- AstraZeneca releases positive Phase 2 COVID-19 vaccine results

- US COVID-19 death toll surpassed 250,000

- US stocks swing between gains and losses

US indices are trading mixed as soaring COVID-19 infections an unexpected rise in weekly jobless claims sparked fears of a slower-than-expected economic recovery. Yesterday US reported more than 173 768 new infections, which is the second-highest number since the pandemic began. Death toll from COVID-19 surpassed 250k on Wednesday. Also hospitalizations reached record number of 79 410. Due to worsening pandemic situation all public schools in New York will be closed. Also new restrictions will be imposed in Kentucky, Minnesota and Wisconsin. On the data front, initial jobless claims rose for the first time since October to a higher-than-expected 742K.

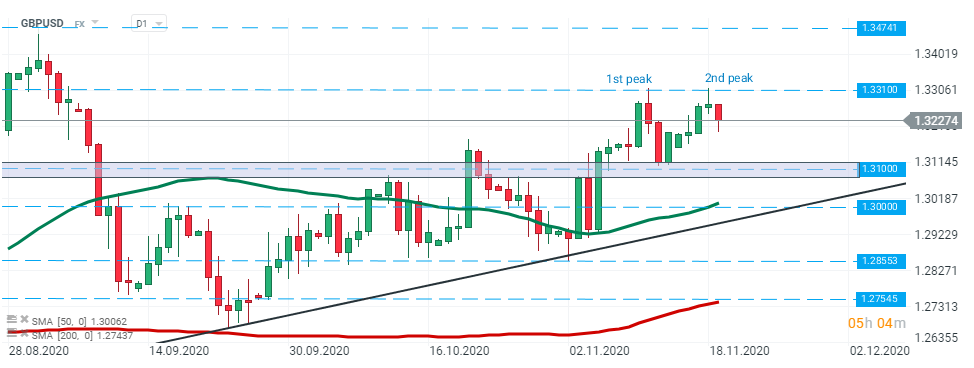

GBPUSD – pair has been trading in an upward trend recently. However, price did not manage to break above the high from 11th November and a double top pattern may be on the cards. The 1.3100 handle is a key support for now. If sellers manage to break below, a bigger downward correction may start. On the other hand, bouncing off the support may trigger another upward impulse. Source: xStation5

GBPUSD – pair has been trading in an upward trend recently. However, price did not manage to break above the high from 11th November and a double top pattern may be on the cards. The 1.3100 handle is a key support for now. If sellers manage to break below, a bigger downward correction may start. On the other hand, bouncing off the support may trigger another upward impulse. Source: xStation5

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽

🚩Silver loses 3%

Oil slightly up amid Iran tensions and US EIA inventories report

Mixed sentiments on Wall Street amid Iran war🗽Oracle shares surge 10%