Global financial now seem to be weighing the ongoing coronavirus spike as cases and deaths continue to rise at a worrying rate. Yesterday the U.S. recorded another single-day record - over 60,000 cases in a 24-hour period. Globally there have been more than 223,000 new infections.

European shares accelerated gains throughout today’s session and major indices finished the day over 1% higher. DAX added 1.15% while CAC 40 gained 1.01%. Even though American equities opened flat, moods quickly improved amid promising news on Gilead’s remdesivir drug. Worth noticing: tech stocks lag today as DJIA, S&P 500 and Russell 2000 are posting gains.

Oil prices have been following stock markets momentum as both Brent and WTI are adding roughly 1%. Gold prices broke below crucial $1800 level as investors tend to bet on riskier assets today. Nevertheless, silver is still in the green territory.

In terms of economic calendar, some investors must have been particularly interested in several PPI reports today. The reading from the U.S. might have shocked as prices unexpectedly fell 0.2% MoM in June (vs expected: +0.4%). French and Italian industrial production came in well above expectations. The former rose in May 19.6% while the latter soared a staggering 42.1% MoM (exp: +22.8%). Finally labour market data from Canada managed to beat forecast as well. There have been almost 1 million new jobs added in June while markets anticipated that employment change amounted to 700k.

Monday will not bring any crucial economic events. Apart from unemployment rate from Sweden, investors should focus on current newsflow. Political disputes may also be of great importance for the markets especially that the presidential campaign in the U.S. has been slowly gathering pace.

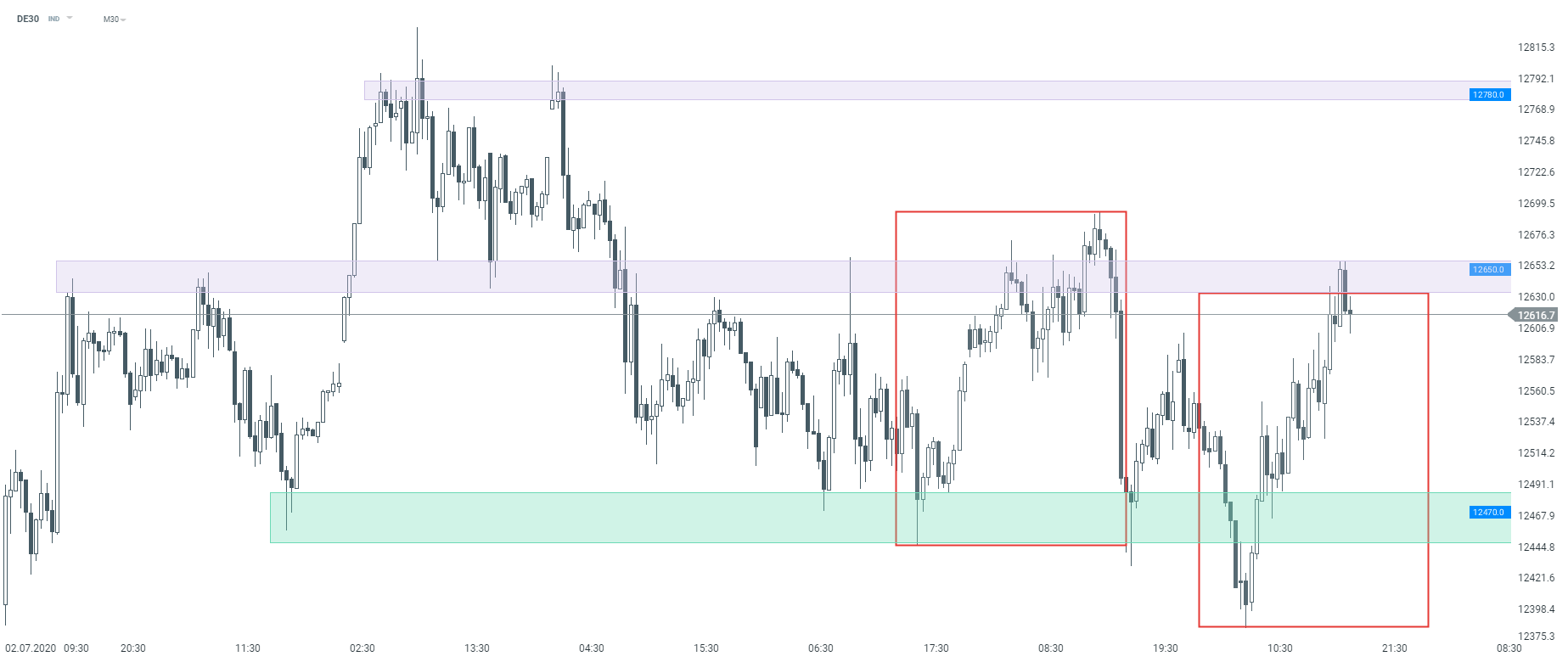

DE30 has completely erased yesterday’s declines. Nevertheless, the index reached crucial resistance level where sellers regained control. This barrier is strengthened by previous price reactions and 1:1 market geometry (12,650 pts). Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈