-

Tuesday was another day in a row marked with strong gains on the global equity markets.

-

Indices from Asia-Pacific moved higher following solid gains made by Wall Street indices yesterday. S&P/ASX 200 gained 0.8%, Kospi added 0.4% and Nifty 50 traded 0.7% higher. Indices from China traded up to 1.6% higher

-

Upbeat moods extended into European trading with blue chips indices from the Old Continent booking solid gains today. German DAX jumped 1.8% while indices from Spain and Italy added around 2.5% each

-

So far, it looks like Wall Street indices are also heading for another day of decent gains with S&P 500 up 0.9%, Nasdaq adding 1.2% and Russell 2000 rallying around 2.5% at press time

-

US banking sector shares are recovering with First Republic Bank stock up over-35% today

-

Market sees around 83% chance of Fed hiking rates by 25 basis points tomorrow

-

Improvement in risky moods led to a reversal on the precious metals market. Gold and platinum trade over 2% lower while silver drops 1.3%

-

CHF and EUR are the best performing major currencies while NZD and AUD lag the most

-

Risky assets other than equities, like energy commodities and cryptocurrencies, are also catching a bid today

-

Oil prices climb over 2% with Brent approaching the $75 mark. Russia's decision to extend oil output cuts through June provided a boost

-

Major cryptocurrencies are gaining with Bitcoin adding 0.5% and Ethereum trading 2% higher. Ripple is an outperformer with a 20% single-day rally

-

Russia's Putin and China's Xi signed documents on strategic cooperation and vowed to boost cooperation in trade and economy

-

Russia will boost energy supplies to China and armed forces of both countries will hold regular air and naval drills

-

Russia's Putin embraced Chinese peace plan but said that Ukraine and the West are not yet ready for serious talks on it

-

German ZEW economic sentiment plunged from 28.1 to 13.0 in March (exp. 16.5)

-

Canadian CPI inflation decelerated from 5.9 to 5.2% YoY in February (exp. 5.4% YoY) while core gauge dropped from 5.0 to 4.7% YoY (exp. 4.8% YoY)

-

US existing home sales reached 4.58 million in February, up from 4.0 million in January and significantly above 4.19 million expected by the market

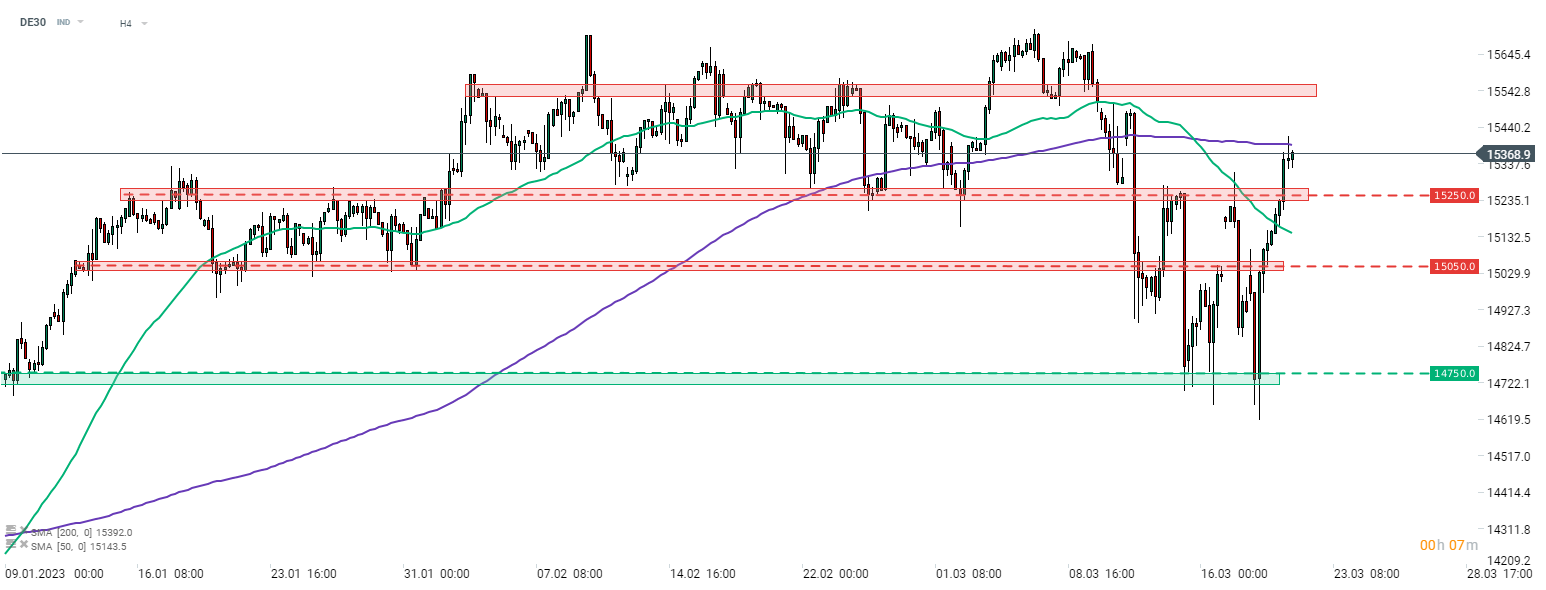

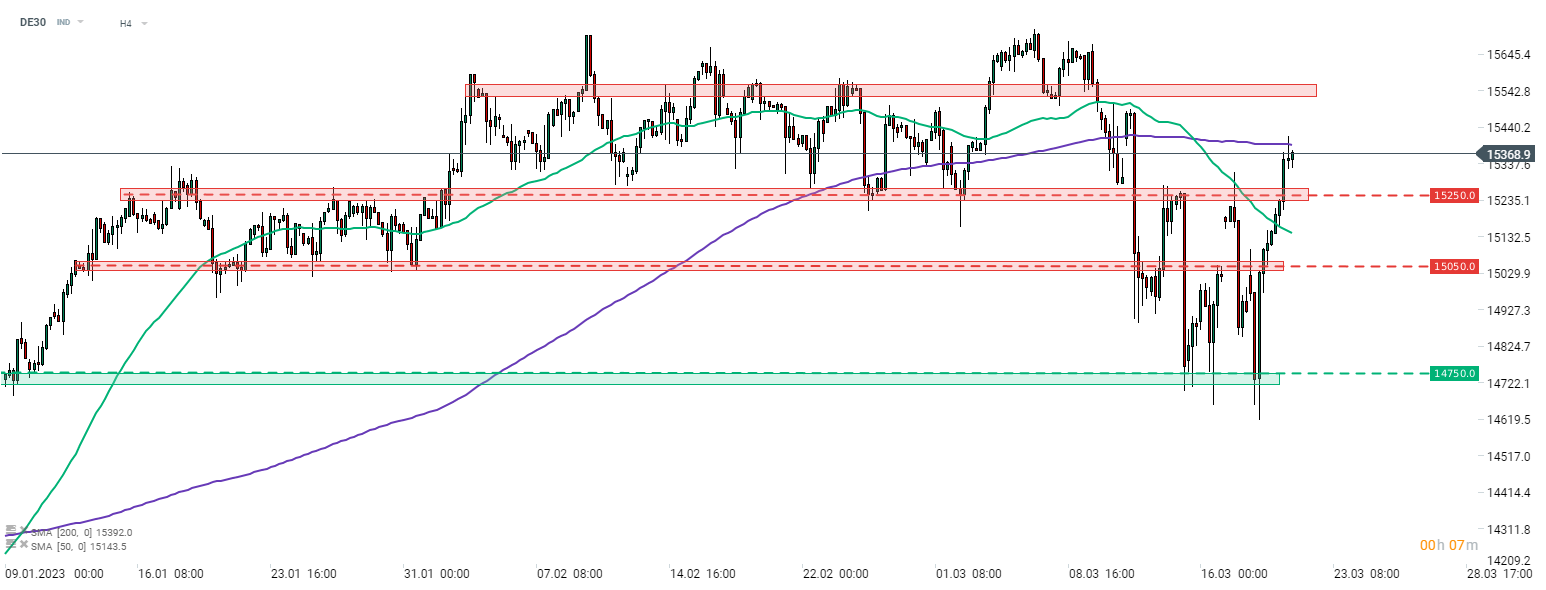

German DAX (DE30) continues to rally as concerns over the banking sector are easing. The index climbed above a 15,250 pts resistance zone today, which halted two previous upward impulses, and reached the highest level in a week. However, today's rally eased after the index encountered a 200-period moving average (purple line, H4 interval) in the 15,400 pts area. Source: xStation5

German DAX (DE30) continues to rally as concerns over the banking sector are easing. The index climbed above a 15,250 pts resistance zone today, which halted two previous upward impulses, and reached the highest level in a week. However, today's rally eased after the index encountered a 200-period moving average (purple line, H4 interval) in the 15,400 pts area. Source: xStation5

BREAKING: US100 reacts to weaker ADP report

Morning Wrap (04.02.2026)

Dailu summary: Sell-off on Wall street 📉 Bitcoin and Ethereum extend downfall in panic

US100 loses 2% 📉