-

European equities finish the day lower

-

CBR considers interest rate cut

-

Fed members to speak on Monday

Friday brought more pessimism to global stock markets. The downturn carried over into European equities as the majority of blue-chip indices finished the day lower. DAX lost 0.70% while CAC 40 slumped 1.22%. Spanish stocks were top laggard - IBEX 35 lost as much as 2.21%. Wall Street opened slightly higher today, yet American stocks tend to slide as time goes by. Tech equities lag the most at press time. Even though gold prices rise almost 1% today, silver seesaws around the flatline. WTI prices manage to stay above $40 a barrel.

In terms of economic data, investors witnessed two retail sales reports releases today. British retail sales rose 0.8% MoM in August (vs exp. 0.7% MoM) while retail sales in Canada grew by 0.6% in July (vs expected 1.0%). The Central Bank of Russian Federation (CBR) kept interest unchanged, but it is worth mentioning that the central bank signalled possible rate cut at one of next meetings. Apart from that, Michigan Consumer Sentiment came in above expectations (78.9 pts vs expected 75.0 pts)

On Monday markets will not see key macro data events. However, some investors will surely pay attention to Fed Chairman’s press conference. After Powell’s speech, FOMC member Brainard will be in the spotlight as well.

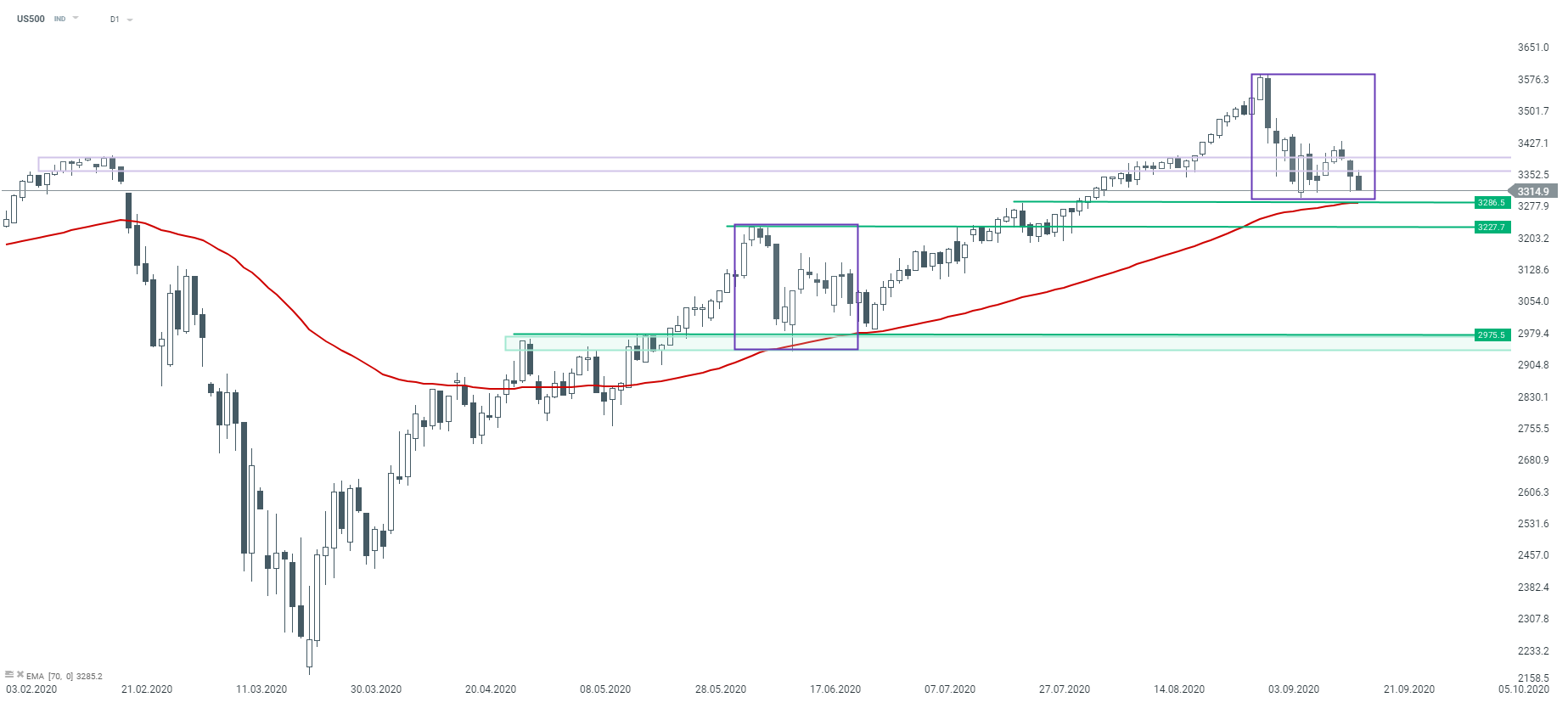

The 3,286 pts seems like a crucial support for US500 right now. Even though U.S. equities started the day higher, moods have clearly deteriorated. Source: xStation5

The 3,286 pts seems like a crucial support for US500 right now. Even though U.S. equities started the day higher, moods have clearly deteriorated. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026