- European equities deeply in the red

- US tech stocks managed to erase early losses

- S&P 500 hit one month low amid inflation concerns

European indices fell sharply today as inflation concerns hit market sentiment today. CPI report from China showed that inflation reached a seven-month high in April, and factory gate prices rose at the fastest rate in three and a half years. Meanwhile Germany's wholesale price inflation recorded the biggest rise since March of 2011 while investor morale in the largest EU economy rose to the highest level since 2000. Dax fell 1.82%, CAC40 lost 1.86% and FTSE100 finished 2.4% lower.

US indices extended yesterday's losses amid ongoing concerns that rising inflation will ultimately lead to rate hikes which would negatively affect the stock market, especially the tech sector which came under severe pressure today. At the beginning of the session Nasdaq dropped to the lowest level since April 1st. The Dow Jones fell 600 pts and tested support at 34,000 while the S&P 500 dropped to a one-month low around 4110 pts. Later in the session major US stock indexes managed to recover some of recent losses following speeches from several FED members. On the data front, the number of job openings in the US increased by 597k from the previous month to 8.123 million in March, the highest level since the series began in December 2000 and well above analysts’ estimates of 7.5 million. Tomorrow investors will focus on the US CPI report, which is expected to show inflation above 3%.

Both WTI crude and Brent rose slightly and are trading respectively at $65.20 a barrel and around $68.54 a barrel. Elsewhere gold rose to $1835/oz early in the session, the highest level since February, while silver is trading 1% higher around $ 27.80 / oz amid a weaker dollar. US Treasury yields rose to 1.62% following a solid three-year note auction amid soaring commodity prices and supply chain issues which are giving rise to further concerns about inflation.

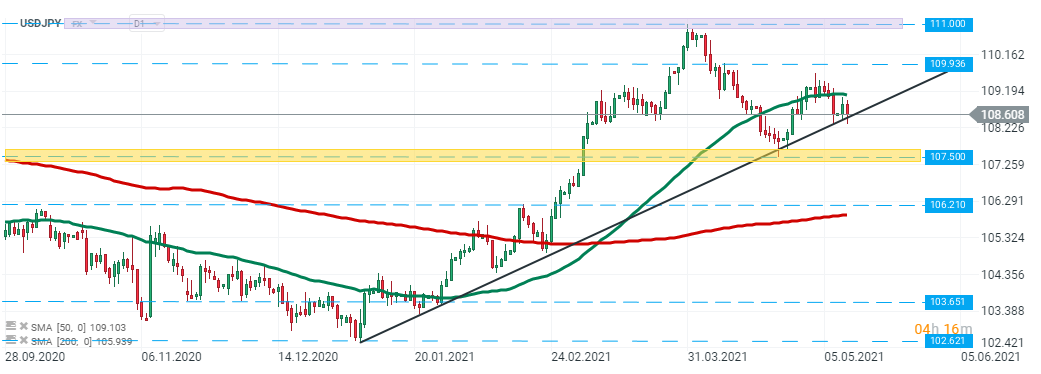

USDJPY pair is testing the long-term trendline. Should a break below the trendline occur, downward move may accelerate towards support at 107.50. However, if buyers will manage to defend it, then upward move may be extended to the resistance at 109.93 or even psychological level at 111.00. Source: xStation5

USDJPY pair is testing the long-term trendline. Should a break below the trendline occur, downward move may accelerate towards support at 107.50. However, if buyers will manage to defend it, then upward move may be extended to the resistance at 109.93 or even psychological level at 111.00. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause