- Talks between the US president Biden and a representative of the House of Representatives, McCarthy on the debt limit are scheduled to take place tomorrow. However, the market is unconcerned about the risks regarding a possible U.S. bankruptcy, despite a massive rise in CDS valuations

- NY Empire falls at -31.8, a return to very low March readings, after a positive surprise in April. April was exceptional due to a significant rise in stocks, also business sentiment in the New York returns to weak area;

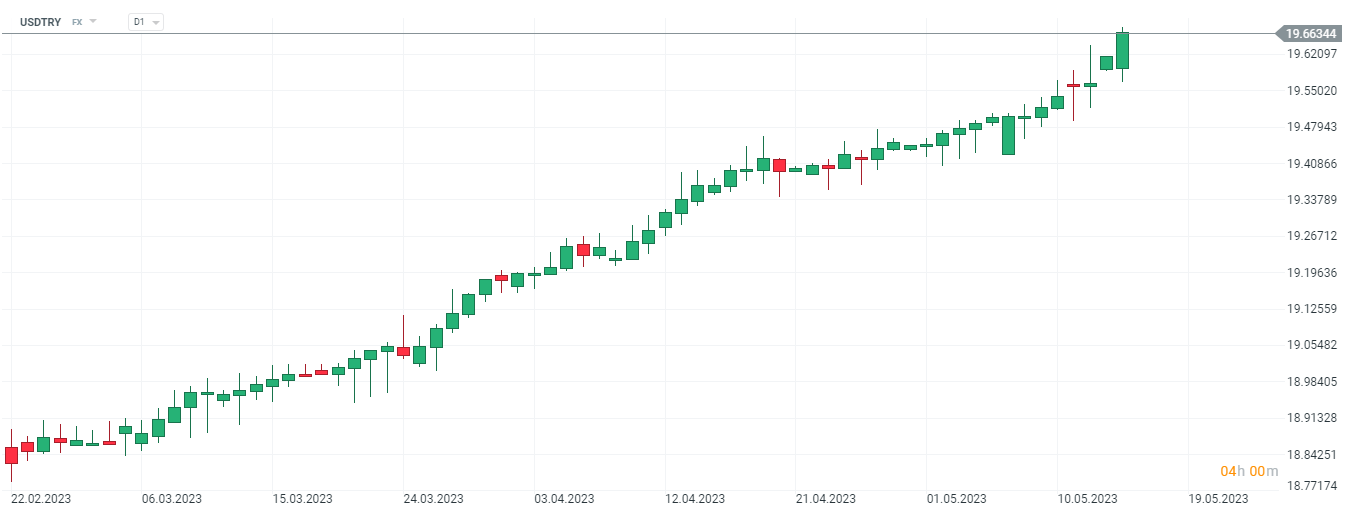

- Turkey's presidential election remains inconclusive. As a result, a runoff between Erdogan (about 49% of the vote) and opposition candidate Kilicdaroglu (about 45% of the vote) will be needed, and will likely take place in two weeks on Sunday, May 28. In parliament, the AKP with its coalition partners gained more than 49% of the vote, which is likely to keep them in power. The lira lost today approaching the 20 level.

- The dollar lost most of its ground today, although the EURUSD pair remained below 1.0900 after a strong sell-off at the end of the week. The AUDUSD pair recovered any losses from Friday's session thanks to good sentiment on Chinese indices.

- Chinese indices scored strong gains today, although without specific reasons. The PBOC is keeping interest rates unchanged, although it is increasing liquidity in the market all the time. Container data shows weak recovery in China

- WTI crude oil returns above $70 per barrel, and gold attacks $2020 per ounce, even despite higher yields. Natgas scores continuation of rebound and tests $2.35/MMBTU amid declining rig count

- After an initial sell-off, US500 gains 0.15% before 8pm, and US100 is higher by 0.3%. The bulls are ignoring weak NY Fed data and hawkish Atlanta Fed chairman Bostic comments. Bostic signalized that interest rates may be unchanged until the end of the year even if recession starts;

- The company C3ai (AI.US) gains nearly 20% today after the release of preliminary financial results. Markets saw them as a signal that momentum around artificial intelligence could actually improve the company long term situation. Preliminary revenues beat Wall Street expectations, and are expected to come in at 72.1 million to 72.4 million versus $71.1 million estimates. HEICO Corp shares at all time high level after Wencor acquisition deal worth $2,05 bln.

- Bitcoin rebounds to $27.500, a Bloomberg investor survey indicated that the largest cryptocurrency could prove to be one of the 'beneficiaries' of a potential US default.

Turkish lira is slightly weaker after first round results. USDTRY bulls are still in favor, supporter by the trend line. Source: xStation5

Turkish lira is slightly weaker after first round results. USDTRY bulls are still in favor, supporter by the trend line. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?