• Europe imposes new restrictions as COVID-19 cases soar

• Average daily new coronavirus cases in US hit all-time high

• Libya's NOC lifts force majeure on last oilfield

European indices finished today's session in red as second wave of COVID-19 infections surges across the continent. Spain and Italy announced stricter lockdown measures over the weekend, while France reported record number of new COVID-19 cases. German Chancellor Merkel is considering a "lockdown light" which would mainly focus on the closure of bars and restaurants to curb the spread of the coronavirus pandemic. On data front, German ifo business morale for October came in below analysts' expectations. DAX 30 fell 3.7% led by an over 20% decline in technology giant SAP., CAC 40 dropped 1.9% and FTSE 100 finished 1.2% lower.

US indices fell sharply during today's session in line with their European counterparts due to the rising numbers of COVID-19 infections and a lack of progress on a US stimulus package. The US reported a record number of daily Covid-19 infections on Friday with more than 83,000, surpassing its mid-July peaks. Meanwhile seven-day average on Sunday reached a new daily record of 68,767 cases according to a CNBC analysis of data from Johns Hopkins University. Authorities El Paso officials are asking citizens to stay at home for the next two weeks. Meanwhile hope for a new COVID-19 stimulus package before the Presidential election is fading as US House Speaker Nancy Pelosi said she was expecting a response to the Democrats' latest proposal for COVID-19 relief package, but did not signal any breakthrough in negotiations. During today's session Dow Jones lost 3.3%, S&P 500 dropped more 2.6%; and the Nasdaq retreated more than 2.7%.

US crude futures fell over 3.3%, while the international benchmark Brent contract dropped more than 2.6 % as investors remain concerned that surging number of new COVID-19 cases will hurt fuel demand recovery. On the supply side, Libya's National Oil lifted restrictions on exports from El Feel oilfield (Murzuq district). The move will intensify the Tripoli-based National Oil Corp.’s attempt to restore Libyan oil production to 1 million barrels each day within a month. Elsewhere, gold futures are trading nearly flat at $1,902/oz, while silver is trading 1.36% lower around $24.24/oz.

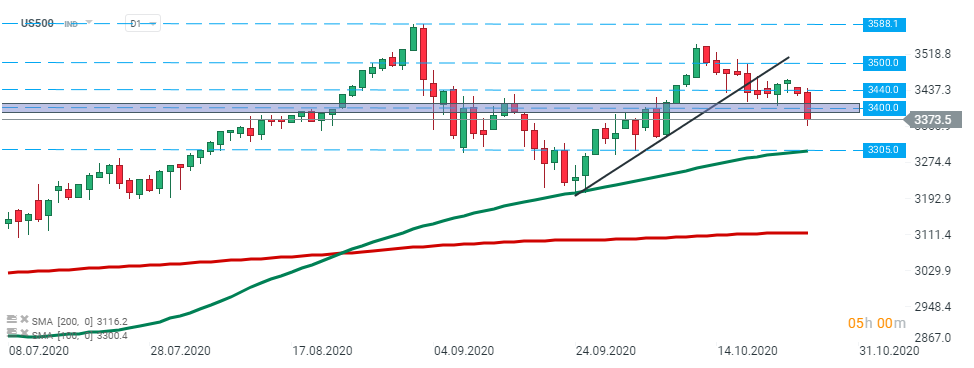

![]() US500 is trading under pressure today. Index broke below the major support at 3400 pts and if the current sentiment prevails, the downward move could be extended to the 3305 pts handle. Source: xStation5

US500 is trading under pressure today. Index broke below the major support at 3400 pts and if the current sentiment prevails, the downward move could be extended to the 3305 pts handle. Source: xStation5

US500 is trading under pressure today. Index broke below the major support at 3400 pts and if the current sentiment prevails, the downward move could be extended to the 3305 pts handle. Source: xStation5

US500 is trading under pressure today. Index broke below the major support at 3400 pts and if the current sentiment prevails, the downward move could be extended to the 3305 pts handle. Source: xStation5