-

Wall Street indices traded higher today, supported by easing of the US dollar rally

-

European stock markets indices finished today's trading with noticeable gains with most blue chips indices from the Western Europe closing 1.4-1.7% higher. Polish WIG20 was a leader in Europe with a 4% jump

-

Fed's Bullard is leaning towards another 75 bp rate hike in September even if inflation data shows deceleration

-

Fed's Waller said he also support another big rate hike at September's meeting

-

WSJ reports that ECB will begin discussions on QT in early-October 2022 and balance sheet run-off may begin in Q1 2023

-

A Canadian jobs report showed a 39.7k drop in employment, driven by a 77.2k decrease in full-time employment. Unemployment rate jumped from 4.9 to 5.4%

-

Chinese CPI inflation decelerated from 2.7 to 2.5% YoY in August while PPI inflation decelerated from 4.2 to 2.3% YoY

-

Bank of England postponed monetary policy decision from September 15 to September 22, 2022 amid national mourning following Queen Elizabeth II's death

-

Cryptocurrencies rallied today with Bitcoin jumping over 10%

-

Commodities benefit from weaker US dollar and overall risk-on moods. Brent jumped back above $90 per barrel and trades almost 5% higher on the day

-

Japanese yen regained some ground after verbal intervention from Governor Kuroda. Kuroda said that recent rapid yen depreciation is undesirable and market took it as a warning that BoJ may step in to intervene in the FX markets

-

AUD, CHF and JPY are the best performing major currencies while USD and CAD lag the most

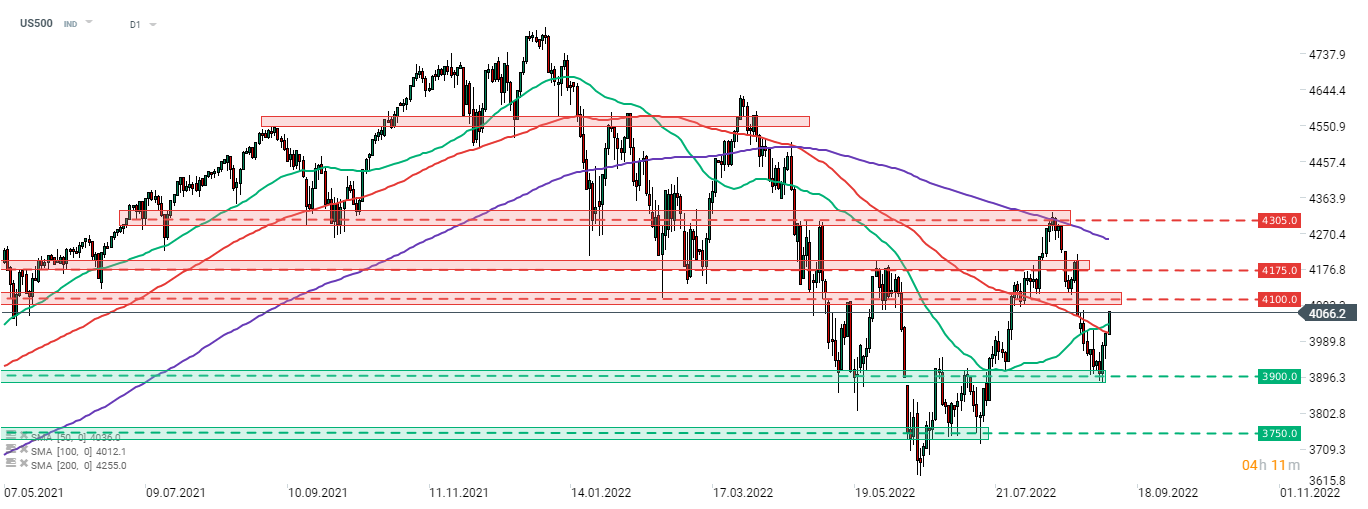

S&P 500 (US500) rallies today, trading 1.5% higher at press time. The index cleared 50- and 100-session moving averages today and is looking towards a test of the 4,100 pts resistance zone. Source: xStation5

S&P 500 (US500) rallies today, trading 1.5% higher at press time. The index cleared 50- and 100-session moving averages today and is looking towards a test of the 4,100 pts resistance zone. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report