Summary:

-

Five countries form international body to combat financial crimes

-

Litecoin (LITECOIN on xStation5) locked between moving averages

-

SYS sold for 96 Bitcoins due to the bug

After strong gains posted by major cryptocurrencies at the beginning of a new week the digital asset market stopped to take a breath today. The most famous coins are trading lower in the morning. Bitcoin bulls try to defend the $6500 mark while Ethereum once again bounces off the support zone.

Governments of five countries announced a foundation of Joint Chiefs of Global Tax Enforcement (J5). United States, United Kingdom, Australia, Canada and the Netherlands created an international body that aims to combat transnational financial crimes. These include for example money laundering and tax evasion schemes. On its website the Group made a clear reference to the digital assets. Namely, J5 said that one of the aims of the Group is to “reduce the growing threat to tax administrations posed by cryptocurrencies and cybercrime and to make the most of data and technology”. In the first place members of J5 will exchange their knowledge and experience and try to figure out a way to more efficiently detect dubious practices.

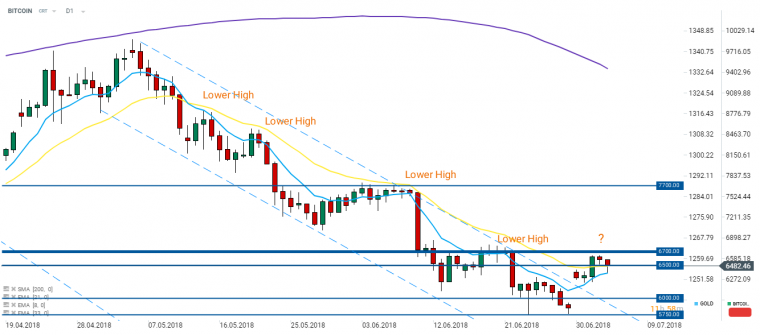

After climbing to the $6600 handle the BITCOIN price pulled back. The decline was halted by the 8-session moving average (blue line). Later on the price managed to move higher towards the $6500 mark where 21-session moving average (yellow line) can be found. In case the BITCOIN bulls manage to break above the $6700 handle a longer upward move may be on cards as a sequence of lower highs would be broken. Source: xStation5

Syscoin, a distributed network behind SYS token, announced yesterday that there might be an issue with its systems and therefore urged cryptocurrency exchanges to halt trading with its coin. The issue was resolved but prior to noticing it some interesting trades were made with the SYS token. Binance, one of the largest cryptocurrency exchanges, decided to halt trading with all the coins it had in offer in response to “abnormal transactions” connected to the SYS token. Namely, unusual transactions on SYS order book caused some wild and unreasonable price swings. Binance admitted that there was one transaction where a single SYS was sold for… 96 Bitcoins. To put this figure into context let us recall that prior to the mentioned issue SYS traded at 0.00004 Bitcoins.

After failing to break above the $480 mark Ethereum retreated to the range of a support zone (red colour). The mentioned zone combined with 78.6% retracement of the upward move started at the beginning of April and 33-period moving average proved to be enough to fend off the bears. From the technical point of view a retest of the $480 swing level may be on cards in the nearby future. Source: xStation5

It looks like the cryptocurrency enthusiasts from India ultimately lost the battle with domestic central bank. Despite numerous appeals and petitions Reserve Bank of India backed its banking ban. The ban is due to take effect on Friday and will prohibit domestic lenders from providing bank accounts to cryptocurrency related entities as well as retail traders. The Indian crypto industry even submitted a claim to the national Supreme Court accusing central bank that his decision was unconstitutional. The Court will work on the case yet the hearing is scheduled on July 20, two weeks after banking ban execution date. Having said that, it looks like Indian cryptocurrency traders will have to obey to the ban until more detailed regulatory framework is drawn.

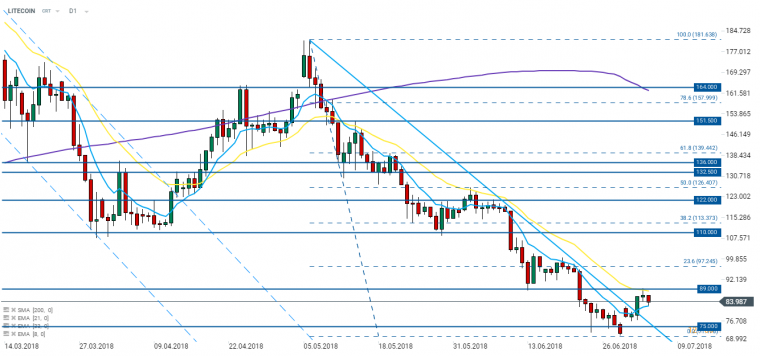

After breaking above the downtrend line LITECOIN has been trading in between 8- and 21-session moving averages (blue and yellow colour respectively). Do notice the lower wick of today’s candlestick suggesting that buyers may be still looming in the vicinity of the “faster” 8-session moving average. Source: xStation5

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.