- European equities end higher across the board

- Fed will lift limits on bank dividends and share repurchases after June 30

- Muted inflation data from the US

- Crude oil rise on Suez Canal blockage

European indices finished today's session higher despite the recent uncertainties regarding the increasing number of new COVID-19 infections and the sluggish vaccine rollout. France extended partial lockdowns to three more areas of the country and German chancellor Angela Merkel signaled that she would declare France a high-risk Covid area. On the economic data front, German business morale in March rose to the highest level since June of 2019. Meanwhile EU leaders decided to tighten the criteria to authorize the export of EU-made coronavirus vaccines, aiming to secure the bloc's supplies. However, they failed to reach an agreement on vaccine distribution and demand from some countries for additional Pfizer/BioNTech vaccines. DAX 30 rose 0.9%, CAC40 gained 0.6% and FTSE100 finished 1% higher.

US indices are trading mixed, Dow Jones rose 0.5%, S&P 500 gained 0.6% while Nasdaq Composite fell 0.3%. Indexes continue to move higher led by bank stocks which rose after the Fed announced that temporary and additional restrictions on bank holding company dividends and share repurchases currently in place will end for most firms after June 30th. The central bank originally planned to remove these restrictions in the current quarter, but even the delayed move gives investors more clarity. Meanwhile, investors cheered data showing subdued inflation and rising consumer sentiment. PCE figures painted a mixed picture: personal income fell slightly less than expected while spending declined at a faster pace and prices pointed to tame inflation. The University of Michigan's consumer sentiment for the US was revised higher to a one-year high of 84.9 in March.

WTI crude rose more than 4.3% and is trading slightly above $61.10 a barrel, while Brent is trading nearly 4.5% higher around $64.70 a barrel as the tanker blocking the Suez Canal remained in place and could stay there by several days or weeks which may affect the supply side. Elsewhere gold fell 0.25% to $ 1,730.00 / oz, while silver is trading 0.40 % lower, slightly below $ 25.00 / oz. Appreciation of precious metal prices is still limited by a stronger dollar. Meanwhile yield on the benchmark 10-year Treasury note increased 0.04 % points to 1.66 per cent, the highest mark since Monday.

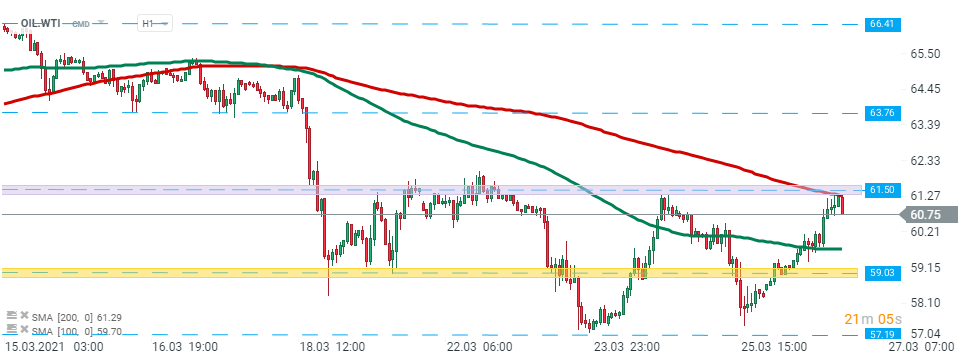

WTI crude (OIL.WTI) moved sharply higher today, however buyers failed to break above major resistance at $61.50 on first attempt and price pulled back. The nearest support lies at $59.86 and coincides with 50 SMA ( green line). On the other hand, should break above the aforementioned resistance occur, then another upward impulse towards $63.76 could be launched. Source: xStation5

WTI crude (OIL.WTI) moved sharply higher today, however buyers failed to break above major resistance at $61.50 on first attempt and price pulled back. The nearest support lies at $59.86 and coincides with 50 SMA ( green line). On the other hand, should break above the aforementioned resistance occur, then another upward impulse towards $63.76 could be launched. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report