-

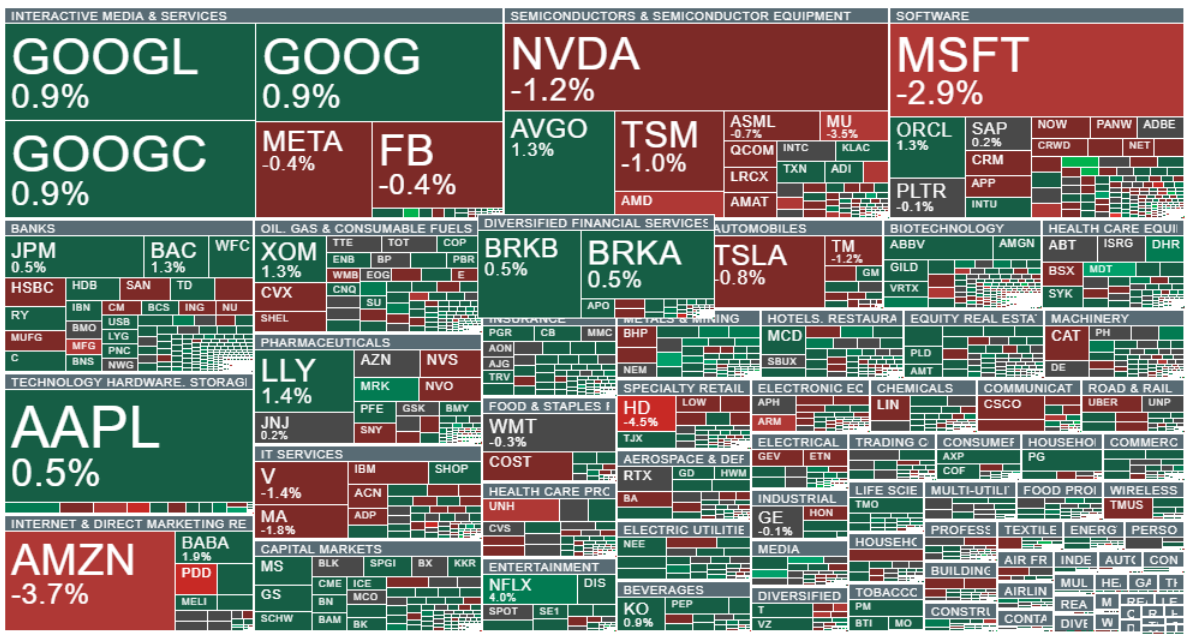

Today’s session in Europe was dominated by sellers, with Germany’s DAX losing nearly 1.8% and the UK’s FTSE falling almost 1.3%. Shares of tobacco company Imperial Brands rose more than 2% following an increase in tobacco sales volumes. The WIG20 declined over 1.7%, moving toward the 2,900-point area. After an initial wave of heavy selling, U.S. indices began to recover around 4 PM BST. The US500 is now down just under 0.2%, compared with nearly -1.1% shortly after the opening bell on Wall Street. The technology sector, however, remains under pressure, with Microsoft and Amazon leading the declines.

-

Analysts at Rothschild & Co Redburn downgraded both companies to neutral from “buy,” and cut the price target for Microsoft shares while leaving the target for Amazon unchanged at $250 per share. Microsoft’s target was reduced to $500 per share. The decision was primarily attributed to what the firm considers excessively high levels of AI-related investment.

- Home Depot shares drop today almost 4% after the company revised lower sales target this year, again signalling weakening demand across the US economy and cautious consumer spending. Nvidia is also trading more than 1% lower ahead of tomorrow’s earnings release, which will be published after the U.S. session closes.

- On the macro side, the revision of US Core Durable Goods (October) came in MoM: 0.3% vs 0.4% exp. and 0.4% previously with US Durable Goods Revised YoY at 2.9% (Forecast 2.9%, Previous 2.9%). US Factory Orders MoM came in at 1.4% MoM (Forecast 1.4%, Previous -1.3%). NAHB Housing Market Index came in 38 vs 37 exp. and 37 previously

- Gold is up 0.6% and continues to rebound from the area around the 50-day EMA, while silver is gaining more than 1%. U.S. Dollar Index futures are trading slightly higher, and EURUSD has inched up after dipping from 1.157 to 1.158. Donald Trump announced that Saudi Arabia will invest $600 billion in the United States under a new trade agreement, while Saudi officials indicated the investment could rise to $1 trillion.

- The United States is also considering restrictions on the export of advanced AI chips destined for Saudi Arabia. Discussions further suggest that the U.S. is evaluating a civil nuclear agreement with the Saudis, which potentially opens the door to future cooperation in the military sphere. It's probable that some amount of the $600 billion will support the AI infrastructure investments across the US.

- Oil is rising for the fourth straight session and is approaching $65 per barrel. Futures on US natural gas Henry Hub (NATGAS) are also posting a strong rebound, climbing from around 4.22 to 4.38 within just three hours between 4 PM BST and 7 PM BST. Sentiment in the cryptocurrency market remains weak. Bitcoin fell today to $90,000 but recovered after a sharp sell-off, moving back above $93,000. Ethereum also erased earlier losses, rising from $2,930 to roughly $3,150.

- Cocoa futures try to stabilize on ICE today, which comes after a huge sell-off. Since the September 1, cocoa prices are down almost 35%. The Trump administration decided to drop its 10% reciprocal tariff on commodities the U.S. doesn’t produce, including cocoa. But cocoa from Brazil still faces a hefty 40% national-security tariff, limiting the impact. Ivory Coast reported shipments from October 1 to November 16 reached 516,787 MT, down nearly 6% from last year. On the other hand, farmers in both Ivory Coast and Ghana describe healthy trees, rapid pod development, and ideal drying conditions. Mondelez even noted that pod counts are 7% above the five-year average. Recently, Asian cocoa grindings plunged 17%, the lowest Q3 reading in nine years with European grindings fell 4.8%, hitting a ten-year Q3 low. North America showed a 3.2% rise, but analysts warn this was distorted by new reporting participants rather than real consumption strength.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war