- Worse sentiment on the stock market

- US500 reached key short-term support

- USD strongest among the majors

- Investors await the Fed

Despite the positive start of the European session, the major indices closed lower, German DAX lost 0.05%, France's CAC 0.7%, UK's FTSE 100 0.8% and Spain's Ibex 0.45%. The beginning of the trading session on Wall Street did not go well and the main indexes also are trading lower.

Looking at the forex market, US dollar is the strongest of the majors. The USD is followed by the JPY and CHF. The AUD and NZD are the weakest. That combination is indicative of "risk off" flows. The potential Omicron acceleration could lead to some reevaluation of economic growth/stock indices/commodities growth. However, the risk of a new variant was ignored last week.

A meeting of the US Federal Reserve this week could boost the dollar further if the central bank decides to take a more hawkish stance on the unwinding of its bond-buying programme and the timing of interest rate rises. The Bank of Canada reaffirmed their 2% inflation target today. Macklem's commentary highlights that they are in no mood to keep rates particularly low, a sign that rate hikes are planned for the "middle quarters" of 2021, which is their guidance. CAD loses nearly 0.6% to USD today.

Crude oil came under pressure today. WTI and Brent are trading about 1% lower. Natgas also is below the baselline despite an attempt to rebound today. Gold, on the other hand, is trading up slightly, with silver gaining 0.65%.

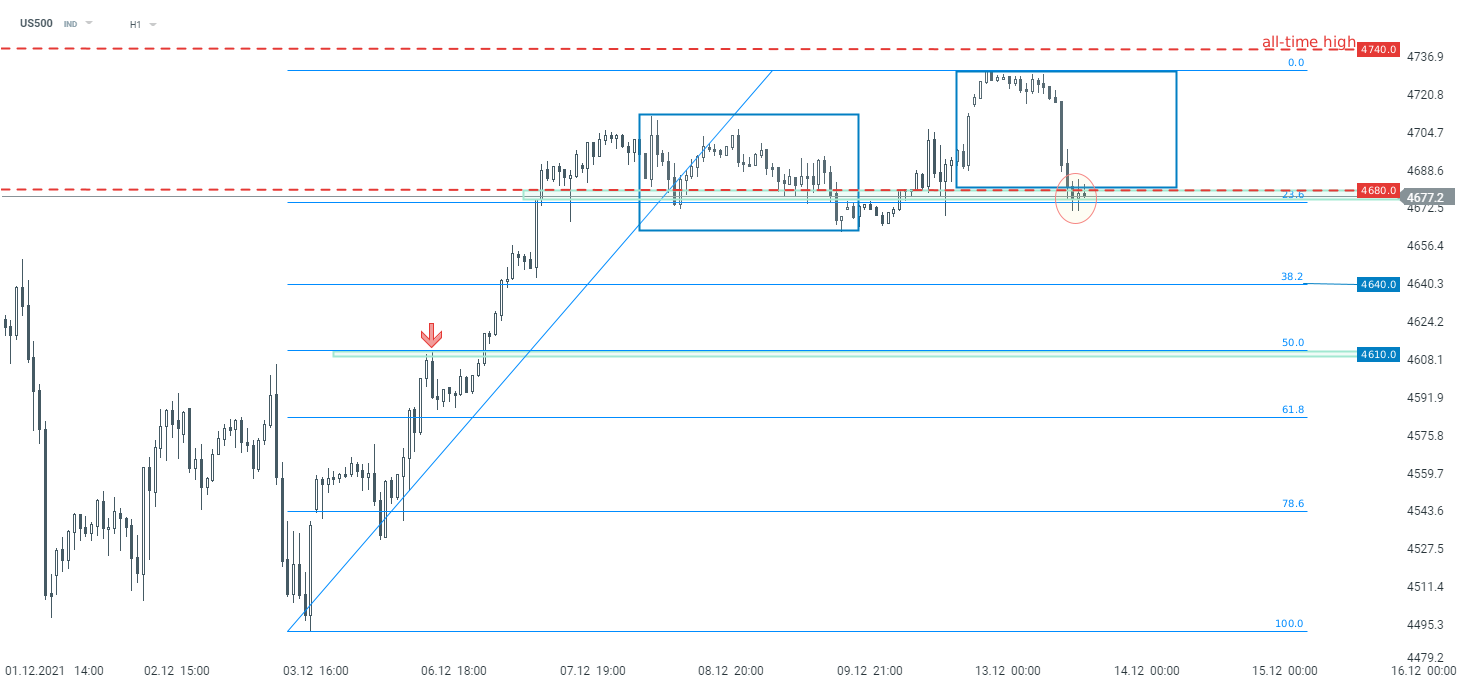

Despite the long term upward trend, the US500 did not manage to reach an all - time high today, and the downward correction started. The current downward correction stopped at the 4,680 pts support, which is marked with the lower limit of local 1:1 structure (blue rectangle) and 23,6% Fibonacci retracement of the recent upward move. If the current sentiment prevails, another attack on the all-time high at 4,740 pts is possible. However breaking below this support may lead to a trend reversal on US500.

US500 reached the key support near 4,680 pts, H1 interval. Source: xStation5

US500 reached the key support near 4,680 pts, H1 interval. Source: xStation5

Chart of the Day: US500 Moves on PCE Data and AI Momentum

Morning Wrap: Russian Oil with a 30-Day Purchase Permit

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)