-

European indices mostly higher

-

DE30 and US500 at new record highs

-

US PPI inflation running hot

Thursday’s session was another successful trading day for European equities. The German DAX (DE30) added 0.70% and climbed to new record highs. The pan-European STOXX 600 notched a fresh all-time high as well, even though the hard data from the Old Continent come in rather mixed. Industrial production from the eurozone for June fell short of expectations.

US indices are trading little changed, but the S&P 500 (US500) still managed to reach new highs. Initial jobless claims from the US fell for third straight week and continuing jobless claims continued to drop as well. Nevertheless, US PPI inflation surprised to the upside as supply chain disruptions in the global economy clearly intensify (we covered the issue in-depth in our today’s MACRO comment). The situation in China seems particularly worrying as Chinese authorities decided to partially shut down 3rd busiest port.

Commodity markets remain relatively stable. Oil, copper and gold prices are little changed. However, silver prices plunged more than 1.50%. Also, cryptocurrencies are under pressure, with Bitcoin tumbling roughly 5% in the evening. As far as FX market is concerned, the US dollar gained significantly against GBP, AUD and NZD (by around 0.40%). The main currency pair remains stable, hovering around 1.1740 in the evening. USDJPY is basically unchanged on the day as well.

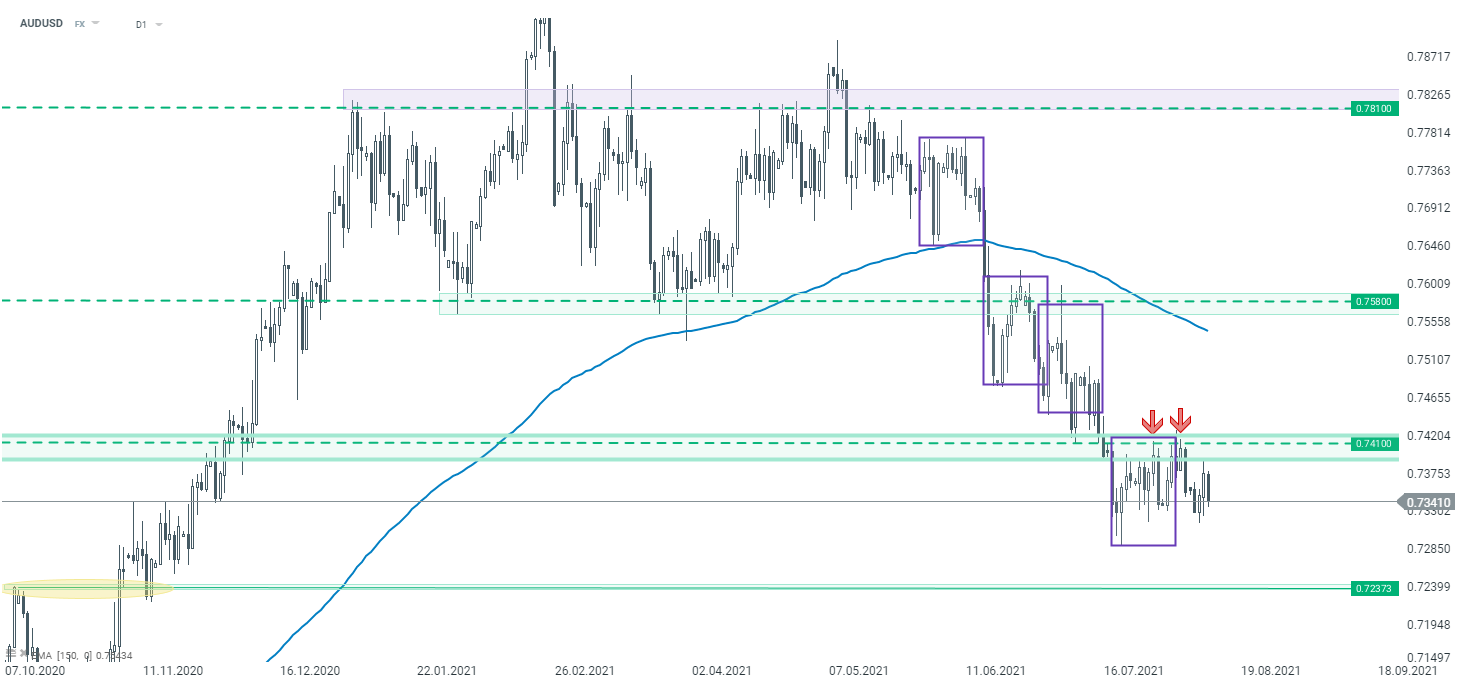

The Australian dollar has weakened significantly against the US dollar today. AUDUSD pair has been trading in a downward trend in recent months. The price bounced off the 0.7410 level during recent upward correction and the currency pair tanked again. As long as the price sits below it, the downward move could potentially deepen. The 0.7237 mark should serve as an important support level in such scenario. Source: xStation5

The Australian dollar has weakened significantly against the US dollar today. AUDUSD pair has been trading in a downward trend in recent months. The price bounced off the 0.7410 level during recent upward correction and the currency pair tanked again. As long as the price sits below it, the downward move could potentially deepen. The 0.7237 mark should serve as an important support level in such scenario. Source: xStation5

Daily summary: Wall Street tries to stop the sell-off 📌Gold down 1.8%, Bitcoin loses 4.5%

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

3 markets to watch next week (14.11.2025)

US Open: US100 initiates rebound attempt 🗽Micron shares near ATH📈