-

Sell-off on global stock markets

-

US bond yields tumble

-

Jobless claims unexpectedly rise

-

Oil moves higher after EIA data

Global equities fell sharply on Thursday amid a broad-based sell-off. Some major European indices tanked more than 2%. Risk-off mood is seen on Wall Street as well, but stocks are currently trying to recoup some losses. At press time the S&P 500 (US500) is down by 0.80% while the Nasdaq100 (US100) is trading 0.50% lower.

Investors might have been spooked by some headlines on the Delta variant of Covid-19, which is now the dominant strain in the US. This might raise concerns about the economic recovery around the world. Apart from that, Tokyo banned Olympic spectators as Japan declared state of emergency - another sign that the combat with the virus is not over yet.

Bond yields plunged today as investors rushed to buy debt securities. US 10-year Treasury yield fell to 1.25%, lowest levels since February. The ECB set its inflation target at 2% after its policy review, allowing consumer prices to overshoot when deemed necessary. From the data front, US jobless claims unexpectedly rose to 373k (vs exp. 350k). The EIA data showed that US oil inventories fell more than expected - oil prices jumped after the release.

Gold prices jumped above $1,800 an ounce amid elevated uncertainty, but the precious metal gave up most gains. The situation on the FX market is rather mixed - despite risk-off mood the USD is not gaining across the board. EURUSD was trading higher, climbing to session highs near 1.1867 and the greenback was also weakening against the JPY.

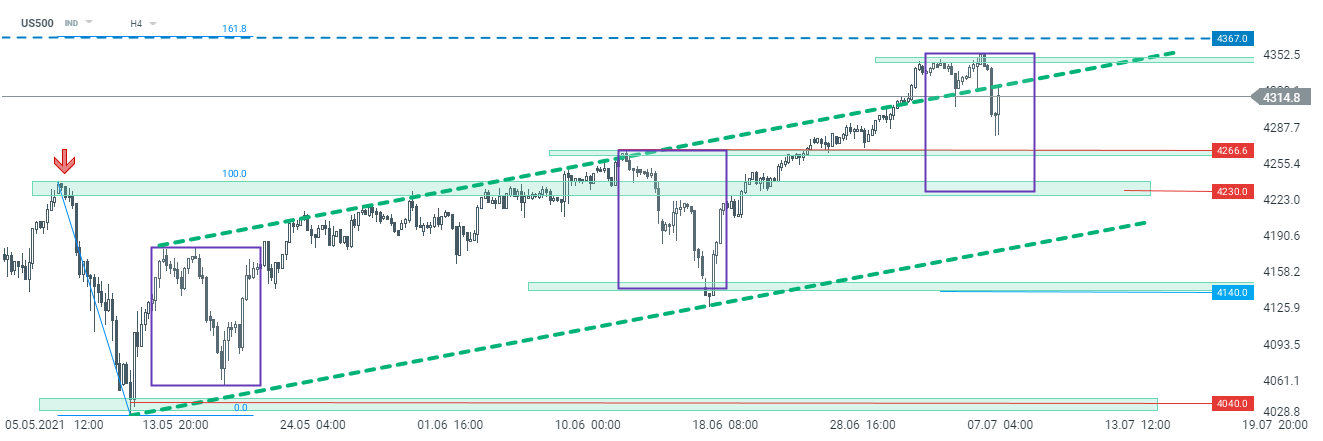

US500 rebounded from session lows and the index tested the upper limit of the upward channel (seen on H4 interval). As a result, the index climbed back above the 4,300 pts mark. Some traders probably just waited to “buy the dip” and such opportunity occurred indeed. Anyway, the area near 4,266 pts may be perceived as the first important support should the sell-off resume. Source: xStation5

US500 rebounded from session lows and the index tested the upper limit of the upward channel (seen on H4 interval). As a result, the index climbed back above the 4,300 pts mark. Some traders probably just waited to “buy the dip” and such opportunity occurred indeed. Anyway, the area near 4,266 pts may be perceived as the first important support should the sell-off resume. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report