- Major European indices finished today's session slightly higher, with DAX rising about 0.35% to a highest level since February 2022, after the ZEW sentiment index moved into positive territory in January for the first time in nearly a year, while final CPI reading suggested cost pressure eased in December.

-

Moods improved in the afternoon on news that ECB may consider slower hikes in the near future. According to ECB sources, the idea of a slower move in March is 'gaining support' and some expect a 50 bps hike at the next meeting and then 25 bps afterwards.

-

FTSE 100 pulled back from recent highs as recent UK employment data showed wages rose the most on record when excluding the height of the pandemic, but real earnings continued to drop due to high inflation.

-

Markets shrugged off recession fears after the release of downbeat GDP figures from China and a survey released at the Davos summit showed that two-thirds of private and public sector economists expected a global recession this year.

-

Mixed moods prevail on Wall Street as traders digest fresh reports from two big US banks. Currently Dow Jones is trading over 1.0% lower, S&P 500 fell 0.10%, while Nasdaq rose 0.17%.

-

Goldman Sachs profits plunged in Q4 by 69% YoY due to heavy losses in its investment banking unit and asset management revenue, while Morgan Stanley positively surprised investors on the upside after its trading business got a boost from market volatility.

-

Oil prices rose over 2.0% early in the session on upbeat OPEC. In its latest monthly report, the group wrote that demand for oil should increase by 2.22 million bpd, or 2.2% in 2023 due to rising consumption in China and a recovery in economic activity among advanced economies. Nevertheless OIL.WTI erased roughly half of today's gains as buyers failed to break above resistance at $81.00.

-

Precious metals pulled further away from recent highs despite a weaker dollar. Gold is trading 0.65% lower and is moving towards the $1900 mark, while silver fell below the $24.00 level.

-

As for the forex market, Tuesday's session brought a slight weakening of the euro, which caused the EURUSD pair fell below the major support at 1.0800. A daily close below this level may have serious technical implications, at least in the short term. In this scenario downward correction may deepen, even towards support at 1.0600 or even 1.0500.

-

Other major currencies benefited from the weaker dollar, which means that the euro is clearly lagging behind today. The dollar lost the most on Tuesday against NZD (0.7%), GBP (0.6%) and AUD (0.4%).

-

Major crypto currencies are trading slightly higher in volatile session. Bitcoin pulled back from its highest since September 2022 after an unsuccessful attempt to break above $21400 level, while Ethereum price failed to stay above $1600 mark.

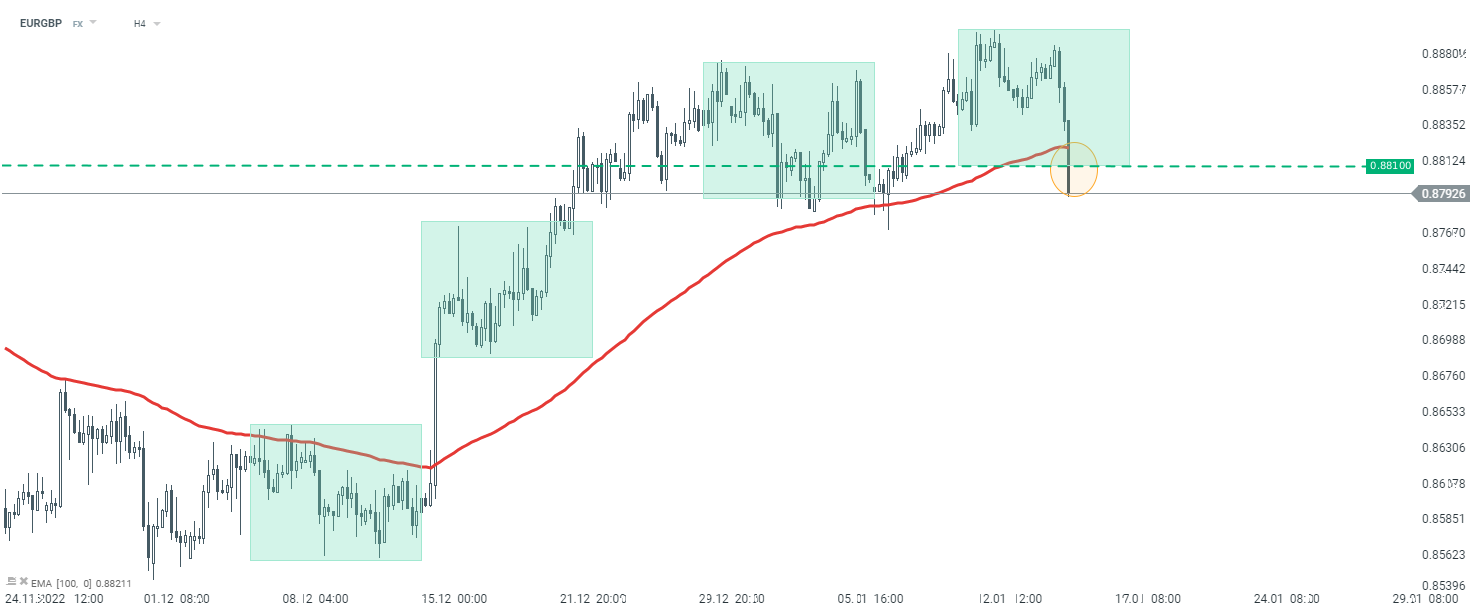

EURGBP pair came under selling pressure on Tuesday and broke below key support at 0.8810, which is marked with the lower limit of the 1:1 system and the EMA100. Source: xStation5

EURGBP pair came under selling pressure on Tuesday and broke below key support at 0.8810, which is marked with the lower limit of the 1:1 system and the EMA100. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause