-

Wall Street is heading toward the end of Monday’s session in positive territory despite broad losses at the open. Optimism was once again fueled by the tech sector, supported by Nvidia’s announced investment in OpenAI. Leading the gains is the Nasdaq (+0.5%), followed by the S&P 500 (+0.4%), Russell 2000 (+0.3%), and DJIA (+0.2%).

-

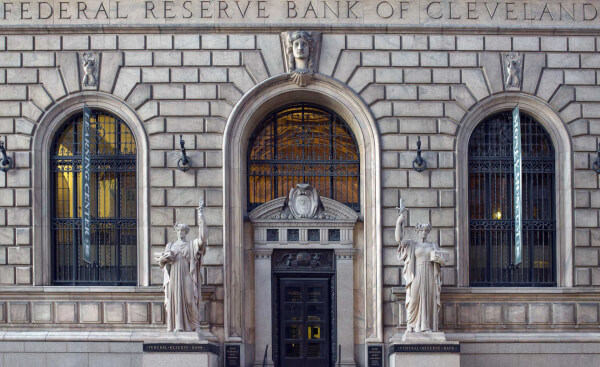

The day was marked by speeches from Federal Reserve officials. Trump nominee Stephen Miran called for “a series of 50 bp cuts,” arguing current rates threaten the economy. Meanwhile, St. Louis Fed President A. Musalem sees policy as between moderately restrictive and neutral, with inflation risks warranting caution. Cleveland Fed’s E. Hammack stressed the difficult balance of risks.

-

Nvidia (NVDA.US) announced a massive $100 billion investment in OpenAI, under which the U.S. tech giant will provide processors with a combined power of 10 gigawatts. Shares are up over 4%.

-

Canada’s producer price inflation (IPPI) rose above expectations in August (0.5% vs. 0.1% consensus, 0.7% prior).

-

Gold surged nearly 1.7% to around $3,745 per ounce, fully erasing the recent correction and setting a fresh all-time high. Other precious metals also rallied: silver +2.4% to $44.05, platinum +1.3%, and palladium +3.5%.

-

Cocoa marked a fifth straight session of declines (-4%), hitting its lowest level since November 2024 amid improved supply prospects. Wheat and soybean futures also dropped 2% on reports suggesting higher export supply.

-

On FX, the U.S. dollar began the week with a selloff (USDIDX -0.3%), ending a three-day rebound. The euro was the strongest G10 currency (EURUSD +0.4% to 1.1795, EURJPY +0.3%, EURGBP and EURCHF +0.1%). Sterling also gained (GBPUSD +0.4%). The Canadian dollar (USDCAD +0.3%) and Norwegian krone (USDNOK +0.8%) weakened against the dollar.

-

Crypto markets saw extreme pessimism, with flows shifting into safe-haven metals. Ethereum fell 6.9% to $4,171, Bitcoin -2.65% to $112,540, with notable losses in Sushi (-12%), Trump token (-9%), and Dogecoin (-8.8%).

US OPEN: The market looks for direction after inflation data

CPI OVERVIEW: Further Disinflation Puts Fed In Comfortable Position 🏦

BREAKING: US CPI below expectations! 🚨📉

⏬EURUSD softens ahead of the US CPI