of the bitcoin cash war) and made some subsequent rebounds. Gold was recovering from a somewhat cyclical drop a couple of months earlier. The moderate correlation back then was perhaps a bit of a coincidence".

Bitcoin’s monthly correlation with gold on daily returns sits at 0.66.Source: CryptoCompare

Bitcoin’s monthly correlation with gold on daily returns sits at 0.66.Source: CryptoCompare Bitcoin price rallied significantly from a tight range between $9,000 - $9,359 and reached new 2020 highs at $11,354. Currently the most popular coin is testing resistance at $11,100. If positive moods persist, then next target for bulls is located at $12,258.58. However, in case sellers regain control, round $10,000 level should provide strong support. Source: xStation5

Bitcoin price rallied significantly from a tight range between $9,000 - $9,359 and reached new 2020 highs at $11,354. Currently the most popular coin is testing resistance at $11,100. If positive moods persist, then next target for bulls is located at $12,258.58. However, in case sellers regain control, round $10,000 level should provide strong support. Source: xStation5Ripple seems to have joined the crypto market rally and on Wednesday reached its highest levels since the beginning of March.

Ripple has been trading in a tight range for more than 2 months with its volatility at its lowest levels. During this period coin did not attract interest, but now the coin becomes valuable again. Since mid-July, the number of wallets holding 1 million to 10 million Ripple has been steadily increasing. Ripple surpassed Tether and become the third most valuable crypto asset in dollar terms, at around $11 billion. There is no clear reason behind the recent rally, but Nairmetrics, through its data feed, noticed that some whales increased their stakes in the digital coin significantly.

Ripple jumped 21% over the past week and 37% over the past month, making it one of the top performers. Coin managed to break above the major resistance level at $0.2258 and rally. Should upbeat moods prevail resistance at $0.2609 may come into play. However if a break below occur, then local support is located at $0.2060 level. Source: xStation5

Ripple jumped 21% over the past week and 37% over the past month, making it one of the top performers. Coin managed to break above the major resistance level at $0.2258 and rally. Should upbeat moods prevail resistance at $0.2609 may come into play. However if a break below occur, then local support is located at $0.2060 level. Source: xStation5Crypto News: Risk-off returns 🚨 Bitcoin drops 2.5% as Wall Street mood sours 📉

Morning wrap (16.01.2026)

Daily summary: Wall Street climbs, oil slides 🗽 Is a stronger dollar weighing on Bitcoin?

ETHEREUM: Is the crypto bull run back? 🎢