-

A rather hawkish FOMC minutes release, combined with a streak of better-than-expected US data today, led to strong risk-off moods on global equity markets

-

Wall Street indices managed to recover from daily lows but continue to trade significantly lower on the day. Dow Jones drops 1%, S&P 500 and Nasdaq drop 0.9% while Russell 2000 plunges around 2%

-

European stock market indices slumped today - German DAX dropped 2.7%, UK FTSE 100 moved 2.2% lower, French CAC40 plunged 3.2%, Italian FTSE MIB dropped 0.6% and Spanish Ibex moved 1.2% lower

-

BoE governor Bailey said that moves by regulators on retail prices will help lower UK inflation

-

Fed Logan said that she would have been okay with a rate hike at June meeting and that more rate hikes are likely necessary

-

ECB Nagel said that he cannot say where interest rates will peak but they will have to remain high for a longer period. Nagel also said that he does not see threat of overtightening

-

US services ISM index jumped from 50.3 to 53.9 in June (exp. 51.0)

-

JOLTS report for May showed job openings at 9.824 million, down from 10.32 million in April (exp. 9.9 million)

-

US Challenger report showed lay-offs in June dropping to a 7-month low of 40.7k, down from 80.1k in May

-

ADP reported for June turned out to be a huge positive surprise and showed a jobs gain of 497k while market expected 230k increase

-

US jobless claims came in at 248k (exp. 246k). Continuing claims came in at 1.72 million (exp. 1.734 million)

-

US trade balance for May came in at -$68.98 billion (exp. -$69.0 billion)

-

Atlanta Fed GDPNow model now points to a 2.1% growth in Q2 2023, up from previous 1.9%

-

Canadian trade balance for May came in at -C$3.44 billion (exp. +C$1.2 billion)

-

German factory orders surged 6.4% MoM in May (exp. +1.2% MoM)

-

Euro area retail sales dropped 2.9% YoY in May (exp. -2.7% MoM). Retail sales were flat month-over-month (0.0% MoM) while market expected a 0.2% MoM increase

-

Saudi Arabia lifted export prices for light, medium and heavy oil deliveries to Asia. Prices for Mediterranean countries, North-West European countries and the United States were increased as well

-

EIA report showed a 1.51 million barrel drop in US oil inventories (exp. -1.7 mb), gasoline inventories declining 2.55 mb (exp. -1.0 mb) and distillate inventories dropping 1.04 mb (exp. -0.5 mb)

-

Threads, text-based communications app by Meta Platforms that is seen as Twitter's rival, has already attracted 30 million users, less than 24 hours after launch

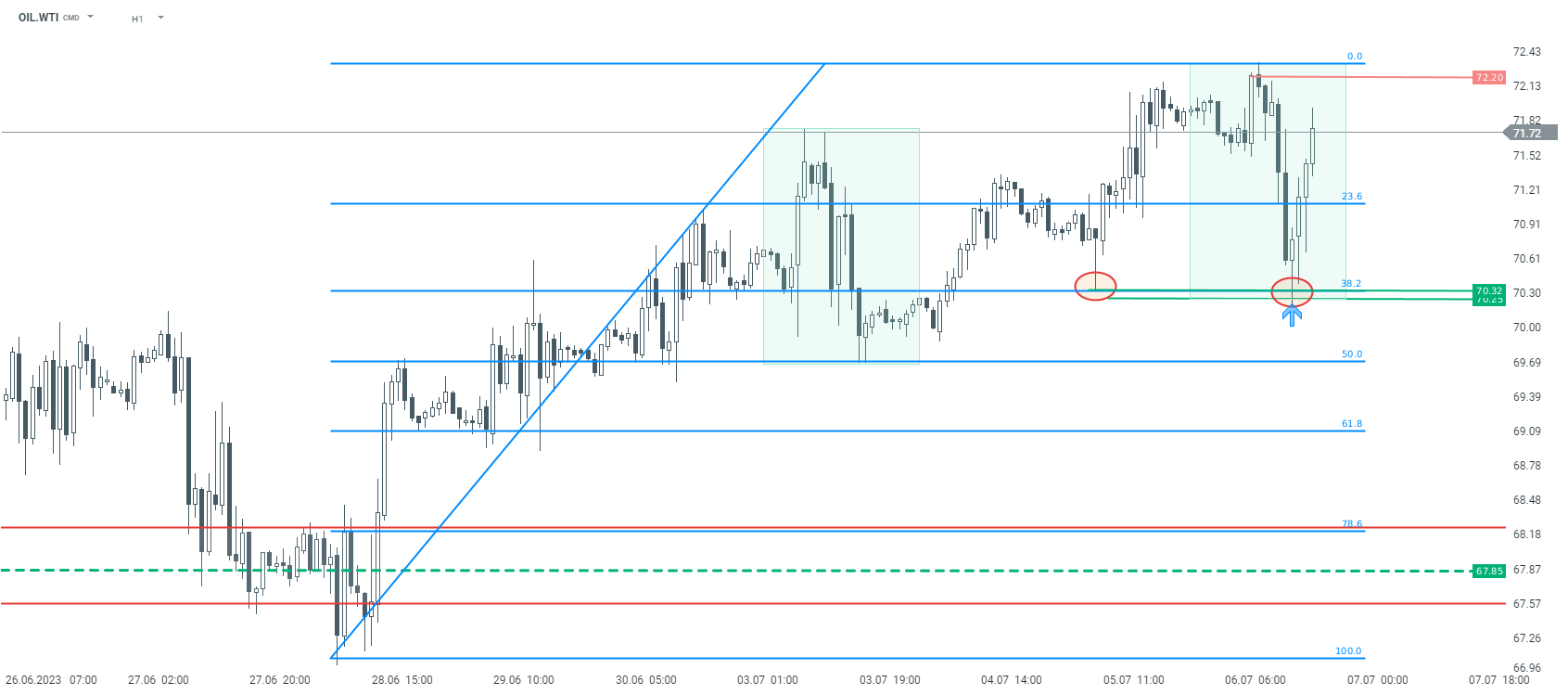

Oil has been pulling back earlier today on overall risk-off moods. However, things change in the afternoon as big inventory draw in EIA report encouraged buyers. OIL.WTI bounced off the $70.30 support zone, marked with the lower limit of the Overbalance structure, and is looking towards a $72.20 resistance zone. Source: xStation5

Oil has been pulling back earlier today on overall risk-off moods. However, things change in the afternoon as big inventory draw in EIA report encouraged buyers. OIL.WTI bounced off the $70.30 support zone, marked with the lower limit of the Overbalance structure, and is looking towards a $72.20 resistance zone. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!