- Major cryptocurrencies move higher

- US markets closed for Thanksgiving

- Lower volatility in the stock market

- Dollar slips slightly in muted trading

One could say that today's session was sluggish. Volatility leaves much to be desired as US markets are closed for Thanksgiving. Moreover, no major macroeconomic releases were scheduled for today, and the minutes of the last ECB meeting did not bring any surprises. Not only the stock market but also the Forex market lacked a specific direction today. Despite the fact that most indices from the Old Continent closed in the green today, it is too early to assume that the downward correction, which we have been dealing with since the end of last week, have come to an end.

The dollar weakened slightly against the EUR and CAD, however we observe slightly higher volatility on the NZD, which is weakening 0.25% against the greenback, which we wrote about in the previous post.

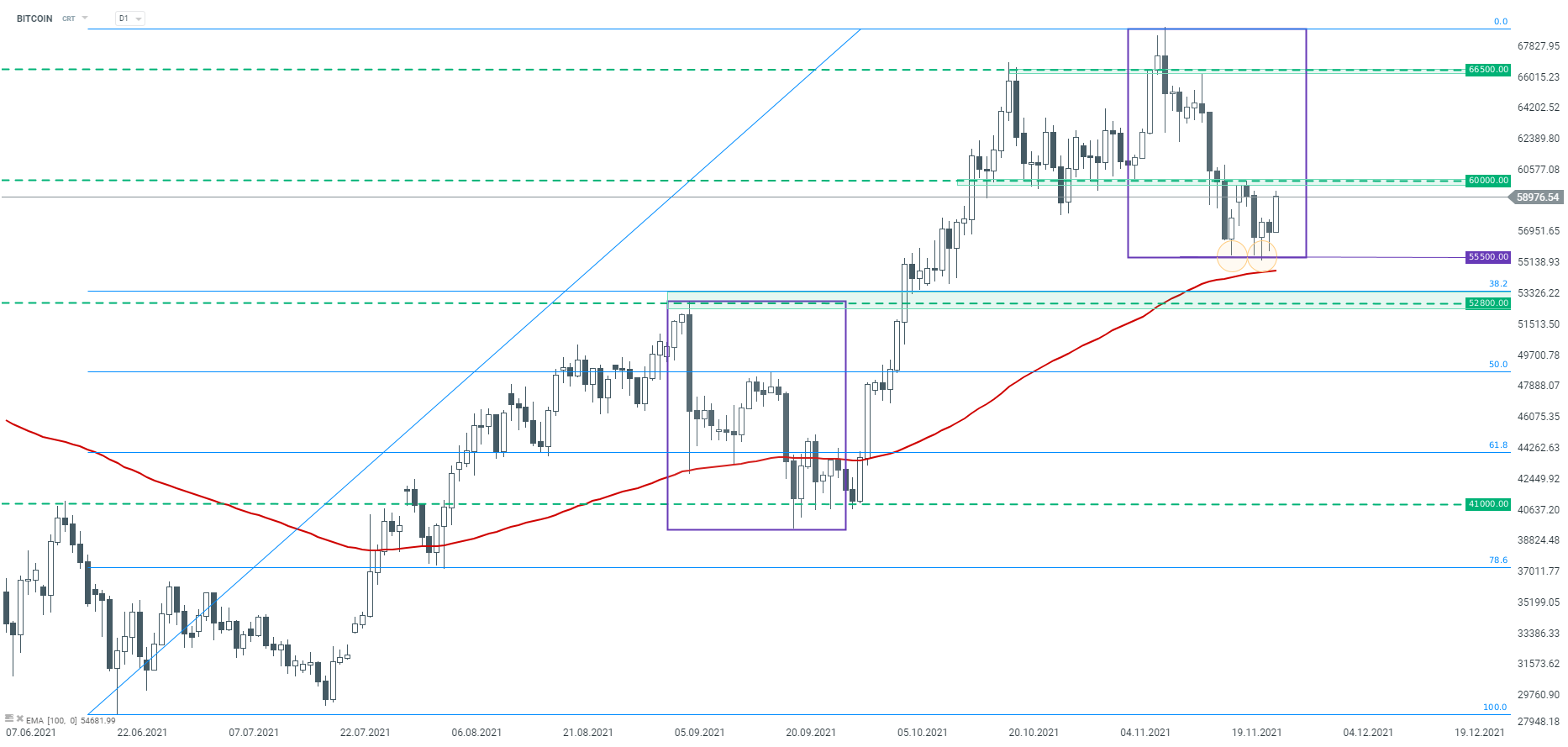

Technically looking at the Bitcoin chart, one can see that the price bounced off the key support at $ 55,500 which is marked with the lower limit of the 1:1 structure. According to the Overbalance methodology, as long as the price sits above the aforementioned support, continuation of an upward move is possible.

Bitcoin interval D1. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected