- Bears dominated the trading floors in Europe. Dutch NED25 (-2.04%) and the German DE30 (-1.8%) were among biggest losers;

- Wall Street is trying to regain some ground after the dynamic decline at the beginning of the session. US100 is trading 3.24% lower, US2000 plunged 2.33%, US500 fell 1.93% while the US30 index is losing nearly 1%;

- Stocks took a hit today after another set of weak macroeconomic data. U.S. new home sales fell 16.6% MoM to 591,000 in April, the lowest level since April 2020 and well below analysts' estimates of 750,000.

- Preliminary PMI indices for services and manufacturing were also negative. Manufacturing PMI index fell to 57.5 in May from 59.2 in April, below analysts' estimates of 57.9. Services PMI index dropped to 53.5 in May, below expectations of 57.4 and from 55.6 in April, driven by rising sales prices and concerns about higher interest rates;

- Snap (SNAP.US) stock plunged over 40.0% after company lowered its quarterly growth forecast due to a deteriorating macroeconomic environment;

- JPY and CHF are the best performing major currencies while CAD and GBP lag the most;

- Investors from the commodity market today moved towards safe haven assets. Recession fears put pressure on crude oil and industrial metals prices. We are currently paying $109.5 for WTI barrel.

- Gold jumped above $1866 and is on its way to posting its fifth consecutive day of gains.

- The correlation of the crypto market with traditional exchanges pushed the valuations of major projects south. Bitcoin is struggling to hold support in the $29,000 area and Ethereum approaches $1940 level. The worst performer is Kusama, which recorded significant gains yesterday.

Once again bleak macroeconomic data from the U.S. economy spooked financial markets and raised concerns over global recession. Warnings in the media about an impending economic slowdown put pressure on the stock market, especially on growth companies. Meanwhile, remarks from Fed Chair Jerome Powell at the National Center for American Indian Enterprise brought no surprises about the outlook of tightening monetary policy. As a result capital migrated to the precious metals market and gold is on track for a fifth consecutive day of gains.

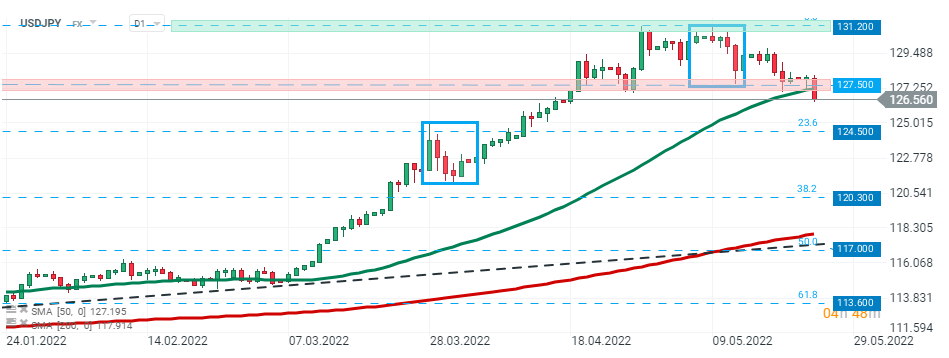

USDJPY broke below local support at 127.50 which is marked by the lower limit of the local 1:1 structure and 50 SMA (green line). If current sentiment prevails, downward move may accelerate towards next support at 124.50 which coincides with 23.6% Fibonacci retracement of the last upward wave. Source: xStation5

USDJPY broke below local support at 127.50 which is marked by the lower limit of the local 1:1 structure and 50 SMA (green line). If current sentiment prevails, downward move may accelerate towards next support at 124.50 which coincides with 23.6% Fibonacci retracement of the last upward wave. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉